Escaping the Paycheck-to-Paycheck Trap

Discover smart ways to break free from the paycheck-to-paycheck cycle. Learn how to save, budget, and invest wisely to achieve lasting financial freedom.

The Ultimate Guide to Building Financial Freedom

There’s a silent struggle happening in many African households — one that cuts across income levels, education, and even ambition.

It’s the feeling of working hard all month only to find yourself broke a few days after payday.

It’s called the paycheck-to-paycheck trap, and millions of people are caught in it.

You’re not poor. You’re not lazy. You’re simply trapped in a financial system — and mindset — that rewards spending but punishes saving.

The good news? Escaping it isn’t about luck or even earning more. It’s about changing how you see, use, and grow money.

This is your practical guide to breaking that cycle — for good.

Part 1: Understanding the Trap

1. What Does “Paycheck-to-Paycheck” Really Mean?

It means living in survival mode — where your next salary determines whether you can pay bills, buy food, or breathe easy.

You earn today, spend everything tomorrow, and repeat the cycle next month.

Statistically, about 7 out of 10 working adults in Africa live this way.

Even professionals earning KSh 100,000, ₦400,000, or $1,000 a month often admit that their salaries never seem enough.

So, what’s really happening?

2. The Psychology Behind the Cycle

Money isn’t just numbers — it’s emotion.

Most people don’t have a spending problem; they have a discipline and purpose problem.

After days or weeks of hard work, spending feels like reward. You convince yourself:

“I deserve this new phone.”

“I’ll save next month.”

“At least I’m not in debt.”

But every impulse spend delays your freedom.

The system is designed that way — from adverts that make you want more, to easy mobile loans that turn future income into today’s consumption.

Breaking free starts with a new mindset:

Money is not for showing off; it’s a tool for buying back your time and peace.

Part 2: Why Most People Stay Trapped

1. Lack of a Clear Plan

Without a written plan, your money follows emotion — not intention.

A salary without a goal is like water without a container: it spills everywhere.

When you don’t plan where your money will go, it disappears on things you can’t even remember.

2. Lifestyle Inflation

You get a salary raise — and instead of saving more, you start eating out, buying better clothes, moving into a bigger apartment.

Before long, you’re still broke, just in a more expensive lifestyle.

This is called lifestyle creep, and it silently kills wealth.

3. Debt Dependency

From mobile apps to SACCO loans, debt has become a way of life.

While not all debt is bad, relying on loans to survive monthly expenses is a red flag.

Debt steals future income and keeps you in bondage.

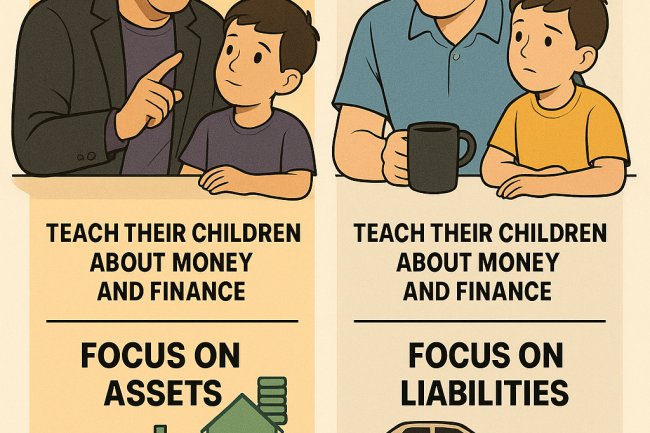

4. Ignoring Financial Education

We’re taught how to earn, not how to manage.

Schools rarely teach budgeting, investing, or compound interest.

That’s why financial literacy is now being called the new currency.

Those who understand money rules win — those who don’t, work for those who do.

Part 3: The Mindset Shift That Changes Everything

If you want to escape the paycheck cycle, start here — in your mind.

1. Stop Thinking Like a Consumer

Rich people think like producers — they create, invest, and multiply.

The average person consumes and complains.

Ask yourself daily:

“Am I consuming or creating value today?”

Each answer tells you whether you’re moving closer to wealth or further from it.

2. Adopt the “Save to Invest” Mentality

Don’t save just to feel safe — save to grow.

Every coin you save should eventually find a home that multiplies it — in a business, fund, or asset.

3. Delay Gratification

Wealthy people master patience.

They understand that comfort delayed today brings freedom tomorrow.

Instead of buying that gadget, they buy an investment that buys them gadgets forever.

4. Think Long-Term

Wealth isn’t built in one year; it’s built through habits repeated for years.

Ask yourself: “What can I do consistently for the next five years that will make me financially free?”

Part 4: The Strategy to Break Free

Let’s get practical.

Below is a 7-step strategy to finally escape the paycheck-to-paycheck life.

Each step builds on the last — so don’t skip ahead.

Step 1: Build a Zero-Based Budget

Budgeting isn’t about restriction — it’s about control.

Every shilling must have a name before you spend it.

Use this simple formula:

Income − Expenses = Zero (on paper).

That means you allocate every coin — even to savings, tithes, and fun.

You’re telling your money exactly what to do.

Tip: Use apps like Chumz, Spendee, or a simple notebook. The method doesn’t matter — discipline does.

Step 2: Pay Yourself First

Before Safaricom, before rent, before anyone else — pay you.

Transfer at least 10% of your income to a savings or money-market fund immediately after payday.

This act alone rewires your financial life.

You’re telling the universe, “I’m serious about growth.”

Even if it’s KSh 500, start. Consistency beats amount.

Step 3: Automate Your Savings

If saving feels hard, make it invisible.

Set a standing order or automated transfer to your investment account.

