Finance for Couples: Joint Budgeting, Money Communication, Shared Goals & Wealth Alignment (Complete Guide)

A complete guide on finance for couples: joint budgeting, money communication, financial planning, shared goals, conflict resolution, and long-term wealth alignment.

Finance for Couples: Joint Budgeting, Money Communication, Shared Goals & Wealth Alignment

Money is one of the greatest forces shaping relationships. It influences lifestyle, decision-making, trust, stability, and long-term success. Yet for many couples, money remains the most avoided conversation and the biggest source of conflict. Aligning financially is not about controlling each other—it is about building a shared vision, creating stability, and empowering the relationship to thrive.

This guide explores the core pillars of finance for couples: joint budgeting, money communication, shared goals, and wealth alignment, and serves as a roadmap for partners who want financial clarity, peace, and long-term prosperity.

1. Why Couples Must Align on Money

Every partner comes with a unique financial background—habits learned from family, personal experiences, cultural expectations, and emotional associations with money. Without alignment, couples drift into financial confusion, hidden debts, unmanaged expenses, and frequent misunderstandings.

Healthy financial alignment enables:

-

Transparency and trust

-

Coordinated life planning

-

Reduced money anxiety

-

Consistent progress toward shared goals

-

Better conflict resolution

-

Long-term wealth creation

When couples align financially, they build unity in purpose and stability in the relationship.

2. Establishing Money Communication in a Relationship

a. The Importance of Open and Regular Money Dialogues

Money communication is not a one-time event. It is a continuous practice that grows with the relationship. Couples who talk openly about finances develop confidence and clarity.

Schedule monthly "Money Dates" where you review spending, savings, investments, upcoming expenses, and goals.

b. Discuss Your Money Personalities

Each partner should understand their financial tendencies:

-

The saver

-

The spender

-

The planner

-

The risk-taker

-

The security-seeker

-

The investor

Understanding these personalities removes assumptions and reduces conflict. It also helps each partner adjust and work collaboratively.

c. Full Transparency

This includes:

-

Income

-

Debts

-

Savings

-

Credit scores

-

Financial obligations (family support, loans, etc.)

Transparency strengthens trust and allows realistic joint planning.

3. Building a Joint Budget That Works for Both Partners

A functional budget is the backbone of couple finance. It ensures clarity, prevents overspending, and prioritizes shared long-term goals.

a. Combine All Income Streams

Whether you merge fully or partially, list:

-

Salaries

-

Business income

-

Side hustles

-

SACCO dividends

-

Rental income

-

Bonuses

You cannot plan what you do not measure.

b. Create a Shared Expenses Structure

Most couples choose one of these models:

-

Full Joint Budgeting – All income goes to a shared account.

-

Proportional Contribution – Each partner contributes based on their income percentage.

-

Split Specific Bills – Each partner pays specific expenses (e.g., rent vs. groceries).

-

Hybrid System – A blend of shared and personal accounts.

Choose what maximizes fairness, simplicity, and peace.

c. Track Monthly Spending

Use tools like:

-

Google Sheets

-

Notion budget trackers

-

Money Manager apps

-

M-Pesa statements

-

Bank apps

Visibility prevents guesswork and promotes accountability.

4. Creating Shared Goals: The Foundation of Unified Wealth

Without shared goals, partners work individually instead of collaboratively. Goals provide direction and measurable progress.

Short-term goals (0–1 year):

-

Rent and utilities

-

Emergency fund (3–6 months)

-

School fees

-

Debt repayments

-

A shared vacation budget

Medium-term goals (1–5 years):

-

Car purchase

-

Home ownership

-

Starting a business

-

Investing in SACCOs or index funds

-

Wedding planning

Long-term goals (5+ years):

-

Retirement planning

-

Real estate investments

-

Children’s college fund

-

Building generational wealth

-

Financial independence

Aligning goals transforms the relationship into a strategic financial partnership.

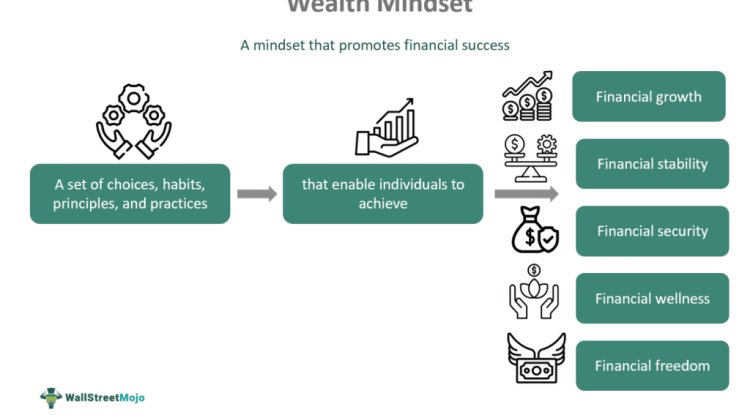

5. Wealth Alignment: Moving From Survival to Abundance

Wealth alignment means ensuring that both partners move in the same direction financially, both in mindset and execution.

a. Create a Wealth Vision Board

List your:

-

Income goals

-

Savings targets

-

Investment plans

-

Business aspirations

-

Lifestyle vision

A visual map enhances clarity and motivation.

b. Build an Opportunity Fund

Beyond an emergency fund, couples should have a fund for:

-

Business openings

-

Land deals

-

Investment dips

-

High-value opportunities

Opportunities rarely wait for financial readiness.

c. Align Investment Strategies

Consider:

-

Index funds

-

Treasury bonds

-

SACCO shares

-

Real estate plots

-

Joint businesses

-

Dollar-cost averaging

-

High-yield savings accounts

Choose risk levels that both partners are comfortable with.

6. Managing Financial Conflicts Peacefully

Money disagreements are normal. What matters is how they are handled.

Strategies for Healthy Resolution:

-

Separate facts from emotions

-

Avoid blame language

-

Use “This is how I feel…” instead of “You always…”

-

Review the budget together

-

Update goals when circumstances change

-

Seek financial counseling if needed

Conflict becomes constructive when both partners feel heard.

7. Protecting the Relationship With Financial Systems

Systems prevent repeated conflicts and eliminate guesswork.

Essential Systems for Couples:

-

Monthly financial meetings

-

Automated savings

-

Investment deductions

-

Bill reminders

-

Shared access to statements

-

Periodic goal reviews

The more automated the finances, the smoother the relationship.

8. Preparing for Marriage or Long-Term Commitment

If you are dating seriously or engaged, discuss:

-

Debt disclosure

-

Spending habits

-

Children planning and school fees

-

Prenuptial agreements

-

Cultural financial expectations

-

Family financial responsibilities

These conversations prevent future stress and align expectations early.

9. Building Long-Term Wealth as a Team

Couples who grow wealthy together do three things consistently:

-

Live below their combined income

-

Invest aggressively in skills and assets

-

Maintain long-term financial discipline

Wealth grows when partners move in the same direction.

Conclusion

Financial success for couples does not happen automatically. It is built intentionally through communication, shared budgeting, aligned goals, disciplined systems, and a unified wealth mindset. When partners commit to financial teamwork, they reduce conflict, build trust, create stability, and unlock opportunities that transform their future.

A relationship with financial harmony becomes a foundation for peace, progress, and prosperity.

What's Your Reaction?