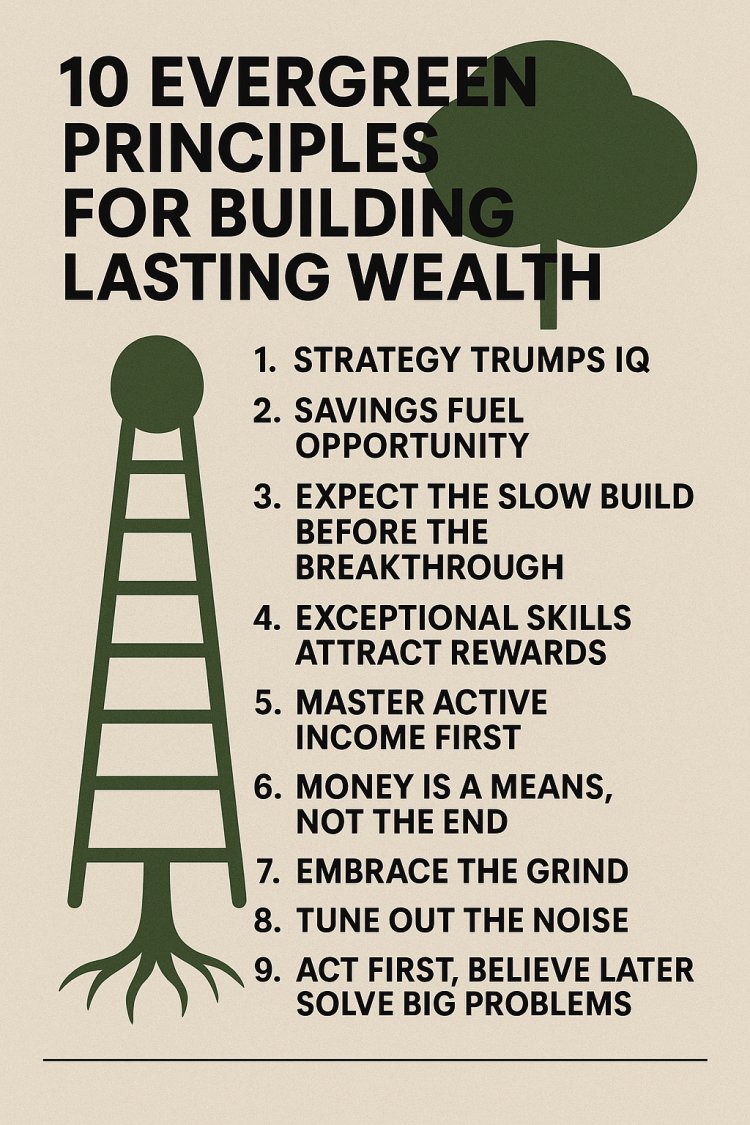

10 Evergreen Principles for Building Lasting Wealth

Learn 10 timeless principles for building lasting wealth with actionable strategies. Discover how to take risks, solve bigger problems, and achieve financial success without needing a genius IQ. Start your journey to wealth today!

Wealth isn't reserved for geniuses or the privileged—it’s forged through smart habits, patience, and purposeful action. Dive into these ten principles to accelerate your financial journey.

1. Strategy Trumps IQ

You don’t need a genius-level IQ or an Ivy League degree to build wealth. Instead, focus on mastering the “money game”: work hard, stay patient, and embrace simplicity. Overthinking can paralyze you—start with practical, calculated steps. wealthinsights.co.ke+1wealthinsights.co.ke+1

How to Start:

-

Learn your field’s fundamentals (e.g., investment trends, sales mechanics).

-

Choose simple, high-ROI projects (like a side hustle).

-

Embrace small, strategic risks.

2. Savings Fuel Opportunity

Savings won’t make you rich overnight, but they grant freedom to explore high-upside ventures. Secure 3–6 months of expenses in an emergency fund to back your bold moves. wealthinsights.co.ke+1wealthinsights.co.ke+1

How to Start:

-

Eliminate high-interest debt (>7%).

-

Build your emergency fund—aim for 6–12 months.

-

Dedicate ~10% of income to investments.

3. Expect the Slow Build Before the Breakthrough

Wealth often climbs steadily, then skyrockets. Think initial learning phases without big returns, followed by accelerated growth once skills compound. wealthinsights.co.ke+5wealthinsights.co.ke+5wealthinsights.co.ke+5

How to Start:

-

Commit to a 2–5 year plan.

-

Celebrate micro-wins (e.g., mastering a new tool).

-

Learn from setbacks to rebalance strategies.

4. Exceptional Skills Attract Rewards

Excel in your field, and financial rewards will follow. Whether you're a top-notch consultant or a specialist, excellence commands a premium. wealthinsights.co.ke+3wealthinsights.co.ke+3wealthinsights.co.ke+3

How to Start:

-

Find your niche.

-

Build proof—use portfolios, testimonials.

-

Invest weekly in skill improvement.

5. Master Active Income First

Active income teaches essentials—marketing, managing, negotiating—that you’ll need for successful passive income ventures like real estate. wealthinsights.co.ke+5wealthinsights.co.ke+5wealthinsights.co.ke+5

How to Start:

-

Develop a high-income skill (e.g., copywriting, software).

-

Begin passive income on the side (e.g., dividend stocks).

-

Educate yourself (e.g., The Intelligent Investor).

6. Money Is a Means, Not the End

Wealth is a tool to build impact—not just bank balances. Define what you’ll accomplish with your money to keep motivation alive. wealthinsights.co.ke

How to Start:

-

Clearly articulate your purpose.

-

Align investments with your values.

-

Balance saving with meaningful spending.

7. Embrace the Grind

No role is too small. Entry-level or seemingly "unsexy" jobs often offer mentorship, connections, and the groundwork that pays off later. wealthinsights.co.kewealthinsights.co.ke+1wealthinsights.co.ke+1

How to Start:

-

Accept roles that offer steep learning curves.

-

Leverage any job for transferable skills.

-

Stay open to unconventional opportunities.

8. Tune Out the Noise

Comparing yourself to others kills progress. Focus inward—track your own growth, not someone else’s highlight reel. wealthinsights.co.ke

How to Start:

-

Measure your metrics (income, skills).

-

Declutter envious influences (social media, conversations).

-

Seek value-based collaborations.

9. Act First, Believe Later

You don’t need perfect confidence to succeed—action builds belief. Skip the “mindset trap”: do, then reflect. wealthinsights.co.ke+3wealthinsights.co.ke+3wealthinsights.co.ke+3wealthinsights.co.ke

How to Start:

-

Mirror daily habits of successful people.

-

Take small bets—launch a product, pitch a client.

-

Allocate 80% of effort to action.

10. Solve Big Problems = Earn Big Rewards

Your income is tied to the problems you solve. Tackle bigger, more painful problems well, and the rewards grow exponentially. wealthinsights.co.ke

How to Start:

-

Research unmet needs in your niche.

-

Begin with smaller problems and scale up.

-

Innovate solutions that reduce effort or pain for others.

In Summary

Wealth isn't magic—it’s deliberate. These ten principles—rooted in action, excellence, and purpose—form a blueprint anyone can follow. Stay consistent, learn continuously, and channel money toward meaningful outcomes.

What's Your Reaction?