Money Mindset: How to Think, Act, and Build Wealth Like the Financially Free

Discover how to build a powerful money mindset for long-term financial success. Learn how beliefs, habits, and smart thinking shape wealth creation in Kenya and Africa.

Every financial journey begins in the mind. Before you can grow your income, invest wisely, or achieve financial freedom, you must first master your money mindset — the beliefs, habits, and attitudes that guide how you earn, spend, save, and invest.

Two people can earn the same salary, live in the same city, and yet end up in completely different financial positions. The difference isn’t luck — it’s mindset.

Your money mindset determines whether you grow wealth or struggle with it. And the good news? You can reprogram it — starting today.

1. What Is a Money Mindset?

Your money mindset is your personal philosophy about money — the internal script that influences every financial decision you make.

It’s how you think about:

-

Earning

-

Spending

-

Saving

-

Investing

-

Risk and opportunity

-

Wealth and success

If you believe “money is scarce,” you’ll hold back from opportunities.

If you believe “money is a tool for growth,” you’ll take smarter risks and invest for the future.

A healthy money mindset doesn’t depend on how much you have. It depends on how you manage and multiply what you have.

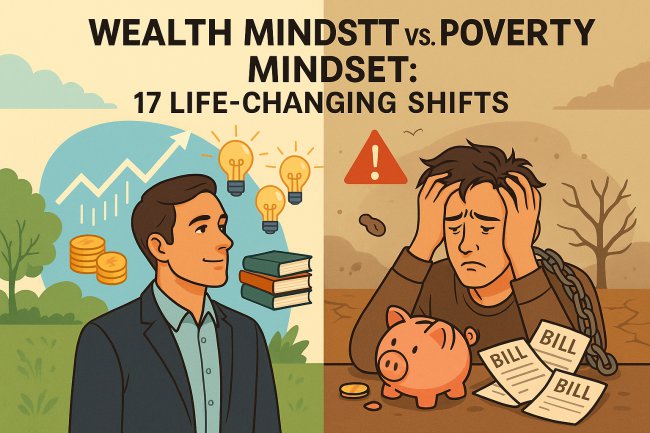

2. The Two Types of Money Mindsets

(a) Scarcity Mindset

People with a scarcity mindset think money is limited — that there’s never enough to go around.

Common traits:

-

Fear of taking risks or investing

-

Living paycheck to paycheck

-

Hoarding instead of growing

-

Feeling guilty for wanting more

This mindset breeds financial stagnation.

(b) Abundance Mindset

People with an abundance mindset see money as renewable — something that flows through hard work, creativity, and strategy.

They focus on opportunities, not limitations.

Traits:

-

Open to learning about investing

-

Sees failure as feedback

-

Believes in creating multiple income streams

-

Focuses on long-term wealth, not short-term comfort

The abundance mindset attracts growth, because it’s built on confidence and responsibility.

3. Why Mindset Shapes Financial Outcomes

Money follows mindset.

If you think like an investor, you’ll find opportunities others overlook.

If you think like a consumer, you’ll spend everything you earn.

Example

Two friends each earn KES 100,000.

-

One spends it all on lifestyle and short-term pleasures.

-

The other saves KES 20,000 monthly and invests through a Money Market Fund.

After five years, one has assets — the other has memories.

Mindset isn’t about how much you make. It’s about how much you keep, manage, and multiply.

4. How the Poor, Middle Class, and Rich Think Differently

Poor Mindset

-

Focus: Survival

-

Money Purpose: Spend immediately

-

Time Horizon: Daily or weekly

-

Common Belief: “If I just earn more, I’ll be fine.”

Middle-Class Mindset

-

Focus: Security

-

Money Purpose: Save and spend carefully

-

Time Horizon: Monthly or yearly

-

Common Belief: “If I get a promotion, I’ll be rich.”

Wealthy Mindset

-

Focus: Freedom and impact

-

Money Purpose: Multiply and sustain

-

Time Horizon: Decades

-

Common Belief: “How can I make my money work for me?”

The transition from middle class to wealthy doesn’t require a lottery — it requires a shift in thinking.

5. 10 Core Principles of a Wealth-Building Mindset

-

Pay Yourself First – Always save and invest before you spend.

-

Separate Needs from Wants – Lifestyle follows income, not the other way around.

-

Learn Before You Earn – Knowledge compounds faster than money.

-

Delay Gratification – Wealth grows in silence, not in impulse.

-

Take Calculated Risks – Every investment involves risk; manage it, don’t fear it.

-

Think Long Term – Short-term thinking destroys compounding.

-

Embrace Financial Education – Learn about SACCOs, MMFs, stocks, and insurance.

-

Budget Intelligently – Control money flow instead of reacting to it.

-

Automate Progress – Use standing orders to build consistent habits.

-

Associate Upward – Spend time with financially disciplined people.

Wealth grows where structure, consistency, and smart habits meet.

6. Money Mindset in the African Context

In Africa, many people grow up with mixed messages about money — that it’s scarce, risky, or even bad to want more. But today’s digital and economic reality requires a mindset shift.

The Modern African Opportunity

-

Fintech revolution: Apps like Chumz, Hisa, and Bamboo make investing easy.

-

SACCOs and Money Market Funds: Allow everyday citizens to invest from KES 500.

-

Youth innovation: Digital entrepreneurship and online business are opening new wealth channels.

-

Knowledge access: Financial education is now free through blogs, podcasts, and platforms like Wealth Insights Kenya.

Limiting Beliefs Holding Africans Back

-

“I can’t invest until I’m rich.”

