Why Hard Workers Retire Poor — And How to Break the Cycle

Most people spend their lives working hard but retire poor — not from lack of effort, but from a lack of financial strategy. This expert guide breaks down why effort alone doesn’t create wealth, reveals the hidden systems that trap workers, and provides actionable frameworks for building financial freedom through investment, discipline, and compounding. Learn the new wealth equation that turns income into independence.

Most people believe that working hard is the surest path to wealth. It’s a comforting story we’ve inherited from generations before us — work diligently, stay loyal, save something every month, and life will reward you with a comfortable retirement.

Yet, reality paints a very different picture. In Kenya, Nigeria, and across the world, millions of workers who followed this rulebook end up financially trapped at the end of their careers. They earn steady incomes for decades, pay taxes, raise families, and still retire poor.

This is not a story about laziness or bad luck. It’s about a system that rewards labor but not leverage — effort but not financial intelligence. The modern economy doesn’t pay you for how hard you work. It pays you for how effectively you turn your income into assets that produce more income.

This guide breaks down why that gap exists, how it traps even disciplined workers, and how you can break free through financial literacy, asset-building, and modern wealth frameworks.

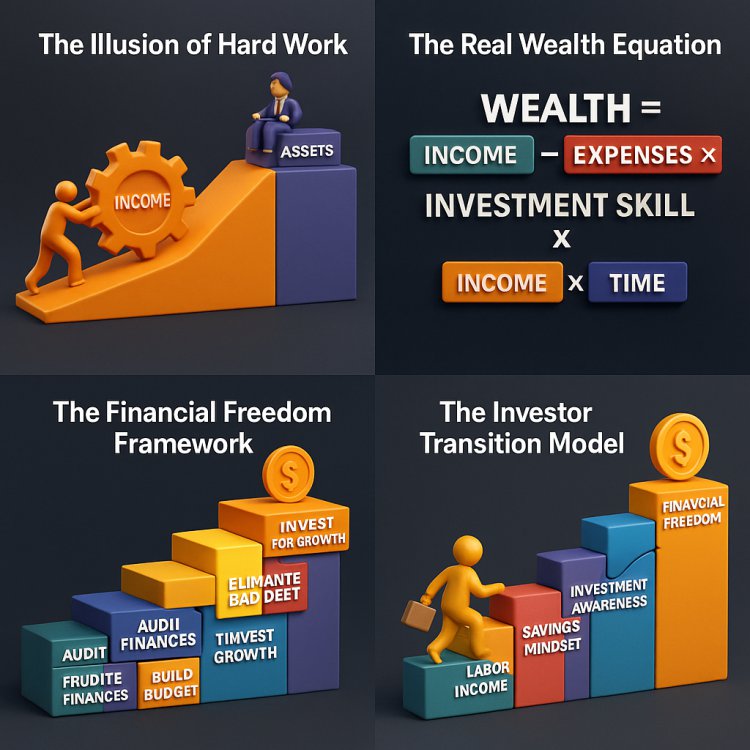

1. The Illusion of Hard Work

The industrial age rewarded effort. The more hours you worked, the more value you produced. But the digital and financial age runs on different rules. It rewards systems and capital, not sweat.

Hard work pays your bills; smart work builds your wealth.

The average employee exchanges time for income — a model that stops working the moment they do. The wealthy, in contrast, build systems that generate revenue without their constant presence.

The illusion lies in this: society conditions us to believe income equals security. But income is temporary. Only assets create independence.

2. The Real Wealth Equation

Wealth isn’t mysterious. It follows a formula that can be learned, tested, and repeated:

Wealth = (Income – Expenses) × Investment Skill × Time

Most people only focus on income. They chase promotions, better salaries, or side hustles — all good pursuits. But without managing expenses and investing the surplus efficiently, income doesn’t translate into wealth.

Let’s dissect this formula.

-

Income – Expenses: Your savings rate determines your potential to invest. If you save nothing, you have nothing to multiply.

-

Investment Skill: The ability to allocate capital wisely — stocks, SACCOs, businesses, real estate, or digital assets — multiplies your base.

-

Time: Compounding turns small, consistent investments into exponential growth.

When you master all three variables, you escape the cycle that traps millions.

