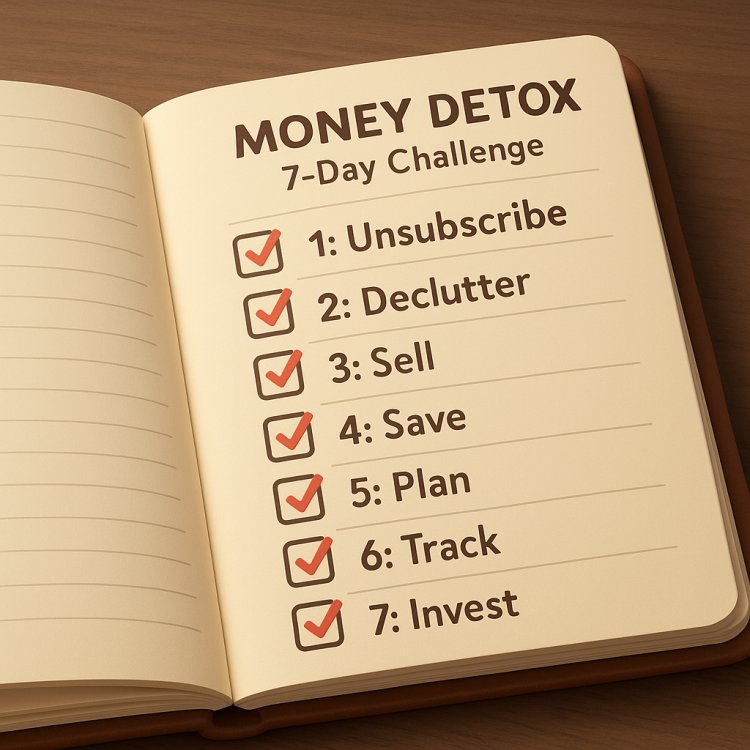

The “Money Detox” Challenge

Reset your finances in seven days with the “Money Detox” Challenge. Learn step-by-step actions to unsubscribe, declutter, save, track, and invest your way to financial clarity and peace.

Reset Your Finances in 7 Days

Introduction: You Detox Your Body — Why Not Your Bank Account?

When life feels cluttered, you take a break, cleanse, and reset.

But what about your finances?

Between unused subscriptions, emotional spending, and ignored budgets, your financial health can easily get toxic — draining your energy and blocking your progress.

That’s why it’s time for a Money Detox — a 7-day challenge to clear out wasteful habits, refresh your money mindset, and rebuild a system that actually works.

It’s not about deprivation. It’s about discipline, direction, and clarity.

Give your money seven focused days — and watch how it transforms your confidence, focus, and future.

Day 1: Unsubscribe — Declutter Your Financial Noise

The first step in detoxing your finances is elimination.

Go through your accounts and cancel:

-

Subscriptions you no longer use (streaming, apps, gym).

-

Automatic renewals you forgot existed.

-

Email marketing that tempts you to buy impulsively.

Every unnecessary subscription is a leak in your financial tank.

Action Step:

Check your bank statements and unsubscribe from at least three things today.

Mindset Shift:

Every dollar you stop wasting becomes a dollar you can use to grow wealth.

Day 2: Declutter — Organize Your Money Environment

Just like a messy room breeds anxiety, a messy financial life breeds confusion.

Today, create order.

-

Delete old financial emails.

-

Rename your bank accounts (e.g., “Bills,” “Savings,” “Freedom”).

-

Create digital folders for receipts and income records.

-

Clean your mobile apps — keep only the ones that help you manage or grow money.

Action Step:

Set up three folders in your email or drive: Income, Bills, and Investments.

Mindset Shift:

Clarity attracts control. When your money space is organized, your decisions follow.

Day 3: Sell — Turn Clutter into Cash

Look around your home. You’re probably sitting on value you don’t even use.

Sell it.

Clothes, electronics, books, furniture — someone out there wants what you’ve forgotten.

Action Step:

List at least three items for sale on local platforms like Jiji, Facebook Marketplace, OLX, or community groups.

Even if you earn just $50, it’s proof that your wealth isn’t limited by income — it’s limited by initiative.

Mindset Shift:

Wealth is not what you have. It’s what you manage.

Day 4: Save — Pay Yourself Before You Pay Anyone Else

Now that you’ve freed up cash, it’s time to give your savings account the respect it deserves.

Follow the “Pay Yourself First” rule:

Transfer a set percentage (10–20%) of your income to a savings or investment account immediately when you get paid.

Automate it if you can.

Action Step:

Set up an automatic transfer or standing order to your SACCO, money market fund, or savings account.

Mindset Shift:

Saving is not about how much you earn — it’s about how much you decide to keep.

Day 5: Plan — Give Your Money a Purpose

Financial detox means clarity — and clarity begins with a plan.

Write down your top three financial goals for the next six months. Examples:

-

Build an emergency fund.

-

Pay off debt.

-

Invest in a money market fund or business idea.

Then, map out how much you’ll save or invest monthly toward each.

Action Step:

Create a simple money plan — income, expenses, and goals. Keep it visible on your phone or journal.

Mindset Shift:

Money without a plan disappears. Money with a mission multiplies.

Day 6: Track — Watch Every Dollar

For one week, write down every single expense.

Yes, even the small ones.

That $3 coffee, that KSh 150 airtime top-up — they all count.

This isn’t about guilt — it’s about awareness. When you see where your money goes, you realize where to take back control.

Action Step:

Use a notes app, budgeting app, or notebook to record all spending for seven days.

Mindset Shift:

Tracking your money is like checking your pulse — it shows how healthy your financial habits really are.

Day 7: Invest — Let Your Money Work for You

A detox is not complete until you start building something stronger.

Now that you’ve saved, decluttered, and organized — it’s time to invest.

Start small, start safe, but start.

Options:

-

Money Market Fund (short-term growth)

-

SACCO (community-based returns and loans)

-

Treasury Bonds or Bills (steady income)

-

Digital investment apps (like Abojani, Cowrywise, or Bamboo)

Even $10 a week is a beginning.

Action Step:

Open an investment account or top up an existing one today.

Mindset Shift:

You can’t build wealth by working for money alone — your money must start working for you.

Bonus Tip: Repeat Monthly

The “Money Detox” is more than a challenge — it’s a habit.

Repeat this seven-day reset every few months.

With each round, your finances become cleaner, sharper, and more powerful.

It’s not just a financial cleanse — it’s a lifestyle reset.

Because true wealth starts with financial awareness, and grows through consistency.

The Results of a Money Detox

After just one week, most people notice:

-

More control and less anxiety.

-

Higher savings and lower waste.

-

Renewed motivation to build wealth intentionally.

The more you practice, the more peace and freedom you gain.

You’ll realize that detoxing your money isn’t about what you remove — it’s about what you reclaim.

Conclusion: The Freedom of Financial Clarity

Money detox is not about perfection — it’s about progress.

In seven days, you can:

-

Clean your money habits.

-

Reclaim wasted income.

-

Realign your goals.

You detox your body to feel lighter.

You detox your finances to live freer.

Your future wealth is waiting — it just needs a clean start.

What's Your Reaction?