Financial Education: The Foundation of Wealth in the Modern World

Discover how financial education transforms your life. Learn practical lessons on budgeting, saving, debt management, and investing — customized for Kenya, Nigeria, and Africa.

Financial freedom doesn’t start with money — it starts with knowledge.

Before you can grow wealth, you must understand how money works, how to manage it, and how to make it work for you. That’s what financial education is all about.

Across Kenya, Nigeria, and Africa at large, millions of people work hard every day but remain trapped in financial uncertainty — not because they lack effort, but because they lack financial literacy.

This comprehensive guide will show you what financial education really means, why it’s your most important lifelong asset, and how you can apply it to master your money, escape debt, and build lasting wealth.

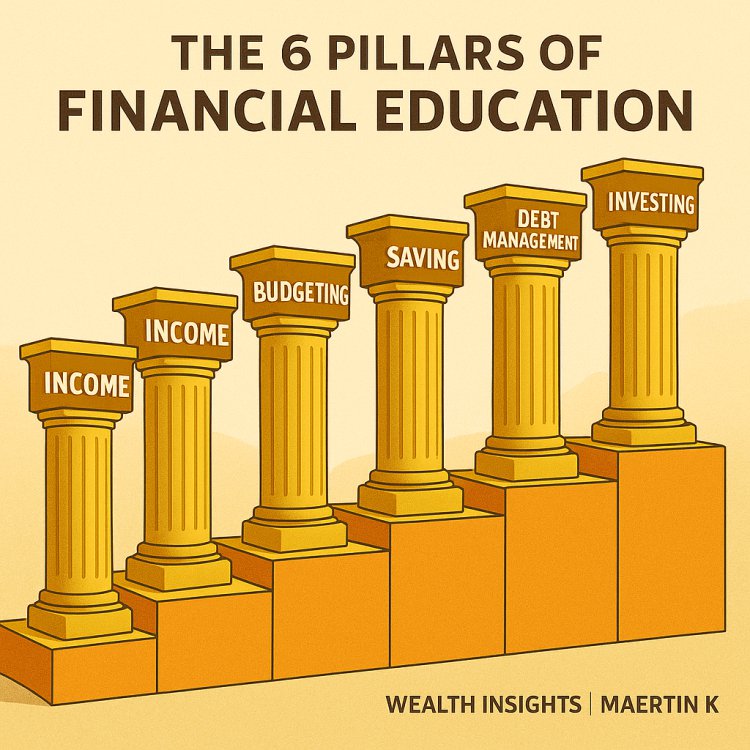

1. What Financial Education Really Means

Financial education is not about complex accounting or economics. It’s about understanding money at a personal level — how you earn it, spend it, save it, borrow it, and invest it.

It’s the ability to:

-

Budget wisely

-

Save consistently

-

Manage debt responsibly

-

Invest intelligently

-

Build long-term financial security

Financial education empowers you to make informed decisions instead of emotional ones. It replaces fear with confidence and confusion with clarity.

In simple terms: financial education is learning how to keep more of what you earn and make it multiply.

2. Why Financial Education Matters

Without financial education, income alone will never bring stability.

Many people earn more than they ever did before — yet still live paycheck to paycheck. Why? Because their money habits didn’t grow with their income.

Financial education helps you:

-

Control your money — instead of your money controlling you.

-

Avoid costly mistakes like unnecessary debt or bad investments.

-

Build wealth intentionally through saving, investing, and planning.

-

Gain confidence to navigate financial systems — banks, SACCOs, fintech apps, and stock markets.

-

Plan for emergencies and protect your future.

Knowledge truly compounds faster than interest. The more you learn about money, the smarter your decisions become — and the richer your results.

3. The Importance of Financial Awareness

Financial awareness is the first step in your education journey.

You cannot fix what you don’t understand.

Most people are financially unaware — they don’t know exactly how much they earn, how much they spend, or how much they owe. Awareness means clarity. It means knowing your numbers and your habits.

Take these steps today:

-

Track every shilling or naira you spend for one month.

-

List all your income sources.

-

Review your debts and their interest rates.

-

Analyze where your money leaks occur.

Awareness alone can improve your financial health dramatically. Once you see the truth, you can begin to make better choices.

