9 Timeless Money Lessons from The Richest Man in Babylon

Learn 9 timeless money lessons from The Richest Man in Babylon. Discover how to spend wisely, earn more, protect your income, and build lasting wealth.

The book The Richest Man in Babylon by George S. Clason may be old, but its financial wisdom is timeless. Packed in simple parables, these principles have stood the test of time and are still highly relevant for anyone who wants to build lasting wealth.

Below are 9 powerful lessons from the book—categorized into spending, making, and protecting money—that can transform your financial journey.

PART 1: SPENDING MONEY

1. Start Thy Purse to Fattening

“A part of all you earn is yours to keep.”

Too often, we treat our paycheck like it's meant for everyone else—landlords, bills, entertainment—and leave nothing for ourselves. The principle here is simple: Pay yourself first. Before spending, set aside a portion of your income for saving and investing.

2. Control Thy Expenditures

“Our expenses will always rise to match our income unless we protest to the contrary.”

This lesson warns against lifestyle inflation. As income grows, so do "necessary" expenses—unless we’re intentional. Know the difference between needs and disguised wants. Budget wisely and live below your means.

3. Enjoy Life While You Can

Wealth isn't just about saving. It's about living a fulfilled life. Set aside money for joyful experiences like travel, hobbies, and time with loved ones. Financial responsibility includes enjoying the fruits of your labor—guilt-free.

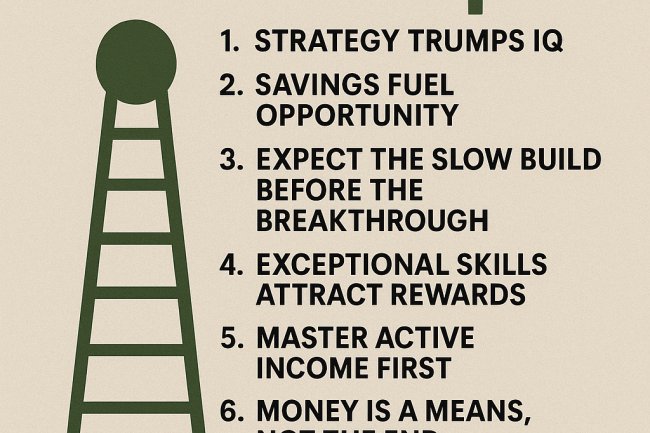

PART 2: MAKING MONEY

4. Make Thy Gold Multiply

“Gold in use will earn more than gold buried.”

Simply saving isn’t enough. To build real wealth, your money must work for you through investment—whether in stocks, business, or real estate. Compound interest is powerful; the earlier you start, the more it rewards you.

5. Ensure a Future Income

This lesson is a call to prepare for retirement. One day, you may not be able (or want) to work. Begin investing now to secure passive income later in life. Don’t wait until it’s urgent—make it a priority today.

6. Increase Thy Ability to Earn

“Man’s wealth is not in the purse he carries. It is the income he builds.”

Don’t accept a fixed income mindset. Continuously grow your skills, learn new things, and open doors to more income opportunities. Combine saving and earning to accelerate your wealth-building.

PART 3: PROTECTING MONEY

7. Guard Thy Treasures from Loss

Don’t invest in things you don’t understand. Arcad loses his savings by trusting a brickmaker with jewel investment advice. The lesson? Do due diligence. Only put your money in places where your capital is safe and the risk is clear.

8. Seek Counsel of Wise Men

Everyone has advice, but not everyone is qualified. Learn from those who have real experience and results. Wise mentors can help you avoid costly mistakes and find proven strategies.

9. Cultivate Good Luck Through Action

“Action attracts opportunity.”

People often say others are “just lucky.” But luck usually finds those who take action, prepare, and stay ready. The more proactive you are, the more “luck” will appear in your life.

Final Thoughts

The ancient city of Babylon may be long gone, but its financial lessons live on. Whether you're just starting your journey or looking to sharpen your money mindset, these timeless principles can guide you toward financial independence and peace of mind.

Which lesson spoke to you most? Leave a comment and share this with a friend who needs it.

Files

What's Your Reaction?