RETIREMENT PLANNING: A COMPLETE GUIDE TO PENSION SCHEMES, LONG-TERM INVESTING & RETIREMENT INCOME STRATEGIES

A complete guide to retirement planning, pension schemes, long-term investing, and income strategies to help you retire comfortably and financially secure.

Introduction: Why Retirement Planning Matters More Today Than Ever

Retirement planning is no longer optional. Modern workers—whether employed, self-employed, entrepreneurs, or freelancers—must take personal responsibility for building financial security that can sustain them for 20–30 years after exiting the workforce. With rising life expectancy, inflation, job disruptions, and fewer companies offering guaranteed pensions, the person who wins is the one who starts early, plans intentionally, and invests consistently.

Retirement planning is not simply about saving money; it is about designing a future where your lifestyle is maintained without relying on employment income. It is a long-term financial strategy involving pension schemes, diversified investments, and sustainable withdrawal methods that ensure steady income throughout retirement.

This guide breaks down everything a beginner or expert needs to master retirement planning—from choosing the right pension scheme, to building a long-term investment portfolio, to creating multiple retirement income streams.

Chapter 1: Understanding Retirement Planning

Retirement planning is the process of preparing financially, mentally, and emotionally for the stage of life when you no longer depend on active work. The aim is not just to retire, but to retire comfortably.

Effective retirement planning involves:

-

Planning how much money you need

-

Establishing pension or retirement accounts

-

Setting up long-term investments

-

Estimating future living expenses

-

Factoring inflation

-

Creating income strategies

-

Managing risk

-

Ensuring you do not outlive your money

In other words, you are building a financial engine that continues to produce income after you stop working.

Chapter 2: How Much Money Do You Need to Retire?

This is the biggest question—and the answer depends on your:

-

Age

-

Lifestyle

-

Expected retirement age

-

Health

-

Dependents

-

Location

-

Passive income sources

-

Savings and investments

A useful formula is:

Target Retirement Amount = Annual Expenses × 25 (The 4% Rule)

Example:

If you need KES 1,000,000 per year to live comfortably:

KES 1,000,000 × 25 = KES 25,000,000 retirement target.

This 4% rule suggests you can safely withdraw 4% annually from your portfolio without depleting it over 30 years.

Chapter 3: Pension Schemes Explained (Private, Employer-Based & Government)

A pension scheme is a structured retirement savings plan where contributions grow over time through investment. Pension schemes offer tax benefits, employer matches, and professional fund management.

1. Employer-Based Pension Schemes

Many organizations offer pension programs where the employer contributes a percentage of your salary while you contribute another. This is free money—always maximize the employer match.

2. Personal/Private Pension Plans

These are ideal for:

-

Self-employed individuals

-

Gig workers

-

Freelancers

-

Entrepreneurs

You choose a provider, contribute consistently, and benefit from tax incentives.

3. Government Pension Schemes

Most governments have a national social security fund. It offers basic retirement support but should not be your only retirement plan.

Benefits of Pension Schemes

-

Tax relief on contributions

-

Compounded growth

-

Employer contributions

-

Professional fund management

-

Long-term stability

Mistakes People Make with Pension Schemes

-

Starting late

-

Withdrawing early

-

Contributing the minimum

-

Relying on one pension plan

-

Ignoring annual statements

Chapter 4: Long-Term Investing for Retirement

Retirement investing must be guided by time horizon and risk tolerance. Long-term investing focuses on wealth accumulation through compounding, minimizing risk, and building diversified streams.

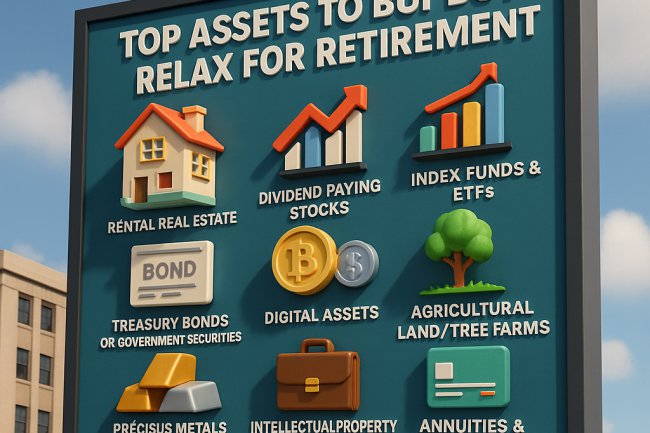

The Best Long-Term Investment Options

1. Stocks (Equities)

Offer high long-term returns but require patience. Ideal for people under 50.

2. Bonds

Stable, lower risk. Suitable for risk-averse investors and those nearing retirement.

3. Mutual Funds & Index Funds

Professionally managed and diversified.

