Tag: tax planning

The Ultimate Guide to Tax Education: Smart Tax Pla...

Learn tax planning, compliance, allowable deductions, and strategies to optimize personal and business taxes. A complete beginner-...

What to Avoid and What to Do When Planning for Ret...

Retirement and estate planning are not just for the wealthy — they’re for anyone who values financial peace, security, and legacy....

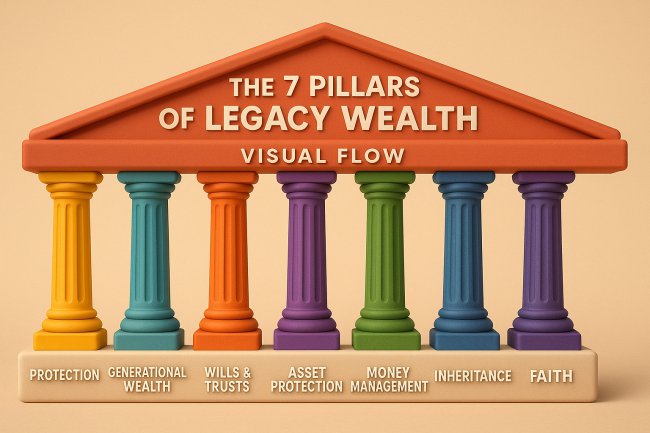

Wealth Protection and Legacy Planning — How to Kee...

Learn the essential steps to protect, preserve, and pass down your wealth. This guide covers insurance, generational wealth, wills...

Entrepreneurship and Business Finance: How to Thin...

A comprehensive financial freedom guide for entrepreneurs — learn how to think like an investor, master cashflow, build scalable p...

The 7 Rules of Money the Rich Never Break — and Ho...

Discover the timeless financial principles that separate the rich from the struggling. Learn the 7 unbreakable money rules the wea...

Taxation 101: A Complete Guide to Understanding an...

Master the basics of personal and business taxation. Learn how to reduce tax liability, stay compliant, file returns accurately, a...

Mastering Personal Finance: The Foundation of Fina...

Discover the ultimate personal finance guide covering budgeting, saving, debt management, investing, taxes, retirement, and financ...

The 12 Pillars of Wealth: Mastering Finance for a ...

Explore the 12 foundational pillars of financial success—financial planning, markets, insurance, retirement, home ownership, debt,...