4. Pillar 1: Understanding Income and Money Flow

Financial education starts with understanding how money flows into and out of your life.

Types of Income

-

Active Income: Money you earn by working — salaries, wages, commissions, freelance jobs.

-

Passive Income: Money you earn automatically from assets — investments, rentals, dividends, royalties.

The financially educated person aims to build multiple income streams, especially those that continue even when they are not working.

Practical Example (Kenya Context)

-

Active: Your monthly salary or daily business income.

-

Semi-passive: Commissions from affiliate sales or e-commerce.

-

Passive: Dividends from Safaricom or BAT Kenya shares, interest from Absa or Britam Money Market Fund, or SACCO annual dividends.

Key Lesson

Don’t depend on one income stream. Learn to diversify early — even if the extra income starts small.

5. Pillar 2: Budgeting and Expense Management

Budgeting is the foundation of financial control.

It’s not about restriction — it’s about direction.

A budget gives every shilling a purpose. Without it, your money disappears silently into impulse purchases, mobile loans, and “small expenses” that add up.

How to Budget Effectively

-

Calculate total income. Include salary, side hustles, dividends, etc.

-

List monthly expenses. Group them into needs, wants, and savings.

-

Apply the 50/30/20 rule:

-

50% on needs (rent, food, utilities)

-

30% on wants (entertainment, lifestyle)

-

20% on savings/investments

-

-

Automate saving. Set up standing orders or use apps like Chumz or Absa app to transfer automatically.

-

Track progress monthly. Review and adjust regularly.

Kenyan Example

Suppose you earn KES 60,000 monthly.

-

KES 30,000 for essentials (needs)

-

KES 18,000 for lifestyle (wants)

-

KES 12,000 for savings/investments

If you automate that final 20%, you’ll save over KES 144,000 in a year — before interest.

6. Pillar 3: Saving and Building Cash Reserves

Saving money is not about how much you earn, but how much you keep.

Your ability to save consistently is the first test of financial discipline.

Why Savings Matter

-

Emergency protection: Life is unpredictable — savings reduce stress.

-

Investment foundation: You need capital to invest.

-

Confidence: Having savings gives you options.

Types of Savings

-

Emergency Fund: 3–6 months of expenses for crises.

-

Short-Term Savings: For goals like vacations, education, or gadgets.

-

Long-Term Savings: For future projects or investments.

Tools for Saving in Kenya/Nigeria

-

SACCOs: Offer disciplined saving and dividends.

-

Money Market Funds (MMFs): Short-term, low-risk investments (Zimele, Britam, Sanlam, CIC).

-

Digital Apps: Chumz, M-Pesa Global Save, Absa App, KCB Mobi Save.

Consistency beats amount. Save automatically every month — even if it’s KES 1,000.

7. Pillar 4: Managing and Eliminating Debt

Debt can be a bridge or a trap. It depends on how you use it.

Financial education helps you distinguish between productive debt and destructive debt.

Productive Debt

Used to acquire something that increases your income or value:

-

Business capital that generates profit

-

Asset purchases (tools, equipment)

-

Education that enhances earning potential

Destructive Debt

Used for consumption or non-productive expenses:

-

Shopping on credit

-

Instant mobile loans for non-essentials

-

Borrowing to maintain appearances

Smart Debt Rules

-

Borrow only what you can repay comfortably.

-

Know the total cost (interest + fees).

-

Prioritize high-interest debt first.

-

Avoid borrowing for wants.

-

Build a repayment plan and automate it.

Example

If you have a mobile loan at 45% and a SACCO loan at 12%, pay off the mobile loan first — it’s draining your income silently.

Freedom from debt is the first real form of wealth.

8. Pillar 5: Investing and Growing Wealth

Saving keeps you safe. Investing makes you rich.

Once you’ve mastered budgeting and cleared bad debt, it’s time to make your money work for you.

What Is Investing?

Investing is putting your money into assets that generate more money. It’s how you multiply your income while you sleep.

Types of Investments

-

Stocks and Shares: Buy ownership in companies (Safaricom, KCB, Equity, BAT Kenya).

-

Money Market Funds (MMFs): Safe, low-risk, and liquid investment vehicles.

-

SACCO Dividends: Annual returns from collective investments.

