Why Blindly Copying the Habits of the Rich Can Make You Poorer

Many people believe mimicking the habits of the rich will lead to success — but without the right financial foundation, these habits can actually backfire. This article explores 9 common behaviors of the wealthy that can harm the middle class and poor if copied blindly, and offers practical, safer alternatives for building true wealth.

In today's hyper-visible digital world, it's easy to admire the lifestyles and financial strategies of the rich and wealthy. From social media to motivational speakers, we’re constantly told to “think like the rich,” “invest like the rich,” or “act like a millionaire to become one.”

But here's the problem: blindly copying the habits of the rich without the proper financial foundation can be dangerous, even destructive. What works for billionaires or high-net-worth individuals can backfire on the poor or middle class and push them deeper into financial stress.

In this in-depth article, we break down the common habits of the wealthy that should NOT be copied blindly—and what you should do instead.

Introduction: The Wealth Illusion

Rich people often operate with leverage, networks, buffers, and cash flow. Their financial behavior is supported by systems, assets, teams, and advisors.

The middle class and poor, on the other hand, are often operating with limited resources, high expenses, and lower financial literacy. When they mimic the actions of the wealthy without understanding the principles, it can lead to debt traps, stress, and burnout.

Let’s break down 9 habits that look appealing but can be harmful if applied incorrectly.

1. Using Debt to Build Wealth

What the Rich Do:

The wealthy use leverage to purchase appreciating assets like real estate, stocks, or businesses. They understand risk management and have the income or collateral to cover loans even in downturns.

What the Poor Do:

Many middle-class or low-income earners use debt to buy depreciating liabilities such as cars, smartphones, fashion items, or vacations.

Why It's Dangerous:

Using debt when you don’t have cash flow, investment knowledge, or a backup plan can lead to financial ruin. Instead of building wealth, you pile up high-interest loans and monthly obligations that eat your income.

What You Should Do:

Focus on learning how debt works—interest rates, credit scores, and repayment terms. Avoid consumer debt. If you must borrow, do so for value-creating purposes like education or starting a side hustle.

2. Delaying or Skipping Salary

What the Rich Do:

Many startup founders or investors delay taking salaries. They reinvest profits to grow their businesses faster. They often survive on savings or other income streams.

What the Poor Do:

Some individuals skip paying themselves, thinking it’s a “rich mindset” without having any passive income or safety net.

The Reality:

You still have bills. If you skip income and can’t cover living expenses, you may resort to borrowing, begging, or panic spending.

Better Alternative:

Always pay yourself a reasonable salary first. After that, reinvest the surplus wisely. Prioritize building emergency funds and automating savings.

3. Outsourcing Everything

What the Rich Do:

Wealthy people outsource tasks—personal assistants, chefs, gardeners, cleaners—to free up time for high-value activities like investing or managing companies.

What the Poor Copy:

People hire services they can’t afford just to feel “successful.” Cleaning, food delivery, transport apps, and laundry pickup all add up.

The Result:

Overspending to keep up appearances leads to credit card debt, overdrafts, or zero savings.

The Smarter Strategy:

Do things yourself while you grow. Invest the saved money in skills or tools that increase your income potential. Delegate only when it makes financial sense.

4. Investing in High-Risk Assets

Rich Mindset:

Rich people can afford to invest in volatile assets like cryptocurrencies, startups, forex, or hedge funds—because they diversify and can afford to lose.

The Imitation Trap:

Middle-class and poor individuals often enter high-risk spaces chasing hype, driven by social media or peer pressure—without proper research or understanding.

What Happens:

They risk their only savings, and a single market downturn wipes them out completely.

Recommended Path:

Start with low-risk, low-cost investments: mutual funds, money markets, or a beginner-friendly real estate fund. Educate yourself before putting money into anything you don’t understand.

???? 5. Traveling for ‘Networking’ or ‘Status’

Rich Practice:

The wealthy travel for business deals, international exposure, and strategic relocation (for taxes, investment, or family security).

What the Poor Copy:

Some travel frequently to “feel rich,” often posting on social media while the trip is funded by loans, Sacco advances, or savings meant for emergencies.

Long-Term Impact:

Temporary fulfillment, long-term regret. You return broke, behind on bills, and with no financial ROI.

Smarter Move:

Save for one intentional trip a year. Focus on building digital connections, free online communities, and local opportunities.

6. Luxury Spending

What the Rich Do:

Luxury purchases—designer clothes, watches, and cars—often come from passive income, investments, or after hitting financial goals.

