Budgeting 101: A Comprehensive Guide to the 50/30/20 Rule

Learn how to manage your money with the simple and powerful 50/30/20 budgeting rule. Our comprehensive guide covers everything you need to create a balanced, realistic budget and build long-term financial security.

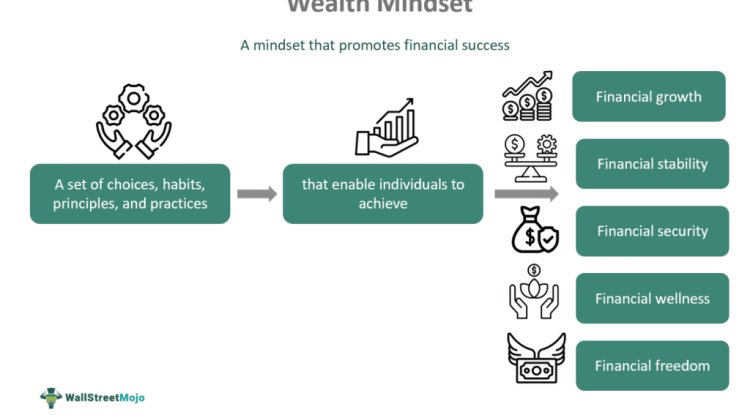

Financial freedom doesn’t happen by accident — it starts with a plan. One of the most effective, beginner-friendly ways to take control of your finances is through budgeting. And among all budgeting methods out there, the 50/30/20 rule stands out for its simplicity and impact.

Whether you’re just starting your financial journey or looking to refine your current budget, this guide will walk you through everything you need to know.

What Is Budgeting, and Why Does It Matter?

Budgeting is the process of creating a plan for how to spend and manage your money. It helps you:

-

Track your income and expenses

-

Avoid debt or get out of it

-

Build savings

-

Reach your short- and long-term financial goals

Without a budget, it’s easy to lose control of your spending, live paycheck to paycheck, or fall behind on bills.

Think of a budget as a roadmap—it tells your money where to go, instead of wondering where it went.

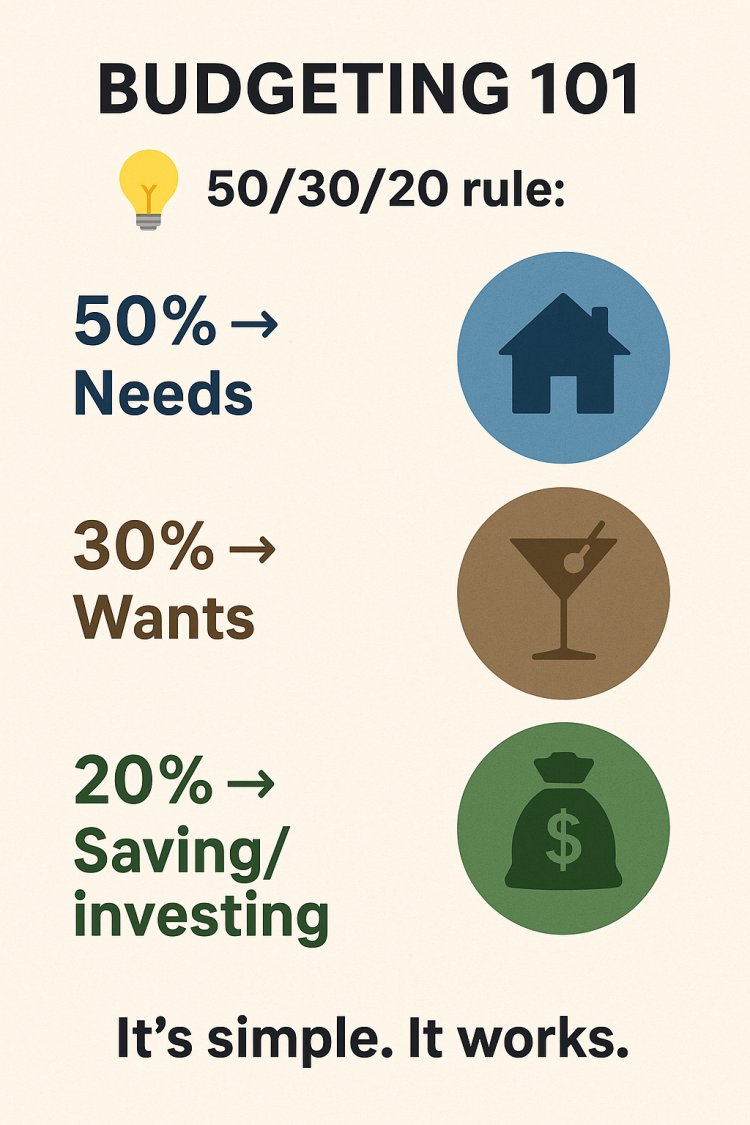

Introduction to the 50/30/20 Rule

The 50/30/20 rule, popularized by U.S. Senator Elizabeth Warren in her book "All Your Worth: The Ultimate Lifetime Money Plan," offers a simple way to divide your after-tax income:

