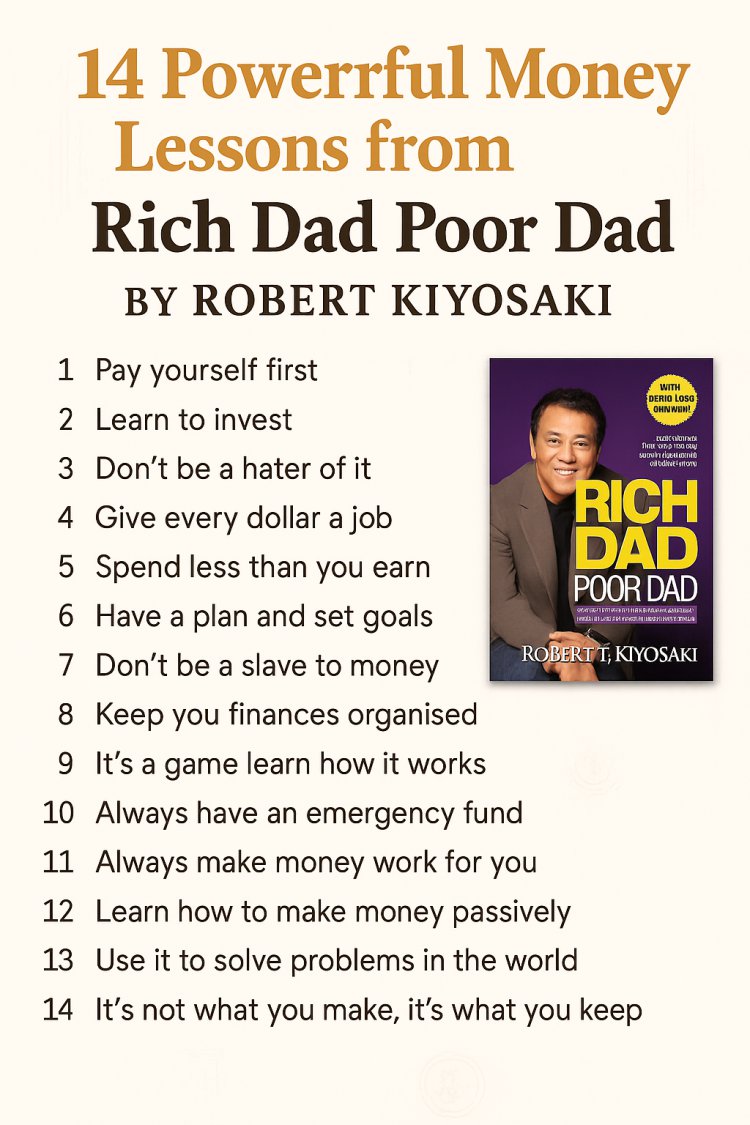

14 Powerful Money Lessons from Rich Dad Poor Dad by Robert Kiyosaki

Explore 14 powerful money lessons from Robert Kiyosaki’s Rich Dad Poor Dad that can transform your financial mindset. Learn timeless principles on saving, investing, passive income, and financial independence—all grounded in real-life wisdom from one of the most influential personal finance books of all time.

Robert Kiyosaki’s bestselling book, Rich Dad Poor Dad, has become a cornerstone in personal finance and wealth education. Through the story of his two "dads"—his biological father (Poor Dad) and the father of his childhood best friend (Rich Dad)—Kiyosaki contrasts two very different approaches to money, work, and financial success. The lessons drawn from the book challenge conventional wisdom about money and offer timeless principles that anyone can apply to improve their financial life.

In this blog, we break down 14 key rules of money inspired by Rich Dad Poor Dad, helping you rethink your financial mindset and build a path toward financial freedom.

1. Pay Yourself First

Before you pay your bills, buy groceries, or go out for dinner, make sure you’ve set aside a portion of your income for savings and investments. This principle is foundational in wealth building. It enforces discipline and helps you prioritize financial growth.

"Don’t save what is left after spending; spend what is left after saving."

2. Learn to Invest

Kiyosaki emphasizes that you can’t become wealthy simply by saving. Investing is the key to growing your wealth. Learn how to invest in real estate, stocks, or businesses—assets that generate passive income.

Education doesn’t end in school. Financial education continues for life.

3. Don’t Be a Hater of Money

Many people are taught that money is bad or greedy. Rich Dad Poor Dad flips that narrative. Money is a tool. Hating it keeps you broke. Respect it, learn how it works, and use it to make a difference.

4. Give Every Dollar a Job

Uncontrolled spending leads to financial instability. Budget every dollar you earn so you can manage your resources intentionally and align your money with your goals.

5. Spend Less Than You Earn

This timeless principle is the bedrock of financial stability. No matter how much you make, if you spend more, you’ll always be in debt. Save and invest the difference.

6. Have a Plan and Set Goals

Financial success requires intentionality. Create short-term and long-term goals. Whether it’s buying property, retiring early, or building a business, a clear plan turns dreams into results.

7. Don’t Be a Slave to Money

Many people work jobs they hate simply to pay bills. Instead, build assets that work for you. Financial independence means you’re not working for money, but money is working for you.

8. Keep Your Finances Organized

Track your income, expenses, debts, and investments. Use tools, apps, or spreadsheets. Knowing where your money goes is essential for gaining control over your financial life.

9. It’s a Game—Learn How It Works

Money isn’t just math. It’s psychology, risk, and strategy. Treat your financial journey like a game: learn the rules, build skills, and level up through smart decisions.

10. Always Have an Emergency Fund

Life is unpredictable. An emergency fund provides a safety net that prevents you from falling into debt when unexpected expenses arise.

Aim for 3–6 months of living expenses set aside in an accessible account.

11. Make Money Work for You

This is the essence of passive income. Don’t trade time for money forever. Invest in assets—stocks, real estate, businesses—that earn income whether you’re working or not.

12. Learn How to Make Money Passively

Passive income is the key to wealth and freedom. Rental properties, dividend-paying stocks, royalties, and digital products are all examples of income that doesn’t require your daily effort.

13. Use Money to Solve Problems

True wealth is not just about accumulation—it’s about impact. Invest in businesses that solve real problems. Use your resources to improve lives and contribute to society.

14. It’s Not What You Make, It’s What You Keep

High income doesn’t guarantee wealth. Many people earn a lot but spend it all. Build wealth by saving, investing wisely, and managing expenses. Keep more of what you earn.

Final Thoughts

Rich Dad Poor Dad is more than just a financial book—it’s a mindset shift. By applying these 14 money rules, you can begin to take control of your financial destiny, break free from the paycheck-to-paycheck cycle, and start building a future based on financial education, discipline, and opportunity.

Start today. Choose to be your own “Rich Dad.”

What's Your Reaction?