What the Middle Class Does:

Buy luxury items with credit cards or salaries, trying to emulate wealth instead of building it.

The Cost:

No investment, no savings, and an inflated lifestyle with no backup plan.

Try This Instead:

Live below your means now. Automate savings. Create a "Luxury Fund" for future lifestyle upgrades. Focus on wealth, not appearances.

7. Low or Zero Tax Payments (Legally)

The Rich Advantage:

The rich have financial advisors, tax attorneys, and offshore vehicles. They use legal loopholes, trusts, depreciation, and real estate laws to reduce tax burden.

The Poor Misstep:

Trying to imitate this through tax evasion—hiding income, fake deductions, or ignoring taxes entirely.

The Danger:

Fines, audits, legal issues, and lost credibility.

Smarter Strategy:

Learn local tax laws. Track all income and expenses. Use allowable deductions and consider hiring an accountant once your income grows. Be legal, lean, and learning.

8. Work Less, Think More

Elite Habit:

The rich prioritize leverage over labor—building teams, automations, and income systems.

Imitation Error:

Quitting jobs or avoiding hard work too early without passive income or systems in place.

Consequence:

Laziness masked as “strategy,” leading to unemployment, stress, and poverty.

Real Game Plan:

Work smart AND hard. Build skills. Network. Use evenings and weekends to create your side hustle. Only reduce active work when your passive income exceeds expenses.

9. "Multiple Streams of Income" Too Early

How the Rich Do It:

They master one income stream (e.g., business, real estate, or stock investing), then diversify into others.

How the Poor Go Wrong:

Start 5 small businesses at once—dropshipping, forex, blogging, car hire—with little capital or knowledge in any.

Why It Fails:

No focus. No mastery. No income. Ends in burnout and failure.

The Right Path:

Focus on one high-potential stream. Grow it. Systematize it. Then expand. Quality over quantity.

Summary: Learn the Principles — Apply with Wisdom

| Habit of the Rich | Why You Shouldn’t Copy Blindly | Safer Alternative |

|---|---|---|

| Using debt for investing | Risky without training or capital | Learn, start small, avoid consumer debt |

| Skipping salary | You need money to survive | Pay yourself first, then reinvest |

| Outsourcing everything | Costs too much without stable income | DIY until you can truly afford it |

| High-risk investments | Can lose all your money | Start with low-risk options and knowledge |

| Travel for status or social proof | No financial ROI | Budget and travel with purpose |

| Luxury lifestyle | Drains income, no return | Save and reward yourself later |

| Complex tax strategies | Legal issues if done wrong | Learn and apply legal basic tax planning |

| Working less without systems | Leads to laziness and no results | Work hard now, buy freedom later |

| Too many income streams at once | Creates chaos and poor results | Master one thing first |

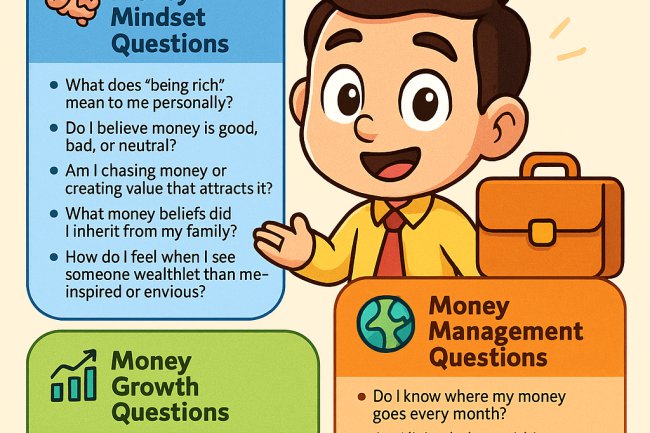

Final Thoughts: Copy Mindsets, Not Methods

Don’t be fooled by what you see on Instagram, YouTube, or flashy podcasts. Success leaves clues — but it also requires context.

Wealthy individuals operate with a foundation:

Cash flow

Knowledge

Safety nets

Time-tested systems

The middle class and poor should not try to skip the process. Instead, focus on:

-

Building strong financial discipline

-

Understanding basic investment principles

-

Managing cash flow

-

Living below your means

-

Investing in yourself

Key Takeaway:

Don’t copy the rich—learn

from them.

Understand the why behind their actions. Then adapt it to your stage, resources, and reality.

What's Your Reaction?