4. Real Estate Investments

Generates rental income and capital growth.

5. REITs

Real estate exposure without buying physical property.

6. Money Market Funds

Good for capital preservation and emergency funds.

7. Annuities

Provide guaranteed income in retirement.

Chapter 5: The Power of Compounding in Retirement Planning

Compounding is the engine that builds long-term wealth.

Example:

If you invest KES 10,000 monthly for 30 years at 10% return:

You contribute: KES 3.6M

Your investment grows to ~KES 22M

Compounding multiplies money quietly, powerfully, and automatically.

Chapter 6: Retirement Income Strategies

The goal is not only saving enough but creating predictable, sustainable income.

1. The 4% Withdrawal Rule

Withdraw 4% yearly to avoid depletion.

2. Bucket Strategy

Divide retirement money into:

-

Short-term cash bucket (1–5 years)

-

Medium-term bonds bucket

-

Long-term growth bucket

3. Annuities

Guarantee lifetime income.

4. Rental Income

Real estate cash flow can fund lifestyle needs.

5. Dividends & Interest Income

Provide passive cash flow from stocks, bonds, and funds.

6. Part-time consulting or passion projects

Some retirees continue earning through hobbies or expertise.

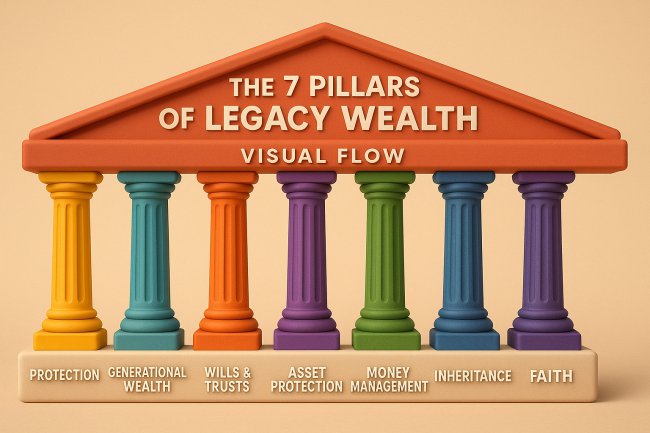

Chapter 7: Protecting Your Wealth in Retirement

Managing risk is essential.

Key Tools:

-

Insurance (health, life, long-term care)

-

A diversified portfolio

-

Avoiding high-risk investments

-

Keeping debt low

-

Maintaining an emergency fund

-

Updating your will and estate plan

Retirement protection ensures your wealth lasts your entire lifetime.

Chapter 8: Mistakes That Destroy Retirement Plans

-

Starting too late

-

Relying on one income source

-

Not adjusting for inflation

-

Withdrawing pension prematurely

-

Poor financial habits

-

High-risk investments close to retirement

-

Failing to plan for healthcare costs

Avoid these pitfalls to preserve and grow your retirement nest egg.

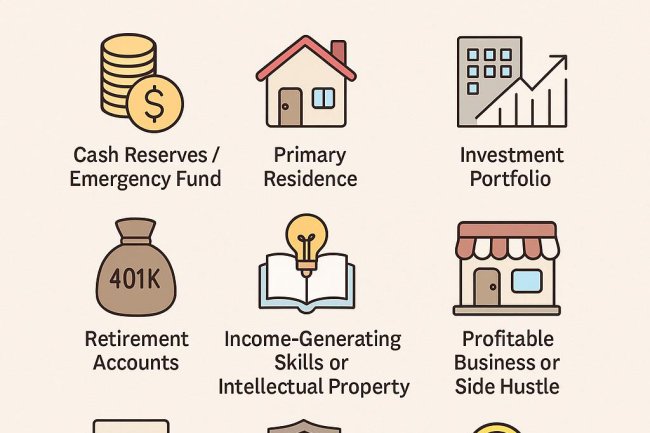

Chapter 9: A Step-by-Step Retirement Planning Blueprint

Step 1: Define your retirement goals

Lifestyle, location, travel plans, healthcare.

Step 2: Calculate your target retirement number

Use the 25× Rule.

Step 3: Choose pension schemes

Use employer pension + private pension.

Step 4: Build long-term investments

Stocks, bonds, real estate, annuities.

Step 5: Automate your contributions

Set and forget.

Step 6: Review annually

Adjust for income, expenses, inflation.

Step 7: Build passive income sources

Rental, dividends, digital assets, consulting.

Conclusion: Retirement Is Built—Not Hoped For

A secure retirement is not a miracle; it is a financial strategy executed over decades. Anyone can retire well—with consistency, discipline, and smart investing.

Your future self is depending on the decisions you make today.

Start now. Start small. Stay consistent.

What's Your Reaction?