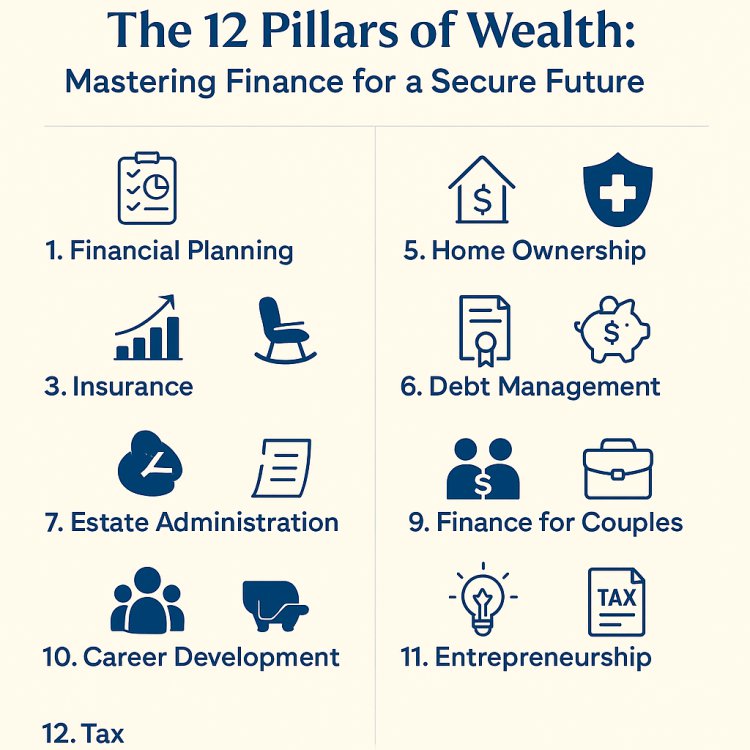

The 12 Pillars of Wealth: Mastering Finance for a Secure Future

Explore the 12 foundational pillars of financial success—financial planning, markets, insurance, retirement, home ownership, debt, estate, kids’ finance, couples' money management, career growth, entrepreneurship, and tax. Your ultimate wealth roadmap.

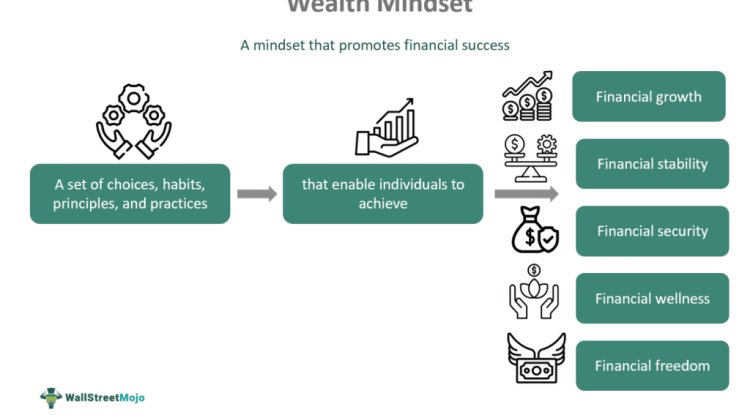

Building Wealth That Lasts

In today’s ever-evolving world, financial literacy is no longer a luxury—it's a necessity. The path to financial freedom is built on core pillars that support every life stage, from childhood to retirement. Whether you're planning your first investment, buying a home, or preparing your estate, a comprehensive understanding of these 12 key financial areas will shape your legacy and elevate your future.

Let’s explore each pillar deeply—so you can master your finances and secure your future.

1. Financial Planning: The Foundation of Wealth

Financial planning is the bedrock of personal wealth. It involves setting clear goals, evaluating resources, budgeting, saving, and investing strategically to achieve long-term success.

Key Components:

-

Budgeting and cash flow tracking

-

Setting short- and long-term goals

-

Emergency fund planning

-

Asset allocation and risk assessment

Why It Matters:

A good financial plan provides direction. It helps prevent lifestyle inflation, reduces financial anxiety, and ensures every shilling works toward your goals.

Quote:

"A goal without a plan is just a wish." – Antoine de Saint-Exupéry

2. Financial Markets: Understanding the Engine of Growth

Financial markets include the stock exchange, bonds, money markets, and foreign exchange markets. They allow individuals and businesses to grow capital, access funding, and hedge risks.

Why Learn About Markets?

-

Allows you to invest in growth (stocks, ETFs)

-

Helps you diversify wealth

-

Builds passive income

-

Teaches you how money moves

Tools to Start:

-

Nairobi Securities Exchange (NSE)

-

SACCOs and Unit Trusts

-

Mutual Funds and REITs

-

Forex trading (with caution)

Tip:

Start with low-cost index funds or diversified mutual funds before jumping into high-risk assets.

3. Insurance: Protecting What You Can’t Predict

Insurance is the invisible shield that protects your finances from unexpected shocks—health issues, death, property loss, or accidents.

Types to Consider:

-

Life Insurance

-

Health Insurance

-

Motor Vehicle Insurance

-

Business Insurance

-

Homeowners and Renters Insurance

Why It’s Critical:

You can't build wealth if you’re constantly depleting your resources to handle emergencies. Insurance is not an expense—it’s a financial strategy.

4. Retirement Planning: Start Early, Retire Happy

Retirement is not an age—it's a financial condition. Planning for retirement is about securing your future independence and maintaining your lifestyle even when you stop working.

