Habits, Discipline, and Mindset: What Truly Separates the Rich from the Poor

Habits, discipline, and mindset—not luck—are what separate the rich from the poor. Learn how daily behaviors, long-term thinking, emotional control, and consistency build real wealth for anyone, anywhere.

The Real Difference Is Invisible

When people talk about wealth, the conversation usually drifts toward money itself—how much someone earns, inherits, or invests. Yet across countries, cultures, and income levels, one truth keeps resurfacing:

Money is not primarily a financial issue. It is a behavioral one.

Two people can earn the same income, live in the same city, and face the same economy—yet end up in completely different financial realities. One builds assets, stability, and freedom over time. The other remains trapped in stress, debt, and paycheck-to-paycheck survival.

The difference is not intelligence.

Not education.

Not luck.

It is habits, discipline, and mindset.

This article explores—deeply and practically—why money is 80% behavior, how wealthy people think and act differently, and how anyone, from any background or income class, can begin closing the gap.

Why Money Is 80% Behavior

Most financial advice focuses on what to do:

-

Save more

-

Invest wisely

-

Budget carefully

But far fewer conversations focus on why people fail to do these things consistently.

Behavior determines:

-

Whether you save or spend

-

Whether you plan or react

-

Whether you learn or ignore

-

Whether you delay gratification or chase comfort

Knowledge Without Behavior Is Useless

Millions of people know they should save, avoid debt, and invest. Yet knowing does not translate into doing.

Behavior is driven by:

-

Beliefs about money

-

Emotional habits

-

Self-discipline

-

Identity (“I’m just bad with money”)

Wealthy individuals are not perfect. They simply align their daily behaviors with long-term outcomes.

Daily Habits of Wealthy People

Wealth is built quietly, not dramatically. The rich rarely rely on single breakthroughs. Instead, they stack small, repeatable habits over years.

1. They Track Their Money

Wealthy people know:

-

Where money comes from

-

Where it goes

-

What it produces

Tracking is not obsession—it is awareness.

Poor financial outcomes often stem from financial blindness, not low income.

2. They Spend Intentionally

The wealthy are not necessarily cheap—but they are deliberate.

They ask:

-

Does this expense add value?

-

Is this consumption temporary or productive?

-

Will this purchase still matter in a year?

Impulse spending is replaced with purposeful allocation.

3. They Read, Learn, and Observe

Wealthy individuals consistently:

-

Read books

-

Study people ahead of them

-

Learn from mistakes (their own and others’)

They treat learning as a lifetime habit, not a school phase.

4. They Build Systems, Not Willpower

Instead of relying on motivation, they:

-

Automate savings

-

Schedule investments

-

Create routines

Systems remove emotion from decision-making.

Long-Term Thinking vs Instant Gratification

At the core of wealth building lies a single psychological divide:

Short-term comfort vs long-term benefit

The Poor Mindset

-

“I deserve this now.”

-

“Life is stressful—let me enjoy.”

-

“I’ll save when I earn more.”

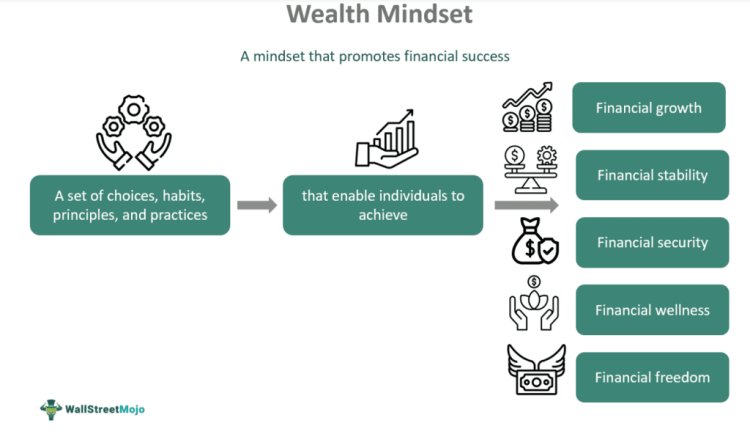

The Wealth Mindset

-

“What does this cost my future?”

-

“Comfort can wait.”

-

“Small sacrifices compound.”

This difference shows up everywhere:

-

Spending vs investing

-

Entertainment vs education

-

Consumption vs creation

Delayed Pleasure: The Superpower of Wealth

Delayed gratification is the ability to postpone pleasure today for a greater reward tomorrow.