You’ll be surprised how fast your savings grow when you remove emotion from the process.

Automation transforms willpower into a system.

Step 4: Eliminate High-Interest Debt

Debt is a silent killer of financial dreams.

Focus first on clearing mobile loans, credit cards, and high-interest obligations.

Use the debt snowball method:

-

List all debts from smallest to largest.

-

Pay minimums on all, but aggressively clear the smallest.

-

Each time you finish one, roll that amount into the next.

You gain momentum, motivation, and freedom.

Step 5: Build an Emergency Fund

Emergencies will happen — but they shouldn’t destroy your finances.

Aim for 3-6 months of expenses in an easily accessible savings or money-market account.

This fund becomes your shield against job loss, illness, or unexpected costs.

Without it, every crisis pushes you deeper into debt.

Step 6: Grow Your Income Streams

You can’t save your way to wealth — you must earn more.

Diversify your income so one paycheck isn’t your lifeline.

Here are practical ways Africans are doing it:

-

Freelancing online (writing, design, virtual assistance)

-

Monetizing skills via courses or YouTube

-

Small e-commerce stores (Jumia, Instagram shops)

-

Farming, delivery services, or digital agencies

-

Passive income through SACCO dividends, REITs, or Treasury bonds

Start small, scale wisely, and reinvest profits.

Step 7: Invest for the Long Term

Once your savings and emergency fund are stable, make your money work for you.

Focus on assets that appreciate or generate income.

Options include:

-

Money Market Funds: For low-risk short-term growth.

-

Stocks: Dividend-paying companies like Safaricom, KCB, or Dangote Cement.

-

SACCOs: For consistent returns and easy access to loans.

-

Government Bonds: For secure, long-term compounding.

-

Real Estate: When capital allows — especially plots or rentals in growing towns.

The goal isn’t to time the market — it’s to spend time in the market.

Part 5: Lessons from Real-Life Stories

1. Mary – The Teacher Who Became Debt-Free

Mary, a primary-school teacher in Nakuru, once relied on salary advances every month.

She started by saving KSh 500 weekly into a SACCO. Within two years, she built an emergency fund and started buying shares.

Today, she earns dividends yearly — and hasn’t taken a loan in three years.

2. Daniel – The Nairobi Boda Rider Investor

Daniel used to spend everything he earned daily.

After a friend introduced him to a money-market app, he began saving KSh 200 daily.

He later bought a second motorbike that now earns him passive income.

Lesson: Small habits create big transformations.

3. Aisha – The Side-Hustle Queen

Aisha, a Nigerian fashion designer, decided to separate personal and business finances.

She now pays herself a salary and invests profits in crypto and mutual funds.

Her consistency turned her hustle into a structured business.

Part 6: Tools and Systems That Help

You don’t need complex tools — just commitment.

Still, these can make life easier:

-

Savings Apps: Chumz, M-Akiba, PiggyVest, Cowrywise

-

Expense Trackers: Wallet, Money Lover, or a simple Google Sheet

-

Investment Platforms: Hisa App, Absa Unit Trusts, Britam, Old Mutual

-

Books to Read:

-

Rich Dad Poor Dad by Robert Kiyosaki

-

The Richest Man in Babylon by George Clason

-

Your Money or Your Life by Joe Dominguez

-

Think and Grow Rich by Napoleon Hill

-

Remember: Tools don’t create discipline — you do.

Part 7: Local Realities — African Context Matters

Living in Kenya or Nigeria comes with unique financial challenges: high inflation, unpredictable taxes, and unstable job markets.

But it also presents opportunities: mobile money, digital jobs, and a young, creative population.

When you understand your environment, you can turn challenges into leverage.

Example:

Instead of complaining about inflation, invest in inflation-proof assets — like Treasury bonds, real estate, or a dollar savings account.

Instead of fearing job loss, build digital skills that make you employable globally.

Don’t fight the system — outsmart it.

Part 8: The Wealth Growth Formula

Escaping paycheck-to-paycheck is just the first step.

The next is to build lasting wealth.

Here’s a proven formula:

Wealth = (Income Growth × Investment Discipline) + Time

The three keys:

-

Earn More: Grow skills, negotiate salaries, start ventures.

-

Spend Wisely: Control lifestyle inflation.

-

Invest Consistently: Reinvest profits, compound returns.

If you do this for five years with focus, you’ll be among the top 10% financially stable Africans — regardless of your starting point.

Part 9: Building Financial Habits that Last

Temporary motivation fades. Habits last forever.

Here are seven small habits that make big wealth over time:

-

Check your accounts weekly.

-

Save something from every income source.

-

Avoid impulse buying — wait 48 hours before big purchases.

-

Read one personal-finance article daily.

-

Review goals monthly.

-

Network with financially literate people.

-

Celebrate progress, not perfection.

Money follows attention — give it yours daily.

Part 10: The Future of Money

The modern economy is shifting fast. AI, automation, and the digital revolution are changing how we earn and save.

In the coming decade:

-

Traditional employment will be unstable.

-

Side hustles will become main income streams.

-

Financial literacy will separate the thriving from the struggling.

So prepare now. Learn digital tools, understand investments, and teach your children early.

Financial education is the inheritance that never devalues.

Final Thoughts

Breaking free from the paycheck-to-paycheck cycle isn’t about perfection — it’s about direction.

You start small, you stay consistent, and you keep learning.

Every decision you make — every coin you save, every impulse you resist — pushes you closer to peace and freedom.

Money is not your enemy; ignorance is.

Master money, and it will serve you.

So today, take the first step:

Write your budget, automate your savings, and commit to growth.

Tomorrow, you’ll look back and realize — you escaped.

What's Your Reaction?