Essentials of Retirement Planning:

-

Start early (the power of compounding)

-

Join pension schemes (NSSF, Tier II, Private Plans)

-

Invest in long-term assets (real estate, dividend stocks)

-

Understand withdrawal strategies

Mistake to Avoid:

Don’t rely solely on employer retirement schemes—diversify your nest egg.

5. Home Ownership: A Pillar of Stability

Owning a home is more than shelter—it’s a wealth-building asset. Real estate often appreciates in value and provides emotional and financial security.

Key Considerations:

-

Understand mortgage terms and rates

-

Budget for hidden costs (insurance, maintenance)

-

Location matters—buy where there’s growth

-

Don’t buy more than you can afford

Is Renting Always Bad?

Not necessarily. Renting can be strategic when investing your money elsewhere yields better returns.

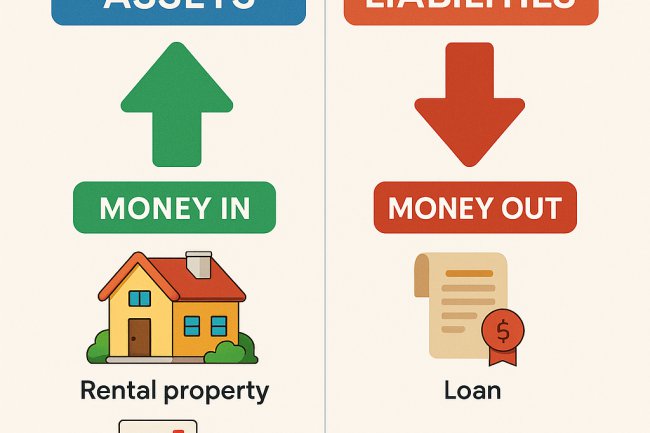

6. Debt Management: From Burden to Lever

Debt can either drain your finances or amplify your net worth. The key is knowing how to manage and use debt wisely.

Good Debt vs. Bad Debt:

-

Good Debt: Business loans, education loans, real estate mortgages

-

Bad Debt: High-interest credit cards, consumption loans

Tips:

-

Always pay above the minimum

-

Consolidate when possible

-

Avoid impulse borrowing

-

Use the debt snowball or avalanche method

Truth:

Debt is not evil—it’s a tool. Misused, it destroys; used wisely, it builds.

7. Estate Administration: Protecting Your Legacy

Estate planning ensures your wealth is transferred smoothly, legally, and according to your wishes.

Key Tools:

-

A valid Will

-

Power of Attorney

-

Trusts

-

Naming beneficiaries on accounts

Why You Need This:

Without a plan, the government decides how your estate is shared—usually through lengthy and expensive probate. Avoid family disputes and delays by planning ahead.

8. Finance for Kids: Teaching Early, Building Strong

Children who learn about money early grow up to be financially confident adults. The habits we instill shape their financial future.

Teach Them To:

-

Save and delay gratification

-

Earn money through chores or creative work

-

Budget using jars or digital tools

-

Differentiate needs from wants

Long-Term Vision:

Start saving for their education with junior investment accounts or education policies.

Remember:

Children learn more from what you do than what you say. Model good financial habits.

9. Finance for Couples: Building Together, Not Apart

Money is a leading cause of conflict in relationships. Couples who talk openly about finances grow stronger together.

Steps to Healthy Couple Finances:

-

Joint budgeting

-

Shared savings goals

-

Emergency fund for the family

-

Understanding each other’s money mindset

-

Setting joint and individual financial boundaries

Rule:

Communicate. Don’t assume. Transparency builds trust.

10. Career Development: The Skill That Pays Forever

Your career is one of your biggest income-generating assets. Invest in improving your skills, education, and network.

Growth Areas:

-

Upskilling through online platforms (Coursera, Udemy)

-

Certifications in high-demand fields

-

Building a strong LinkedIn profile

-

Seeking mentors

Pro Tip:

Don’t just aim for promotions—develop skills that make you irreplaceable or enable you to pivot into entrepreneurship.

11. Entrepreneurship: The Road to Ownership and Impact

Entrepreneurship is the most powerful engine of wealth creation. It involves turning ideas into profitable ventures.

Starting Right:

-

Identify a market gap

-

Validate the idea with real customers

-

Start lean—minimize costs

-

Reinvest profits

-

Learn marketing and sales

Challenges:

Cash flow, taxes, customer acquisition, burnout—yet the rewards are freedom, impact, and legacy.

12. Tax: Understanding What You Owe and Why

Tax is a reality for individuals and businesses. Smart tax planning keeps you compliant while maximizing savings.

Basic Tax Tips:

-

Understand your tax bracket

-

Keep records of income and expenses

-

Take advantage of tax reliefs (insurance, pension contributions)

-

File returns on time (iTax Kenya)

-

Consult a tax advisor for business taxes

Avoid This:

Ignoring taxes doesn’t make them disappear—it only increases penalties. Be proactive.

Conclusion: Your Wealth, Your Responsibility

Mastering these 12 financial pillars equips you to build lasting wealth, enjoy peace of mind, and impact future generations. Whether you're an employee, entrepreneur, parent, or investor, the time to take control of your finances is now.

Start small, stay consistent, and keep learning. Your future self will thank you.

What's Your Reaction?