-

Real Estate: Land or rental property (requires patience and planning).

-

Digital Assets: Online stores, eBooks, YouTube channels, or digital courses.

Investment Rules

-

Understand before you invest.

-

Avoid “get-rich-quick” schemes.

-

Start small but stay consistent.

-

Reinvest your returns.

-

Think long-term, not overnight profits.

In Kenya, even small investors can start with KES 1,000 through Hisa app or KCB Capital. The earlier you start, the stronger the compound effect.

9. Pillar 6: Protecting and Sustaining Wealth

Building wealth is half the journey — keeping it is the other half.

Protection Strategies

-

Insurance: Health, life, business, or property insurance shields you from shocks.

-

Emergency Fund: Prevents falling back into debt.

-

Financial Records: Keep all statements, receipts, and contracts organized.

-

Diversification: Don’t put all your capital in one investment. Spread risk.

Example

A family with health insurance avoids selling assets during medical emergencies. A small business with records can access financing faster than one without.

Protect your progress. Losing wealth due to poor planning is more painful than never having it.

10. The Mindset of Financially Educated People

Financial success begins with mindset, not money.

Financially educated individuals think differently:

-

They live below their means.

-

They delay gratification.

-

They make informed decisions.

-

They stay curious and keep learning.

-

They view mistakes as lessons, not failures.

They understand that success comes from discipline, consistency, and continuous learning — not luck or shortcuts.

If your mindset grows faster than your income, your wealth will follow.

11. Common Financial Mistakes to Avoid

Even the smartest people lose money by repeating common mistakes.

Avoid these traps if you want to progress faster:

-

Spending more than you earn

-

Ignoring your financial statements

-

Borrowing to fund lifestyle

-

Chasing trendy investments

-

Skipping an emergency fund

-

Failing to track expenses

-

Not learning about taxes and inflation

-

Relying solely on salary

-

Poor recordkeeping

-

Lack of patience — quitting before growth happens

Wealth building takes time. The biggest difference between the rich and poor is not opportunity — it’s patience.

12. Financial Education in the African Context

Africa’s financial environment is unique — full of opportunities and challenges.

Opportunities

-

Growing fintech adoption (Chumz, Hisa, M-Pesa, Flutterwave, Paystack).

-

Expanding stock markets in Kenya, Nigeria, South Africa.

-

Accessible investment vehicles: SACCOs, unit trusts, MMFs.

Challenges

-

Low financial literacy levels.

-

High mobile loan interest rates.

-

Cultural pressure to spend for status.

-

Unregulated investment scams.

What You Can Do

-

Learn continuously — through books, blogs, and videos.

-

Verify every investment before joining.

-

Apply both global and local strategies — combine the wisdom of Warren Buffett with the practicality of SACCO savings.

Financial education turns challenges into stepping stones. The more you know, the fewer mistakes you make.

13. How to Build a Lifelong Financial Education System

Financial learning is not a one-time course — it’s a lifelong commitment.

Step-by-Step Learning Plan

-

Month 1–3:

-

Track expenses and set a budget.

-

Read basic finance books (Rich Dad Poor Dad, The Richest Man in Babylon).

-

Watch videos or listen to finance podcasts weekly.

-

-

Month 4–6:

-

Build an emergency fund.

-

Learn about SACCOs, MMFs, and digital saving tools.

-

Start a small side hustle.

-

-

Month 7–12:

-

Study investing basics: stocks, bonds, and ETFs.

-

Open an investment account.

-

Attend free online classes on personal finance.

-

-

Year 2–3:

-

Expand income streams.

-

Explore real estate or long-term investing.

-

Mentor someone else — teaching reinforces learning.

-

The goal is not speed — it’s sustainability.

14. The Future Belongs to the Financially Literate

In a digital and unpredictable economy, those who understand money will always stay ahead.

Financial education is the new currency — the tool that ensures your effort is never wasted and your future is never uncertain.

Whether you earn KES 10,000 or KES 1,000,000, your progress depends on what you know and how you apply it.

Keep learning. Keep growing. Keep controlling your money — before it controls you.

The earlier you start, the longer your money works for you.

— Maertin K | Wealth Insights Kenya

What's Your Reaction?