The Psychology of Making Money: Why Mindset Determines Wealth More Than Income

This article explores the psychology behind wealth creation, explaining how money scripts, identity, scarcity thinking, and behavioral biases influence financial outcomes. It provides practical frameworks to rewire limiting beliefs, distinguish assets from liabilities, and align mindset with long-term wealth building.

Most people believe that wealth is created by intelligence, hard work, or luck. While those factors matter, they are not the primary drivers of long-term financial success. The single most important factor separating people who struggle financially from those who build lasting wealth is the psychology of money.

Money follows behavior. Behavior follows belief. And beliefs are often formed long before we ever earn our first paycheck.

Understanding how your mind interacts with money—and learning how to reprogram unhelpful patterns—is one of the most powerful financial skills you can develop.

1. Money Scripts: The Hidden Code Running Your Financial Life

Every financial decision you make is influenced by an internal “money script.” These are subconscious beliefs about money formed in childhood through family, culture, and lived experience.

You did not consciously choose these beliefs, yet they silently control:

-

How much you think you deserve to earn

-

How comfortable you feel charging for your work

-

Whether you save, spend, invest, or avoid money

-

How anxious or confident you feel around wealth

Financial psychology research identifies four dominant money scripts.

a) Money Avoiders

Money avoiders believe money is bad, corrupting, or undeserved. They often associate wealth with greed or moral failure.

Common behaviors:

-

Under-earning despite capability

-

Guilt around financial success

-

Self-sabotage when income increases

b) Money Worshippers

Money worshippers believe money will solve all problems and bring happiness.

Common behaviors:

-

Constant chasing of “more”

-

Never feeling satisfied

-

Hoarding or overworking at the expense of relationships

c) Money Status

People with this script tie self-worth to net worth.

Common behaviors:

-

Overspending to maintain appearances

-

Constant comparison with others

-

Anxiety when someone else earns more

Research shows this script is strongly associated with lower happiness and higher stress.

d) Money Vigilant

Money vigilant individuals are disciplined savers who live below their means—but often feel chronic anxiety about the future.

Common behaviors:

-

Excessive caution even when financially secure

-

Difficulty enjoying money

-

Fear of spending despite abundance

Most people are a mix of these scripts, but one usually dominates.

The first step to change is awareness.

2. Rewriting Your Money Script

Money scripts are not facts. They are inherited narratives.

Common phrases like:

-

“Money doesn’t grow on trees”

-

“Rich people are greedy”

-

“Be grateful for what you have”

are opinions—not financial laws.

Once a belief enters your subconscious, it begins dictating:

-

What jobs you pursue

-

How much you charge

-

What level of comfort feels “normal”

Action step:

Write down your earliest memory about money. How did your parents talk about it? How did they behave with it?

Then replace the old script with a neutral, empowering one, such as:

Money is a tool that helps me create freedom, security, and impact.

Changing the internal narrative reduces emotional charge and aligns behavior with better outcomes.

3. The Wealth Ceiling: Why Income Is Capped by Identity

Many people unknowingly operate under a wealth ceiling—an invisible income cap created by self-image.

Your self-concept acts like a thermostat:

-

Earn above your identity → you sabotage or overspend

-

Earn below your identity → you stress until you return to “normal”

If you see yourself as someone who earns a certain amount, you will unconsciously regulate your life to stay there.

This explains why people:

-

Receive raises but end up no better off

-

Grow income but increase expenses immediately

-

Repeatedly return to the same financial level

Identity drives income, not effort alone.

Exercise:

-

Write: “I’m the kind of person who…” and complete it honestly

-

Then rewrite: “I’m the kind of person who builds and manages wealth intentionally.”

You don’t need to fully believe it yet. You only need to stop rejecting it.

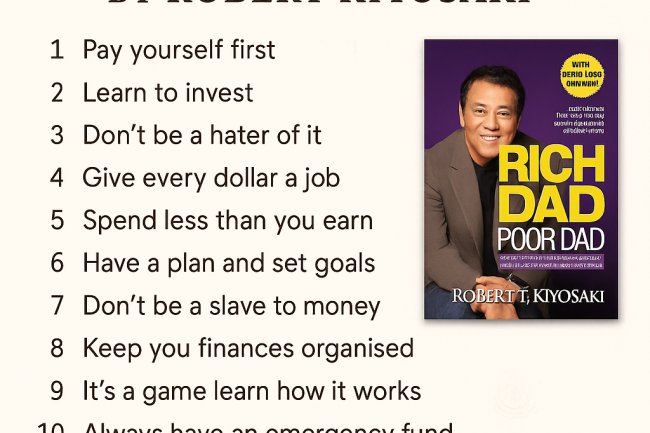

4. Assets vs. Liabilities: The Simplest Wealth Filter

Wealth creation is often misunderstood as complex. In reality, it follows a simple distinction:

-

Assets put money in your pocket

-

Liabilities take money out of your pocket

Many people spend their lives buying liabilities while believing they are assets.

Common examples:

-

Personal cars → liabilities (depreciation, fuel, maintenance)

-

Primary residence → liability (mortgage, taxes, repairs)

-

Skills, education, revenue-producing tools → assets

Even money sitting idle can become a liability due to inflation and lost opportunity.

Better question to ask before spending:

“Will this pay me back?”

When you consistently filter decisions this way, wealth begins to compound.

5. Scarcity vs. Abundance: How Fear Shrinks Financial Intelligence

Humans are wired for scarcity. Historically, resources were limited. But money today is not finite—it is renewable and constantly being created.

A scarcity mindset focuses on:

-

Protection instead of creation

-

Short-term survival instead of long-term growth

-

Fear of loss instead of opportunity

Neuroscience shows that scarcity reduces cognitive bandwidth, leading to poorer decisions and limited planning.

An abundance mindset shifts the question from:

“How do I protect what I have?”

to

“How do I create more value?”

This simple shift unlocks better financial reasoning.

6. Loss Aversion: Why People Avoid Wealth-Building Risks

Psychological research shows that losing money feels twice as painful as gaining the same amount feels pleasurable.

This bias explains why people:

-

Hold losing investments too long

-

Stay in bad jobs or businesses

-

Avoid negotiating pay

-

Fear investing

Your brain is designed to protect what you have, not pursue what you could have.

Reframe losses as tuition.

Every loss is education paid for in advance. When framed this way, fear loses its control.

7. The Time Trap: Saving Money vs. Buying Time

Most people try to save money—but forget that time is the real non-renewable asset.

If you earn a certain amount per hour, doing tasks worth less than that amount is a net loss.

Wealthy individuals:

-

Delegate early

-

Automate low-value tasks

-

Focus on high-leverage activities

They don’t buy convenience—they buy time.

Simple calculation:

Annual income ÷ 2,000 working hours = hourly value

Then ask:

“Is this task worth my time at this rate?”

Final Thought: One Shift Is Enough to Start

You do not need to fix everything at once.

Choose one belief to challenge this week:

-

Rewrite one money script

-

Reclassify spending decisions

-

Delegate one low-value task

-

Reframe one financial loss

Wealth is not built by motivation alone.

It is built by identity alignment, psychological clarity, and consistent behavior over time.

Change the way you think about money—and your results will eventually follow.

What's Your Reaction?