-

50% for Needs

-

30% for Wants

-

20% for Savings and Investments

This framework brings balance: it covers the essentials, allows room for enjoyment, and builds a future.

50% for Needs: Covering the Essentials

This portion of your budget should be allocated to essential expenses — things you need to survive and maintain stability. These include:

-

Rent or mortgage payments

-

Utilities (electricity, water, internet, phone)

-

Groceries (basic food staples, not dining out)

-

Transportation (fuel, car payments, public transit)

-

Health insurance and medical bills

-

Minimum debt payments (e.g., student loans, credit cards)

???? Example:

If your monthly after-tax income is KES 100,000, then KES 50,000 should go to your needs.

Pro Tip: If your needs exceed 50%, it may be time to reassess. Consider moving to a more affordable home, refinancing a loan, or reducing your electricity/water usage.

30% for Wants: Enjoying Life Responsibly

Wants are non-essential expenses that enhance your quality of life. This is your guilt-free zone — as long as you stick to the budget.

Examples of wants include:

-

Dining out and takeout

-

Subscriptions (Netflix, Spotify, etc.)

-

Gym memberships or hobbies

-

New clothes, gadgets, or entertainment

-

Vacations and getaways

Example:

With an income of KES 100,000, you have KES 30,000 to spend on wants.

✅ Pro Tip: Always distinguish between a need and a want. A car may be a need, but a luxury SUV is a want.

20% for Savings & Investments: Building Your Future

This final 20% is where your financial security is born. It includes:

-

Emergency fund (3–6 months of living expenses)

-

Retirement contributions (pension schemes, retirement benefit schemes)

-

Investments (stocks, real estate, business ventures)

-

Paying off high-interest debt faster

Example:

From KES 100,000, you should allocate KES 20,000 to saving, investing, or paying down debt.

✅ Pro Tip: Automate your savings and investments. Set up standing orders or automatic transfers right after payday.

Benefits of the 50/30/20 Rule

✅ Simplicity—You don’t need a financial degree to understand it

✅ Flexibility – Adjusts as your income or goals change

✅ Discipline – Encourages conscious spending and saving

✅ Balance – Avoids extreme frugality or reckless spending

✅ Results – Builds a solid foundation for wealth and stability

How to Apply the 50/30/20 Rule Step-by-Step

-

Calculate Your After-Tax Income

Include your salary, business income, freelance work, etc.

Example: KES 120,000 monthly. -

Break It Down

-

Needs: 50% → KES 60,000

-

Wants: 30% → KES 36,000

-

Savings: 20% → KES 24,000

-

-

Track Your Expenses

Use a budgeting app, Excel sheet, or notebook to categorize your spending. -

Adjust as Needed

If your needs exceed 50%, cut down on wants or temporarily reduce savings (but aim to return to balance).

Common Challenges & How to Overcome Them

1. Low Income

Solution: Focus on reducing expenses and increasing income through side hustles, skill development, or better-paying jobs.

2. Irregular Income

Solution: Base your budget on your average monthly earnings. Save more during high-income months to cover the low ones.

3. Debt Overload

Solution: Prioritize high-interest debt in your 20% category. Consider debt consolidation or negotiating lower rates.

Beyond Budgeting: Long-Term Financial Goals

Once you’ve mastered the 50/30/20 rule, start working toward broader goals:

-

Buying a home or land

-

Starting a business

-

Saving for children’s education

-

Investing in stocks or SACCOs

-

Planning for retirement

Final Thoughts: Budgeting Is Self-Care

Budgeting isn't about restriction—it's about freedom. The freedom to spend confidently, live within your means, and build a life without financial stress.

The 50/30/20 rule gives you structure while letting you enjoy your hard-earned money. Start small, stay consistent, and watch your financial life transform.

What's Your Reaction?