The Money Mindset: How to Think Wealthy and Build Financial Freedom

Master the money mindset in 2025. Learn how wealthy people think about money, overcome limiting beliefs, and adopt habits that create financial freedom.

“Wealth begins in the mind before it shows up in the bank account.”

Most people believe that money problems are solved by earning more. But the truth is, money is 80% mindset and only 20% mechanics. The way you think, feel, and act around money determines whether you stay broke, live paycheck to paycheck, or achieve financial independence.

In this article, we’ll explore what a money mindset is, the common limiting beliefs that keep people poor, and the wealthy habits you must adopt if you want lasting prosperity.

What is a Money Mindset?

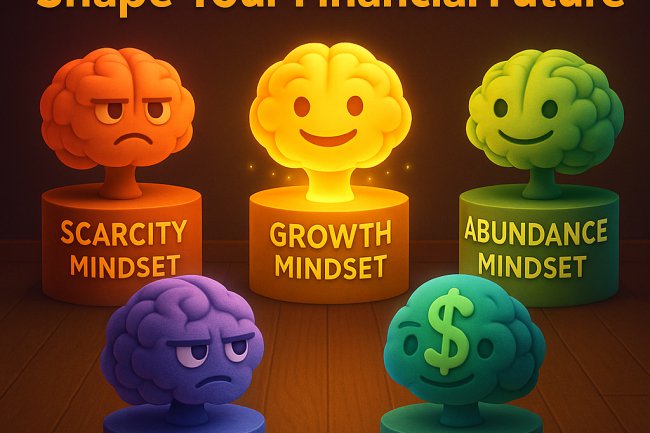

Your money mindset is the set of beliefs and attitudes you hold about money. It shapes how you save, spend, invest, and even earn.

-

Scarcity Mindset: Believes money is hard to get, limited, and always running out.

-

Abundance Mindset: Believes money flows, opportunities are endless, and wealth can grow.

Rich people don’t just think differently — they expect money to multiply through value creation, while poor people often focus only on survival.

7 Limiting Money Beliefs That Keep People Broke

-

“Money is the root of all evil.”

Truth: The love of money without values is evil. Money itself is neutral — it amplifies who you already are. -

“I’m just not good with money.”

Truth: Financial literacy can be learned by anyone. -

“I’ll start saving when I earn more.”

Truth: If you can’t save Ksh 1,000, you won’t save Ksh 100,000. Habits matter more than amounts. -

“Rich people are greedy.”

Truth: Many wealthy people build fortunes by solving problems and serving others. -

“Debt is normal, everyone has it.”

Truth: Smart debt builds assets. Bad debt keeps you poor. -

“Investing is too risky.”

Truth: Not investing is the biggest risk — inflation eats idle money. -

“I need multiple jobs to get rich.”

Truth: You need multiple income streams, not just jobs.

Wealthy Money Mindset Habits

-

Pay Yourself First

Save and invest before you spend — not after. -

Think Long-Term

Wealthy people ask: “Where will this money be in 10 years?” Poor people ask: “What can I buy today?” -

Turn Income into Assets

Buy investments (stocks, SACCO shares, real estate, MMFs) instead of only liabilities (cars, gadgets). -

See Money as a Tool, Not a Master

Money should work for you — not control your emotions or decisions. -

Invest in Knowledge

Books, courses, mentors — the best ROI comes from self-education. -

Surround Yourself with Wealth Thinkers

Your environment shapes your financial destiny. -

Practice Gratitude and Generosity

Money flows more easily when you value what you already have and create value for others.

African & Global Examples of Money Mindset in Action

-

Kenya: Young professionals investing early in Money Market Funds or SACCOs, instead of spending all on lifestyle.

-

Nigeria: Entrepreneurs building online businesses on Jumia and re-investing profits into real estate.

-

Global: Warren Buffett still lives frugally despite billions, proving that mindset, not luxury, creates lasting wealth.

Final Thoughts

Your money mindset will either attract wealth or repel it. If you keep telling yourself “I’m broke,” money will keep running from you. If you start saying “I am building wealth daily,” your actions will align with that belief.

✅ Train your mind to see money as seed for multiplication.

✅ Build habits that create financial freedom.

✅ Remember: The wealthy think differently, and that’s why they get different results.

What's Your Reaction?