The Books That Build Wealth: What to Read at Every Stage of Your Financial Journey

Discover the best personal finance and investing books for every wealth stage. Learn what to read when you’re broke, building savings, investing, or scaling your business to global impact.

Because financial freedom isn’t luck—it’s literacy.

Introduction: Why Books Are Wealth Accelerators

Before wealth appears in your bank account, it must first appear in your mind.

The most successful people on earth—from Warren Buffett to Strive Masiyiwa—are voracious readers. Buffett reads hundreds of pages daily. Masiyiwa once said that reading taught him to think like an entrepreneur.

Reading is the most affordable mentorship you will ever find. A single book compresses decades of another person’s experience into hours of learning. It’s leverage. One idea from one chapter can alter the direction of your financial life.

In this article, you’ll explore five wealth classes—each representing a stage of financial growth—and the books that will help you level up from one stage to the next.

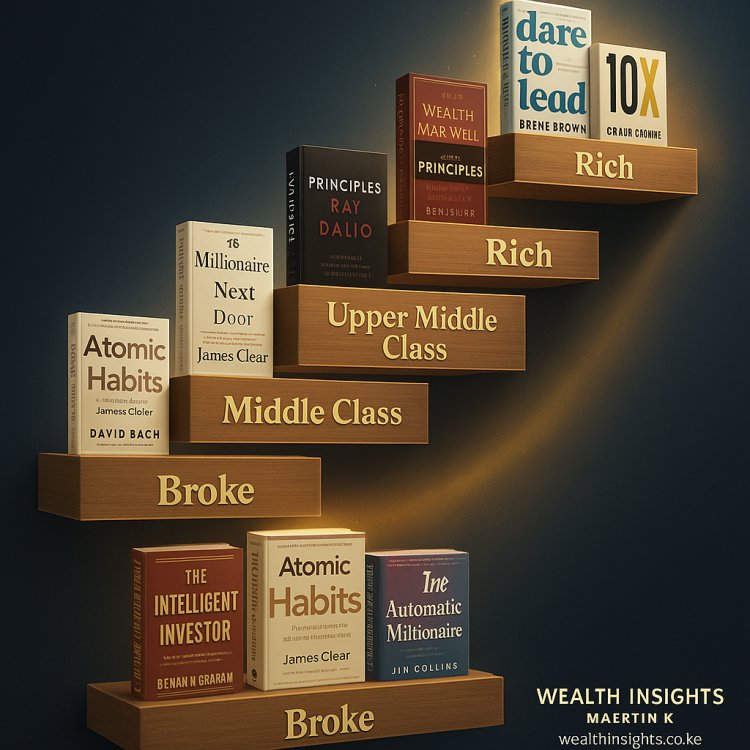

Stage 1: The Broke Class — Escaping Survival Mode

When you are broke, the goal is not to look rich; it’s to stop struggling. This stage is about unlearning bad habits, changing your mindset, and building a foundation for financial literacy.

Mindset Goal

Replace limiting beliefs with accurate knowledge about how money works.

Recommended Books

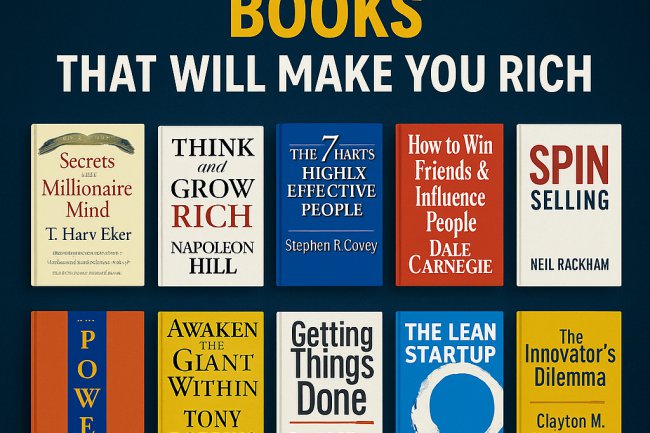

-

The Richest Man in Babylon – George S. Clason

A timeless guide written in parables. It teaches fundamental financial principles like saving, budgeting, and paying yourself first. -

Rich Dad Poor Dad – Robert Kiyosaki

Explains the difference between assets and liabilities and how the wealthy think differently about money. -

The Total Money Makeover – Dave Ramsey

A practical system for getting out of debt, budgeting effectively, and taking control of your financial life. -

Think and Grow Rich – Napoleon Hill

Focuses on mindset, desire, and persistence—the mental foundation needed to create wealth. -

You’re Not Broke, You’re Pre-Rich – Emmanuel Asuquo

A relatable, modern approach to personal finance, especially for young Africans navigating digital and urban lifestyles.

African Context

At this level, you’re likely surviving on limited income, freelancing, or building small hustles.

Start simple. Track your spending, save small amounts using digital apps like Chumz or Hisa, and read for 10–20 minutes daily. Each book you finish adds value to your financial IQ.

Stage 2: The Middle Class — Building Discipline and Systems

Once you’ve escaped survival mode, the next challenge is stability. At this stage, you have income, but you must learn to manage and multiply it effectively.

Mindset Goal

Create order. Build habits and systems that make saving and investing automatic.

Recommended Books

-

The Millionaire Next Door – Thomas Stanley and William Danko

Research-based insights into how most real millionaires live—quietly, frugally, and purposefully. -

Atomic Habits – James Clear

Demonstrates how tiny, consistent habits lead to massive success over time. -

The Automatic Millionaire – David Bach

Shows how automating your savings and investments creates wealth effortlessly over years. -

The 4-Hour Work Week – Tim Ferriss

Redefines the idea of work and teaches how to automate income, outsource tasks, and focus on high-value activities. -

Smart Money Woman – Arese Ugwu

A modern African finance story that explains budgeting, debt management, and investing in relatable ways.