-

“Business is too risky.”

-

“Only certain people can succeed.”

Replace these with empowering beliefs:

-

“I can start small and grow consistently.”

-

“Risk is manageable when I learn.”

-

“My financial future depends on my mindset, not my background.”

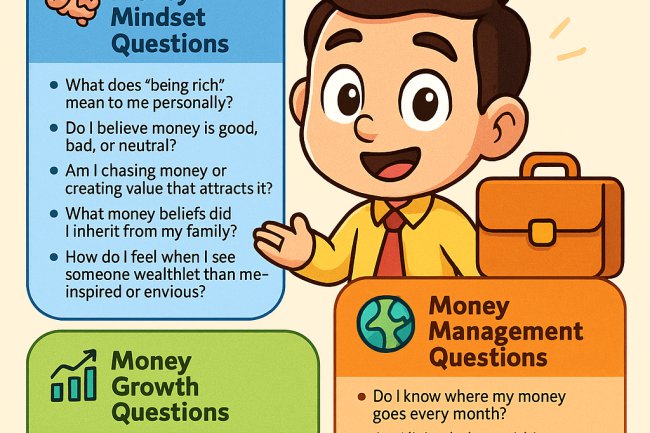

7. Rewiring Your Money Mindset

Shifting your mindset takes awareness and intentional action.

Step 1: Identify Your Money Story

Ask: What did you learn about money growing up?

Write down your beliefs — both positive and negative.

Step 2: Challenge Limiting Beliefs

If you believe “investing is for the rich,” question it. Many platforms now let you start with as little as KES 100.

Step 3: Set New Financial Goals

Define what financial freedom means for you. Example: “I want to have an emergency fund equal to 6 months of expenses by next year.”

Step 4: Educate Yourself

Read books, watch financial videos, and follow credible sources like CMA Kenya, NSE, and reputable blogs.

Step 5: Take Small Wins Seriously

Open your first investment account, save your first KES 5,000, clear one debt. Each win reprograms your brain for abundance.

8. Habits That Build a Positive Money Mindset

-

Track Expenses Weekly

Awareness builds control. -

Review Goals Monthly

Keeps you focused on growth, not frustration. -

Avoid Lifestyle Inflation

Don’t increase spending every time income rises. -

Celebrate Discipline, Not Spending

Reward progress — not consumption. -

Invest Automatically

Set up recurring deposits in Money Market Funds or SACCOs. -

Network With Smart Investors

Join communities that discuss finance and growth. -

Keep a Long-Term Journal

Document lessons learned, investment performance, and insights.

9. The Psychology Behind Money Decisions

Financial behaviour is 80% emotion and 20% logic.

Marketers, banks, and platforms know this — that’s why emotional spending is common.

Triggers That Lead to Bad Money Decisions:

-

Stress or boredom

-

Comparison (social media lifestyle pressure)

-

Fear of missing out (FOMO)

-

Poor planning or impulsive rewards

Solutions

-

Use cooling-off periods before big purchases.

-

Stick to your written budget.

-

Review goals before any new commitment.

-

Build discipline muscles — consistency beats excitement.

10. Building Generational Wealth Through Mindset

Changing your mindset doesn’t just impact you — it changes your lineage.

Financially empowered individuals pass on knowledge, not just money.

Teaching children about budgeting, saving, and investing creates generational stability.

Africa’s wealth gap isn’t just about income inequality; it’s about information inequality.

By developing the right mindset, you close that gap for yourself and others.

11. Mindset Shifts That Create Financial Freedom

| Old Mindset | New Wealth Mindset |

|---|---|

| “I can’t save enough.” | “I start small and grow.” |

| “I’ll invest when I have more.” | “I invest something every month.” |

| “Debt is normal.” | “I use debt strategically.” |

| “I don’t understand finance.” | “I can learn one concept at a time.” |

| “I must look rich.” | “I prefer being rich, not looking rich.” |

Wealth begins where excuses end.

12. The Role of Education and Technology

Financial education and digital tools are the modern equalizers.

-

Digital Finance Apps: Hisa (stocks), Chumz (saving), Absa App (MMFs), Bamboo (global ETFs).

-

Online Courses: Platforms like Udemy, Coursera, and local workshops teach personal finance.

-

Market Information: NSE and CMA Kenya publish data anyone can access.

Technology is your teacher, banker, and mentor — use it to build wealth.

13. From Consumer to Creator: The Entrepreneurial Mindset

A true money mindset goes beyond saving — it creates value.

-

Consumers spend money to survive.

-

Creators build products, services, and systems that attract income.

The moment you shift from “how do I spend?” to “how do I earn more?” your financial future changes forever.

Start small — a digital store, a service, or an informational product. Let your skills become income streams.

14. Long-Term Thinking: The Ultimate Wealth Advantage

Most people underestimate what they can do in 10 years but overestimate what they can do in 1.

The wealthy understand time as leverage.

Compounding, business growth, and financial learning all reward patience.

Start now. Stay consistent. Your future wealth is a delayed reward for today’s discipline.

Conclusion: Think Rich, Act Smart, Grow Consistently

The biggest difference between the financially free and the financially frustrated is mindset.

A strong money mindset transforms fear into confidence, mistakes into lessons, and effort into results.

You don’t need to be born rich — you need to think rich, learn daily, and act deliberately.

Change your beliefs. Build good habits. Keep your eyes on the long game.

The right mindset won’t just change your finances — it will change your life.

— Maertin K | Wealth Insights Kenya

What's Your Reaction?