Set Yourself Up for Financial Wellness

Learn how to build financial wellness with practical steps — budgeting, saving, investing, and mindset strategies tailored for African professionals.

A Simple Approach for Africans Ready to Build Real Wealth

Money doesn’t have to be a mystery.

Financial wellness isn’t about luck, a huge salary, or being born rich—it’s about control.

The truth is, many Africans today are earning more than their parents ever did, yet feeling more financially stressed than ever before. Why? Because most people manage money by accident, not by design.

This article will show you a simple, step-by-step system to transform your finances — from surviving paycheck to paycheck to living with peace, purpose, and prosperity.

What Is Financial Wellness?

Financial wellness means being in a position where your money supports your life — not controls it.

It’s not just about how much you earn, but how well you manage, save, invest, and plan for your future.

Think of it like physical health:

-

Eating healthy = budgeting

-

Exercising = saving & investing

-

Resting = peace of mind from financial stability

When you’re financially well, you can handle emergencies, make confident decisions, and work toward dreams — without fear.

Step 1: Know Where You Stand

Before fixing your finances, you need to face them.

Most people don’t know exactly how much they earn, spend, or owe.

Start by writing down:

-

Your total monthly income (salary, side hustles, business profits)

-

Your fixed expenses (rent, transport, bills)

-

Your debts or loans

-

Your savings & investments (if any)

This simple snapshot will reveal your real financial picture.

Example:

If you earn KSh 80,000 but spend KSh 75,000 monthly, your margin is too small for savings or investment. The first goal is to widen that gap.

Rule: You can’t improve what you don’t measure.

Step 2: Create a Budget That Works for You

Budgeting isn’t punishment — it’s freedom. It’s how you tell your money where to go instead of wondering where it went.

Use this simple 50/30/20 rule:

-

50% for needs (housing, food, transport)

-

30% for wants (entertainment, lifestyle)

-

20% for savings/investment

You can tweak this to your lifestyle — the key is consistency.

African Example:

If you earn ₦200,000, then ₦100,000 goes to essentials, ₦60,000 to lifestyle, ₦40,000 to savings/investment.

Apps like Chumz, Money Lover, or Wallet can help you track automatically.

Rule: Budgeting is self-care for your money.

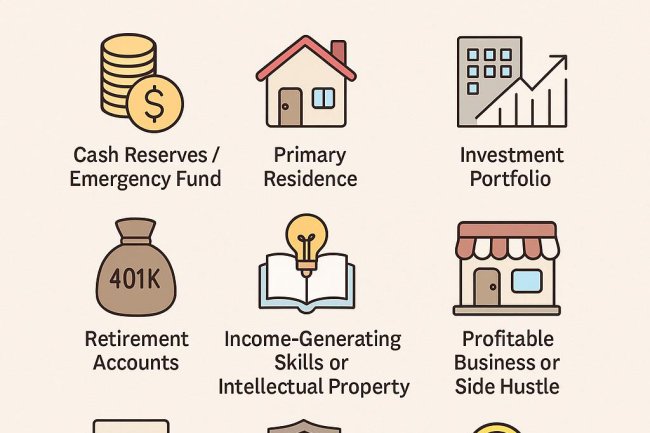

Step 3: Build an Emergency Fund

Life happens — medical bills, job loss, or business slumps. Without a safety net, one crisis can erase years of effort.

Start small. Aim for 3–6 months of expenses in a separate account or money-market fund.

Example:

If you spend KSh 30,000 monthly, target KSh 90,000–180,000 as your emergency buffer.

Store it somewhere accessible but not too easy to withdraw — like a SACCO or money-market account.

Rule: Your emergency fund is your peace of mind fund.

Step 4: Clear Toxic Debt

Debt is not evil — but toxic debt keeps you stuck.

If you’re borrowing for lifestyle (new phone, parties, impulsive spending), you’re paying tomorrow for today’s pleasure.

Focus on clearing:

-

Mobile app loans

-

Credit cards

-

Salary advances

Use the Debt Snowball Method:

-

List all debts from smallest to largest.

-

Pay minimums on all but aggressively pay the smallest.

-

Once cleared, roll that money into the next debt.

Example:

If you owe ₦10,000 on one loan and ₦30,000 on another, pay off the smaller one first to build momentum.

Rule: You can’t build wealth while paying interest on lifestyle debt.

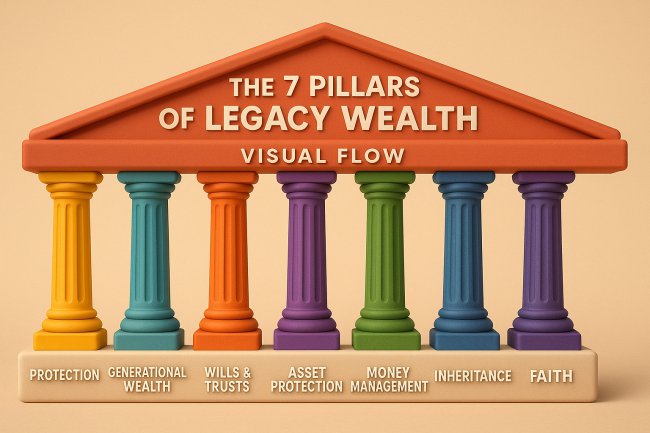

Step 5: Protect Yourself and Your Family

Financial wellness isn’t just about saving; it’s about security.

