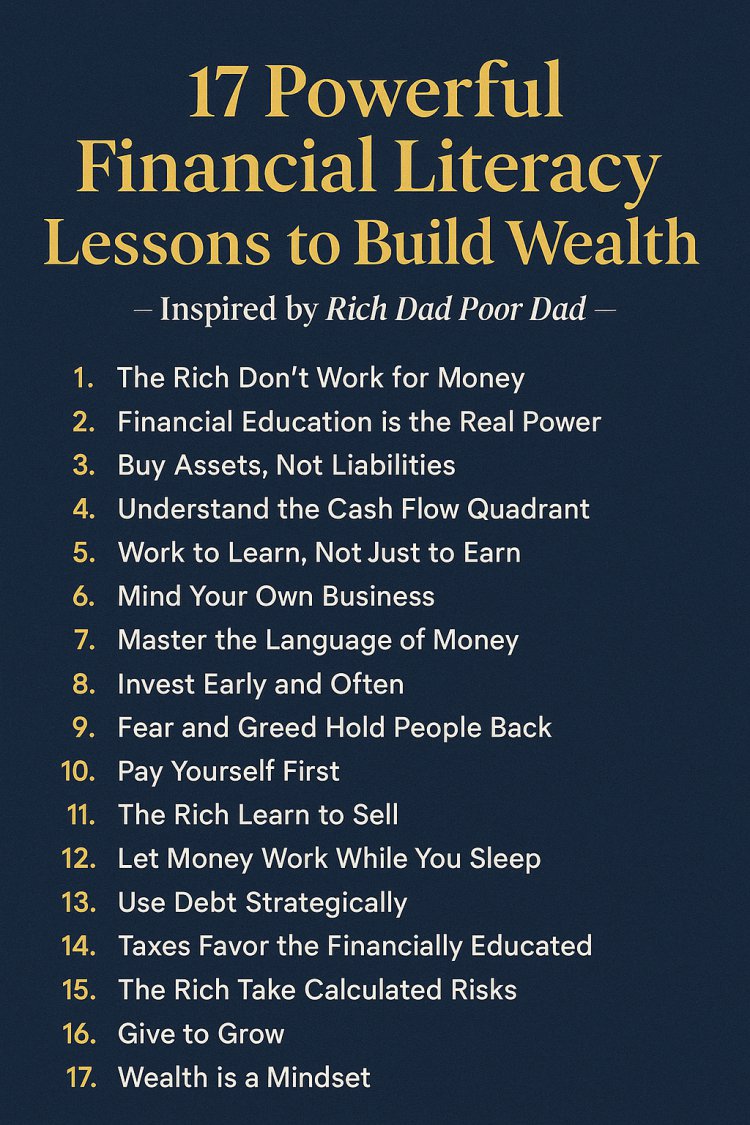

17 Financial Literacy Lessons to Build Wealth: Inspired by Rich Dad Poor Dad

Master wealth-building with 17 financial literacy lessons from Rich Dad Poor Dad. Learn about assets vs. liabilities, passive income, and more to secure your financial future.

If you've ever wondered why some people grow rich while others remain stuck in financial struggle, the answer often lies in one key area: financial literacy. Robert Kiyosaki's bestselling book, Rich Dad Poor Dad, has become a global guide to mastering money—and it all begins with learning the right financial lessons early.

Here are 17 transformative lessons drawn from Rich Dad Poor Dad to help you build sustainable wealth and achieve financial freedom:

1. The Rich Don’t Work for Money

Wealthy individuals learn how to make money work for them through investments and passive income streams, instead of trading time for a paycheck.

2. Financial Education is the Real Power

It’s not how much money you make, but how much you keep and how wisely you invest that determines your wealth. Financial education is more valuable than academic degrees alone.

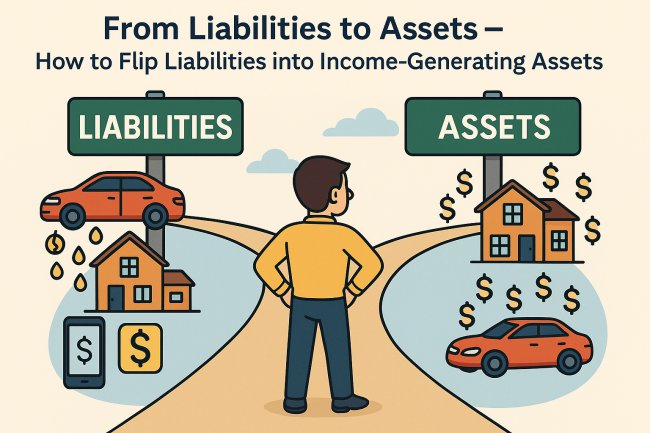

3. Buy Assets, Not Liabilities

The rich invest in income-generating assets—like real estate, stocks, or businesses. Poor financial habits often lead people to accumulate liabilities disguised as assets (like cars or expensive gadgets).

4. Understand the Cash Flow Quadrant

There are four ways to earn: Employee (E), Self-Employed (S), Business Owner (B), and Investor (I). True wealth is built on the B and I side.

5. Work to Learn, Not Just to Earn

Early in your career, focus on learning skills like sales, leadership, communication, and investing. These will pay off far more than a salary alone.

6. Mind Your Own Business

Always develop something on the side—whether it’s a business or investment portfolio—that grows your wealth independent of your day job.

7. Master the Language of Money

Learn the basics of accounting, investing, markets, and taxation. It’s the language of the financially successful.

8. Invest Early and Often

Time is your biggest asset. The earlier you start investing, the greater the compounding effect on your wealth.

9. Fear and Greed Hold People Back

Many don’t invest because they fear losing money. Others are driven by greed, chasing risky get-rich-quick schemes. Wealth-building requires calm, informed decisions.

10. Pay Yourself First

Always save and invest a portion of your income before paying bills or spending on luxuries. Build your financial foundation first.

11. The Rich Learn to Sell

Sales and marketing are essential skills in business and investing. Whether you're selling a product, a service, or an idea—learn to persuade effectively.

12. Let Money Work While You Sleep

Develop passive income streams that earn while you’re not working—dividends, rental income, royalties, etc.

13. Use Debt Strategically

Bad debt buys liabilities. Good debt is used to acquire cash-flowing assets. The rich often leverage other people’s money to grow wealth.

14. Taxes Favor the Financially Educated

Understand how tax laws work. Business owners and investors often enjoy tax advantages not available to employees.

15. The Rich Take Calculated Risks

Instead of avoiding risks, financially literate people learn to manage and reduce them through education and strategy.

16. Give to Grow

Contribution multiplies value. Giving—whether through mentorship, charity, or community involvement—creates abundance, not scarcity.

17. Wealth is a Mindset

Ultimately, wealth begins with mindset. Believe in abundance, think long-term, and act with discipline—and your external wealth will follow.

Final Thoughts:

Building wealth is not about luck or inheritance—it’s about learning and applying key financial principles. Inspired by Rich Dad Poor Dad, these 17 lessons can help you transform your mindset, reshape your habits, and start your journey toward financial independence.

Start today. Learn continuously. Act boldly.

Files

What's Your Reaction?