It is one of the strongest predictors of:

-

Financial success

-

Career growth

-

Emotional stability

Examples of Delayed Pleasure

-

Investing instead of upgrading lifestyle

-

Learning a skill instead of binge entertainment

-

Saving consistently instead of spending occasionally

The rich are not immune to desire—they simply control it.

Learning Before Earning

One of the most misunderstood wealth principles is this:

Income grows naturally when skills grow first.

The Poor Pattern

-

Chase money without skills

-

Jump into opportunities they don’t understand

-

Avoid learning because it feels slow

The Wealth Pattern

-

Invest time before expecting money

-

Learn industries before entering them

-

Study markets before risking capital

They understand:

-

Skills compound

-

Knowledge reduces risk

-

Ignorance is expensive

Emotional Control With Money

Money triggers powerful emotions:

-

Fear

-

Greed

-

Envy

-

Shame

-

Excitement

Poor financial outcomes are often emotional reactions, not logical decisions.

Emotional Spending

-

Retail therapy

-

Status buying

-

Panic purchases

Emotional Investing

-

Buying hype

-

Selling in fear

-

Chasing quick profits

Wealthy individuals develop emotional discipline:

-

They pause before acting

-

They separate feelings from facts

-

They accept boredom over chaos

Consistency Over Motivation

Motivation is unreliable.

Consistency is unstoppable.

Motivation

-

Emotional

-

Temporary

-

Mood-dependent

Consistency

-

Boring

-

Repetitive

-

Powerful

Wealth grows through:

-

Regular saving

-

Regular learning

-

Regular investing

-

Regular review

Small actions repeated over years beat intense effort applied briefly.

Why Mindset Beats Luck

Luck exists—but it only benefits the prepared.

Two people can receive the same opportunity:

-

One multiplies it

-

The other wastes it

Why?

Mindset determines readiness.

Wealth Mindset Beliefs

-

“I can learn this.”

-

“Mistakes are tuition.”

-

“Time is my greatest asset.”

-

“I am responsible for outcomes.”

Poverty Mindset Beliefs

-

“Money is evil.”

-

“The system is against me.”

-

“I’ll never catch up.”

-

“It’s not my fault.”

Beliefs shape actions.

Actions shape results.

The Compound Effect of Small Choices

Wealth is not built in dramatic moments—it is built in ordinary days.

-

One disciplined decision today

-

Repeated over months

-

Compounded over years

This is why wealth often looks sudden from the outside—but never is.

Wealth Across All Income Levels

This is not a story about millionaires only.

People with modest incomes build wealth by:

-

Controlling expenses

-

Increasing skills

-

Avoiding destructive debt

-

Investing patiently

People with high incomes remain poor by:

-

Lifestyle inflation

-

Emotional spending

-

Lack of planning

-

Ego-driven decisions

Income helps—but behavior decides.

Breaking the Cycle: How to Shift Your Mindset

1. Change Identity First

Stop saying:

-

“I’m bad with money”

Start saying:

-

“I’m learning to manage money well”

Identity drives behavior.

2. Build One Keystone Habit

Choose one:

-

Track expenses

-

Save automatically

-

Read daily

One habit changes many others.

3. Reduce Financial Noise

Avoid:

-

Get-rich-quick schemes

-

Constant comparison

-

Social pressure

Clarity creates progress.

4. Think in Decades, Not Months

Ask:

-

“Where will this decision place me in 10 years?”

Wealth is a long game.

Common Myths That Keep People Poor

-

“I need a lot of money to start”

-

“I’ll invest when I earn more”

-

“Rich people are just lucky”

-

“Money will change who I am”

These beliefs delay action and justify inaction.

A Simple Action Plan (For Anyone)

-

Track your money weekly

-

Save something—no matter how small

-

Invest in learning monthly

-

Delay unnecessary pleasure

-

Review progress quarterly

-

Repeat consistently

This plan works globally, across all income classes.

Final Thoughts: Wealth Is an Inside Job

The true separation between the rich and the poor is not income, geography, or education.

It is:

-

How they think

-

How they act daily

-

How they control emotions

-

How they value time

Change your habits.

Strengthen your discipline.

Upgrade your mindset.

Money will follow.

What's Your Reaction?