3. Why Hard Workers Stay Broke

a. Financial Illiteracy

The school system teaches you how to earn, not how to manage or multiply money. You learn algebra, not compound interest. You master grammar, not portfolio diversification.

Without financial education, workers unknowingly make poor money decisions — buying liabilities instead of assets, relying on savings accounts instead of investments, and misunderstanding inflation.

A shilling saved but not invested loses value over time. Inflation silently erodes purchasing power every year, punishing those who keep money idle.

b. Lifestyle Inflation

Every pay raise triggers new spending habits — a better phone, a bigger car, a more expensive apartment. Instead of saving the difference, workers expand their liabilities to match their income. This psychological trap, called lifestyle inflation, ensures that expenses always rise faster than earnings.

The result? People earn more over time but save less, creating a false sense of progress while quietly falling behind.

c. Single Income Dependency

Relying on a single income stream is dangerous in a volatile economy. Job loss, illness, or market downturns can erase decades of effort. The wealthy mitigate this risk by creating multiple sources of income — investments, royalties, side businesses, or rental income.

When your income depends entirely on your labor, you’re one crisis away from poverty.

d. Lack of Compounding

Compounding — the exponential growth of reinvested earnings — is the most powerful force in finance. But it needs time. Most people start investing too late, withdraw too early, or chase unrealistic returns.

The earlier you invest, the less you need to contribute to achieve financial independence. The rich don’t rely on luck; they rely on math.

4. The System That Keeps Workers Poor

The global economy is structured around consumption. Advertising convinces you to buy things you don’t need, with money you don’t have, to impress people who don’t care.

Debt becomes a lifestyle. Credit cards, loans, and mortgages create the illusion of comfort while chaining you to years of repayment.

Meanwhile, those who understand the system use it differently. They borrow to acquire assets, not to fund consumption. They use leverage strategically — investing in productive ventures that generate returns higher than the cost of debt.

In essence, the poor use debt to look rich; the rich use debt to get richer.

5. The Financial Freedom Framework

To escape the hard-work trap, you need a roadmap — not random advice. Let’s break it into a structured system called the Financial Freedom Framework.

Step 1: Audit Your Finances

Before you build wealth, you must know where your money goes. Track every expense for 90 days. Categorize them into essentials, wants, and leaks. You’ll discover that small, recurring costs (subscriptions, takeout, transport) eat away at your investment potential.

Awareness is the first step toward control.

Step 2: Build a Budget That Prioritizes Investment

Budgeting isn’t about restriction; it’s about direction. The wealthy allocate funds to investments first and spend what’s left. The poor do the opposite.

Adopt the 50-30-20 rule as a baseline:

-

50% for needs (rent, food, transport)

-

30% for wants (entertainment, lifestyle)

-

20% for investments and debt repayment

As income grows, increase the investment percentage. Your savings rate is your future freedom rate.

Step 3: Eliminate Bad Debt

Not all debt is evil — but consumer debt is. Clear high-interest loans, credit cards, and non-productive liabilities. Every shilling of interest you avoid is a guaranteed return on your money.

Once bad debt is gone, you can begin using good debt strategically — for business expansion, property, or income-generating assets.

Step 4: Automate Wealth

Human discipline is unreliable. The key is automation. Set up standing orders to transfer money directly into investment accounts, SACCOs, or mutual funds as soon as your salary arrives.

Automation ensures consistency, removes emotion, and accelerates compounding.

Step 5: Build an Emergency Fund

Financial freedom starts with stability. Keep 3–6 months of expenses in a liquid account (like a money market fund). This fund shields you from emergencies that would otherwise force you to liquidate investments or take expensive loans.

Step 6: Invest for Growth

Your money must work harder than you do. Diversify across:

-

Stocks and ETFs: For long-term capital appreciation.

-

SACCOs and Money Market Funds: For stability and regular returns.

-

Real Estate: For tangible value and rental income.

-

Digital Assets or Businesses: For scale and future-proofing.

Focus on consistent, compounding growth — not speculation.

Step 7: Protect and Scale

As wealth grows, protect it. Get insurance, write a will, and diversify geographically. The rich don’t gamble; they hedge.