That means:

-

Getting health insurance (NHIF, HMO)

-

Having life insurance if you have dependents

-

Keeping your documents organized

-

Having a “What If” plan (trusted contact or emergency document folder)

Example:

In Kenya, NHIF + private cover for dependents can cost as low as KSh 2,000/month — cheaper than one hospital bill.

Rule: Insurance isn’t for the rich — it’s for the wise.

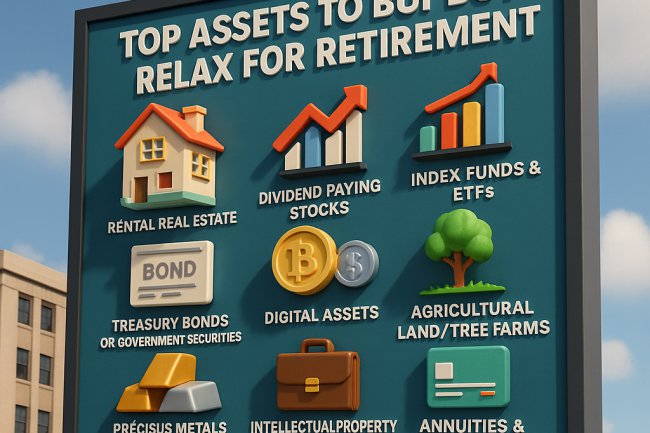

Step 6: Start Investing Early (Even Small)

You don’t need millions to invest — you need discipline.

Start with what’s available:

-

Money Market Funds (CIC, Britam, Zimele)

-

SACCOs for dividends and loans

-

Stocks like Safaricom, Equity, Dangote Cement

-

Treasury Bonds or Bills for safe returns

-

Digital Investment Apps like Hisa, Bamboo, or Chumz

Even KSh 1,000 a month compounds over time.

Example:

KSh 1,000 invested monthly at 10% annually = KSh 200,000+ in 10 years.

Rule: Don’t wait for more money — invest to create it.

Step 7: Keep Learning About Money

Financial literacy is the new currency.

What you don’t know about money will always cost you.

Start small:

-

Read books (Rich Dad Poor Dad, The Richest Man in Babylon)

-

Follow finance podcasts or YouTube creators

-

Take free online courses on Coursera or Khan Academy

Tip: Dedicate 20 minutes daily to financial learning — it compounds faster than interest.

Rule: Every shilling you invest in education multiplies your future earnings.

Step 8: Separate Business and Personal Finances

Many entrepreneurs and freelancers mix business and personal money — a fast route to confusion.

Open separate accounts:

-

One for business income/expenses

-

One for personal use

-

One for savings/investment

This gives you clarity, discipline, and professional credibility.

Example:

If your small printing shop earns KSh 50,000 monthly, pay yourself a set salary (say KSh 15,000) and reinvest the rest.

Rule: If your business pays your bills, treat it like a business — not a wallet.

Step 9: Automate Everything You Can

Automation removes emotion.

You can’t “forget” to save if the system does it for you.

Set up:

-

Automatic transfers to savings/investment accounts

-

Auto payments for recurring bills

-

Expense tracking alerts

Example:

On payday, have 15% automatically move to your SACCO or MMF account. You’ll adapt to what’s left.

Rule: Systems build success faster than motivation.

???? Step 10: Plan for Retirement (Now, Not Later)

Retirement isn’t an age — it’s a financial condition.

You retire the day your money works harder than you do.

Start contributing to:

-

Pension Schemes (NSSF, Zamara, Jubilee)

-

Personal Retirement Accounts (PRAs)

-

Long-term investments like dividend stocks or real estate

Example:

If you invest KSh 5,000 monthly for 25 years at 12% interest, you’ll have over KSh 8 million.

Rule: The earlier you start, the cheaper retirement becomes.

Step 11: Define What Wealth Means to You

Financial wellness isn’t just about numbers — it’s about freedom.

Ask yourself:

-

What does wealth look like to me?

-

Is it peace of mind? Family time? Travel? Business growth?

Your goals shape your plan.

Wealth without purpose feels empty — purpose gives money meaning.

Example:

One person saves to buy land, another invests to send kids to school, another wants time freedom. All are valid — just know your “why.”

Rule: Money is the tool — not the goal.

Financial Wellness Checklist

✅ Know your income and expenses

✅ Create a realistic budget

✅ Build an emergency fund

✅ Eliminate high-interest debt

✅ Get insurance protection

✅ Start small investments

✅ Keep learning

✅ Separate business/personal money

✅ Automate savings

✅ Plan retirement

✅ Define your “why”

Final Thoughts

Financial wellness isn’t about perfection — it’s about progress.

Even one small step in the right direction puts you ahead of those who do nothing.

Start where you are.

If all you can do this month is save KSh 500, do it. Next month, double it.

If all you can do is download a budgeting app, start there.

The goal isn’t to be rich tomorrow — it’s to be financially free forever.

Remember: Money doesn’t change who you are — it amplifies what’s inside you.

Master your money, and you master your life.

What's Your Reaction?