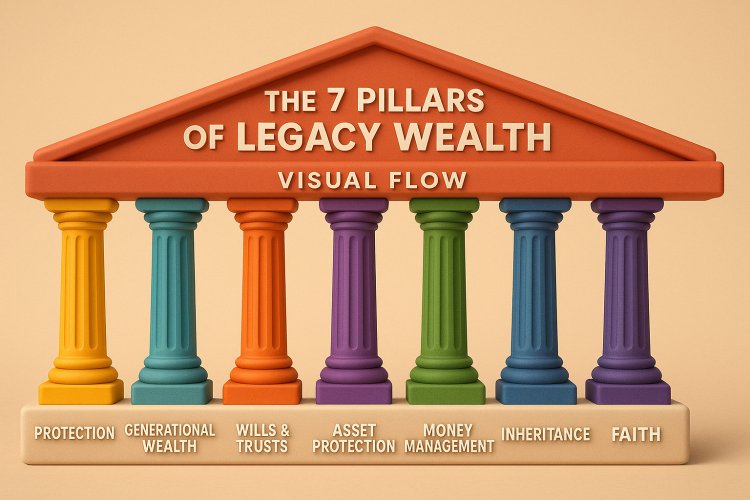

Wealth Protection and Legacy Planning — How to Keep and Transfer Wealth Across Generations

Learn the essential steps to protect, preserve, and pass down your wealth. This guide covers insurance, generational wealth, wills, trusts, asset protection, and biblical financial principles for long-term prosperity and legacy.

Introduction: Why Protecting Wealth Matters More Than Earning It

Many people chase wealth — few learn to protect it. In today’s volatile economy, fortunes are made fast, but they’re also lost fast. True financial freedom isn’t just about income; it’s about security, stability, and succession.

As Proverbs 13:22 teaches: “A good man leaves an inheritance to his children’s children.” That’s not only about money — it’s about legacy, impact, and wisdom passed through generations.

In this in-depth guide, you’ll learn how to secure your wealth, shield it from inflation and crises, build generational prosperity, and ensure your legacy continues — spiritually and financially.

1. The Foundation: Why Wealth Protection Comes Before Growth

Financial freedom isn’t a one-step climb — it’s a layered system.

Think of it like building a house:

-

Income is the foundation.

-

Savings are the walls.

-

Investments are the roof.

-

Protection (insurance, legal structures, trusts) are the locks and security systems.

Without proper protection, even the wealthiest individuals can lose everything due to illness, lawsuits, inflation, or family mismanagement.

Key Insight:

It’s not how much you make — it’s how much you keep and transfer that defines real wealth.

2. Insurance Essentials: Guarding Your Wealth Against the Unexpected

Insurance is not an expense — it’s a shield.

A. Life Insurance

Provides financial security for your dependents.

Choose between:

-

Term Life: Affordable protection for a fixed period.

-

Whole Life: Combines protection with investment value.

B. Health Insurance

Covers medical emergencies that can destroy savings. In developing economies, medical debt is a leading cause of financial collapse.

C. Business Insurance

If you’re an entrepreneur, insure your:

-

Assets and equipment

-

Employees and liabilities

-

Loss of income during crises

Tip: Regularly review policies every 12–18 months to ensure coverage aligns with your financial growth.

3. Building Generational Wealth: The Power of Legacy Thinking

Generational wealth isn’t built by accident — it’s built by design.

A. Define Your Family’s Financial Vision

Ask:

-

What values do we stand for?

-

How should wealth be used to honor God and bless others?

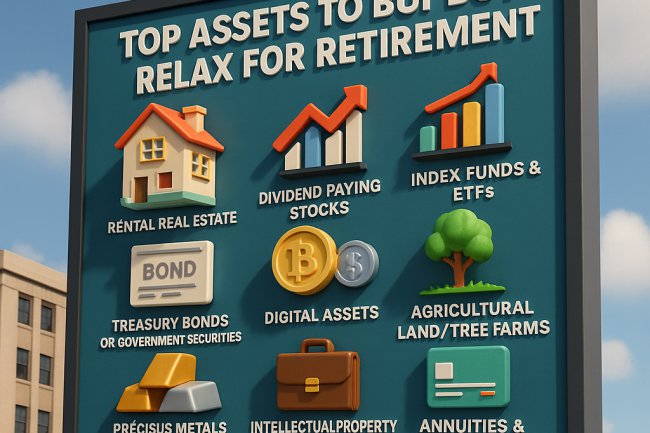

B. Build Assets That Outlive You

Focus on:

-

Real Estate: Rental and commercial properties.

-

Stocks and ETFs: Dividend income over decades.

-

Businesses: Companies with systems, not just personal hustle.