Then scale — reinvest returns, build systems, and mentor others. True wealth multiplies not just money but impact.

6. The Investor Transition Model

Transitioning from worker to investor is a mindset shift, not a leap. It happens in stages.

Stage 1: Labor Income

You trade time for money. Your goal is survival.

Stage 2: Savings Mindset

You begin to manage expenses and save a portion of income.

Stage 3: Investment Awareness

You learn how money grows and start testing low-risk options — SACCOs, mutual funds, or bonds.

Stage 4: Asset Builder

You allocate capital into scalable income sources: business, real estate, or stocks.

Stage 5: Financial Freedom

Passive income exceeds expenses. You work by choice, not necessity.

Each stage requires different knowledge, habits, and mentors. The journey isn’t linear — it’s behavioral.

7. The Wealth Multiplier Mindset

There are only three paths to financial freedom:

-

Earn More — increase income through skills, entrepreneurship, or leadership.

-

Spend Less — reduce lifestyle costs to grow your savings rate.

-

Multiply Faster — invest in high-return assets and compound them long-term.

The magic lies in the third path.

To multiply faster, you must understand three compounding levers:

-

Rate of Return: Higher returns accelerate compounding, but sustainability matters more than speed.

-

Frequency: Reinvest profits regularly to maximize exponential growth.

-

Time: The earlier you start, the more powerful your compounding curve.

The goal is to design a system where your money earns money — and that money earns even more money.

8. The African Context

In Africa, financial systems are evolving fast. We have unique challenges — volatile currencies, inflation, and limited formal pension structures. But we also have massive opportunities — youth demographics, digital finance, and regional trade growth.

Workers who adapt now will own the next economic wave.

Here’s what that looks like:

-

Kenya: Invest through SACCOs, unit trusts, and stocks like Safaricom or KCB.

-

Nigeria: Use fintechs like Cowrywise or Bamboo to access global markets.

-

Ghana: Leverage Treasury bills, mutual funds, and real estate cooperatives.

The strategy is universal: turn local income into global growth.

9. The Role of Financial Education

Knowledge compounds faster than money.

Make financial learning a lifelong habit. Read books like The Psychology of Money, Rich Dad Poor Dad, Your Money or Your Life, and The Millionaire Next Door. Follow reputable finance educators, attend seminars, and test small investments.

In the information age, ignorance is more expensive than risk.

10. Designing Your Freedom Blueprint

Let’s make this actionable. Here’s a blueprint you can implement immediately.

-

Track: Write down all income and expenses for 3 months.

-

Plan: Create a monthly budget that includes a fixed investment contribution.

-

Automate: Schedule automatic transfers into investment accounts.

-

Diversify: Mix short-term (money market), mid-term (SACCOs, ETFs), and long-term (stocks, property) investments.

-

Grow: Reinvest returns and increase your contribution annually.

-

Protect: Get insurance and maintain an emergency fund.

-

Review: Assess your net worth every quarter and adjust your strategy.

This system doesn’t depend on luck — only consistency.

11. The Real Definition of Retirement

Retirement isn’t an age; it’s a condition.

You are retired the day your passive income covers your living expenses. For some, that happens at 65. For others, it happens at 35.

The number of years you work doesn’t matter — what matters is what your money does while you sleep.

12. The New Model of Wealth

The old model says: “Work hard for 40 years, then rest.”

The new model says: “Build systems that work for you, then live.”

Your goal isn’t to quit work. It’s to quit dependency.

By mastering financial literacy, owning assets, and letting compounding do its job, you can design a life of independence — not someday, but progressively, year by year.

Conclusion

The tragedy of the modern worker is not lack of effort; it’s misdirected effort. The system teaches labor, not leverage. Effort alone cannot defeat inflation, taxation, or consumer psychology.

But knowledge can. Strategy can. Systems can.

You don’t need to be born rich to retire free. You need to start thinking like an investor today — building habits, assets, and financial systems that outlive your labor.

Hard work is noble. But in the 21st century, smart, structured, and strategic work is what guarantees freedom.

By Maertin K | WealthInsights.co.ke

Building Africa’s Financially Free Generation

Join the Wealth Insights community to start your financial freedom journey.

What's Your Reaction?