African Context

You’re now earning more, possibly in a job or small business. The danger here is lifestyle inflation.

Focus on creating a system: budget monthly, automate savings, and avoid unnecessary expenses.

Study books that help you manage both money and mindset because this stage decides if you’ll progress or stay stuck in the comfort zone.

Stage 3: The Upper Middle Class — Investing and Scaling

Now that you have financial stability, your focus shifts to multiplication.

At this level, it’s about investing intelligently and scaling your income streams.

Mindset Goal

Stop trading time for money. Start creating and owning income-generating assets.

Recommended Books

-

The Intelligent Investor – Benjamin Graham

The ultimate guide to investing. Learn how to identify undervalued assets, manage risk, and think long term. -

One Up On Wall Street – Peter Lynch

Explains how ordinary individuals can outperform experts by investing in what they understand. -

Money Master the Game – Tony Robbins

Breaks down the path to financial freedom through diversification, asset allocation, and compounding. -

The Simple Path to Wealth – JL Collins

Ideal for professionals who want a straightforward approach to investing and building passive income. -

Unshakeable – Tony Robbins

Focuses on emotional intelligence in investing and staying calm through market volatility. -

The Intelligent Entrepreneur – Bill Murphy Jr.

Real case studies showing how entrepreneurs scale ventures and manage growth.

African Context

This is the point to diversify.

-

Invest in dividend stocks on the Nairobi Securities Exchange (Safaricom, KCB, BAT Kenya).

-

Consider money market funds (CIC, Britam, Zimele).

-

Reinvest business profits into new income streams such as digital products or real estate.

Every book in this category will expand your strategic thinking and help you make smarter, data-driven decisions.

Stage 4: The Rich Class — Leadership and Legacy

You have achieved financial independence. Now it’s about sustainable growth, leadership, and long-term impact.

Mindset Goal

Shift from personal success to systems success. Build structures that outlive you.

Recommended Books

-

The 21 Irrefutable Laws of Leadership – John C. Maxwell

A practical framework for leading teams, managing organizations, and building influence. -

Principles – Ray Dalio

A transparent breakdown of how one of the world’s most successful investors makes decisions and runs teams. -

Good to Great – Jim Collins

Explains why some companies thrive while others fail and how to sustain greatness. -

Leaders Eat Last – Simon Sinek

Focuses on building trust, culture, and loyalty within organizations. -

The 10X Rule – Grant Cardone

Teaches massive action, goal expansion, and relentless execution. -

Dare to Lead – Brené Brown

Explores courage, vulnerability, and innovation as modern leadership essentials.

African Context

At this point, you’re likely employing others or leading a company. Leadership, delegation, and mentorship are key.

Your focus should shift from running operations to building people and processes that scale results even when you step away.

Stage 5: The Wealthy and Impact Class — Global Thinking and Legacy Creation

At the top, the focus moves beyond personal gain to global influence and impact. You are building ecosystems—businesses, networks, and legacies that shape the economy and inspire others.

Mindset Goal

Move from wealth accumulation to wealth multiplication and strategic influence.

Recommended Books

-

Principles for Dealing with the Changing World Order – Ray Dalio

Deep insights into global economic cycles, policy shifts, and how to navigate them as an investor or leader. -

The Almanack of Naval Ravikant – Eric Jorgenson

A concise collection of timeless wisdom on wealth, leverage, happiness, and long-term thinking. -

The Outsiders – William Thorndike

Profiles of unconventional CEOs who mastered capital allocation and grew companies exponentially. -

Zero to One – Peter Thiel

Explains how innovation and unique ideas build world-changing businesses. -

The Hard Thing About Hard Things – Ben Horowitz

Candid lessons on leading through chaos, crisis, and uncertainty. -

Shoe Dog – Phil Knight

The inspiring autobiography of Nike’s founder—a lesson in vision, risk-taking, and perseverance. -

The Everything Store – Brad Stone

Chronicles the rise of Amazon and Jeff Bezos’s strategy of long-term thinking and innovation.

African Context

You are now operating at a regional or global level. Focus on books that stretch your strategic worldview—economics, innovation, technology, and leadership.

At this stage, your influence shapes industries, jobs, and opportunities. Your reading list should keep you informed, visionary, and adaptive.

How to Use This Reading Roadmap

-

Start Where You Are

Don’t jump to advanced books too early. Master the principles that apply to your current stage first. -

Apply Every Lesson

The purpose of reading is transformation, not entertainment. Take one actionable idea from each book and implement it immediately. -

Build a Personal Library

Dedicate a space in your home or office for books. Treat it as your growth investment. -

Document Your Progress

Keep a reading journal. Write what you learned, what surprised you, and how you’ll apply it. -

Balance Your Topics

Mix financial literacy with leadership, psychology, and strategy. Broad knowledge creates innovation. -

Join Book Communities

Discuss what you read with peers. Surround yourself with people who talk about ideas, not gossip. -

Revisit Books

As you grow, the same book reveals new meaning. Reading once gives knowledge; rereading gives wisdom.

Conclusion: Your Bookshelf Is Your Bank

Books are assets. They don’t lose value; they compound it.

Every page you read builds intellectual capital that translates into better financial decisions.

Most people want success fast, but real wealth is built in silence—through reading, reflection, and consistency.

Your library is your mirror. If you want to measure your potential, look at the titles you’re feeding your mind.

Start where you are. Read daily. Think bigger.

Because readers don’t just earn more—they become more.

— Maertin K | Wealth Insights Kenya

What's Your Reaction?