-

Intellectual Property: Books, courses, or digital assets that pay royalties.

C. Teach Financial Literacy Early

Train your children to understand budgeting, saving, and investing.

Generational wealth dies when the next generation isn’t trained to sustain it.

“If you leave wealth without wisdom, you’ve only delayed poverty.”

4. Wills, Trusts, and Succession Planning

A. Wills

A will defines how your assets will be distributed when you pass.

Without it, government laws (intestacy) decide for you — often causing disputes and loss.

B. Trusts

A trust allows assets to be transferred privately, efficiently, and sometimes tax-free.

Types include:

-

Living Trusts – active while you’re alive.

-

Testamentary Trusts – effective after death.

-

Charitable Trusts – for donations and faith-based giving.

C. Business Succession

If you own a business, prepare for leadership transfer:

-

Identify successors.

-

Document systems.

-

Train and mentor the next generation.

Succession is not an event — it’s a process.

5. Protecting Assets from Inflation and Crisis

Inflation silently erodes purchasing power.

If your money isn’t growing faster than inflation, you’re losing wealth.

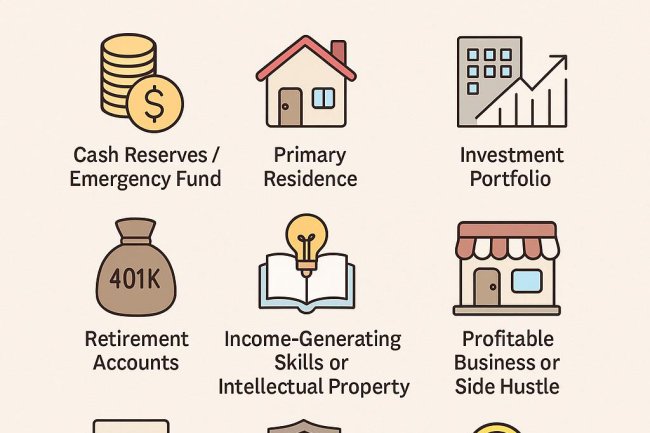

A. Diversify Your Assets

-

Real Assets: Gold, land, real estate.

-

Productive Assets: Businesses and equities.

-

Cash Flow Assets: Bonds, REITs, dividend stocks.

B. Maintain an Emergency Fund

Cover at least 6–12 months of expenses.

C. Crisis-Proof Your Finances

-

Avoid high debt.

-

Keep income sources diversified.

-

Build digital or remote income streams that survive market shifts.

D. Invest in Inflation-Protected Instruments

Consider Treasury Inflation-Protected Securities (TIPS) or local equivalents.

6. Family Money Management and Inheritance Principles

A. Create a Family Financial Constitution

A document outlining:

-

Shared financial goals

-

Family values around money

-

Giving and saving principles

B. Set Up a Family Trust or Investment Club

Encourages joint ownership, shared learning, and accountability.

C. Teach Biblical Stewardship

Remind the next generation that wealth is borrowed stewardship from God, not personal glory.

“The earth is the Lord’s, and everything in it.” — Psalm 24:1

D. Encourage Charity and Legacy Giving

Tithing, community investment, and charity are not losses — they’re investments in eternity.

7. The Faith Perspective: Money with a Mission

Faith-based wealth planning goes beyond profit — it seeks purpose.

As Christians, our role is not just to accumulate but to steward resources for impact.

-

Earn diligently.

-

Manage wisely.

-

Give generously.

-

Transfer responsibly.

Your wealth should reflect your walk with God — disciplined, compassionate, and generational.

8. Practical Steps to Begin Legacy Planning Today

-

Audit your current wealth — assets, debts, insurance, and income sources.

-

Consult a financial advisor — ensure your plan is tax-smart and legally sound.

-

Draft a will and discuss it openly with family.

-

Set up a trust for long-term estate management.

-

Train your heirs in financial literacy and biblical stewardship.

-

Review annually — update documents and beneficiaries as life changes.

9. Common Mistakes to Avoid

-

No documentation: Verbal promises lead to legal chaos.

-

Ignoring inflation: Idle cash loses value.

-

Not educating heirs: Untrained inheritors destroy family wealth.

-

No insurance: One accident can wipe out decades of savings.

-

Delaying planning: Tomorrow is not guaranteed.

10. Conclusion: Legacy Is More Than Money

True wealth is not measured in bank balances — it’s measured in impact and continuity.

Your money, when guided by wisdom and faith, can:

-

Empower your children

-

Strengthen your community

-

Support the kingdom of God

You are not just building wealth — you are building a legacy of purpose.

“A good man leaves an inheritance to his children’s children.” — Proverbs 13:22

That’s the call to every believer: not just to prosper, but to prepare.

What's Your Reaction?