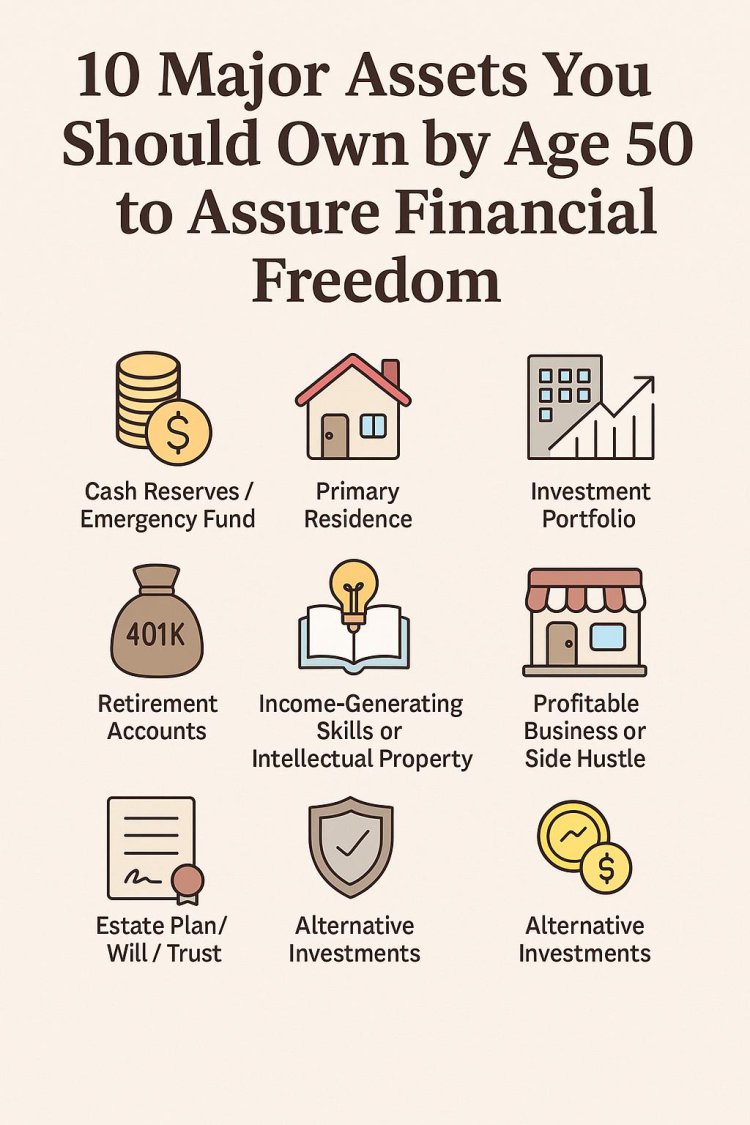

10 Major Assets You Should Own by Age 50 to Assure Financial Freedom

Discover the top 10 assets you must own by age 50 to achieve financial independence. Learn how to build wealth through real estate, investments, skills, and more in this ultimate guide to financial freedom.

The Road to Financial Independence

Financial freedom doesn’t happen by accident. It requires intention, planning, and disciplined action over time. By the age of 50, you should be entering your financial prime. But the real question is, what assets should you have accumulated by now to truly enjoy peace of mind and long-term security?

This article outlines the 10 most important assets every financially free individual should own or be working toward by age 50. These aren’t just possessions—they’re tools that help you build, protect, and multiply wealth. Let’s explore each asset class in detail, with practical insights and strategies you can apply today.

1. Emergency Fund (Cash Reserves)

An emergency fund is your financial shock absorber. Life is unpredictable—medical emergencies, job loss, or urgent repairs can happen at any time. Having liquid cash reserves helps you navigate these challenges without going into debt or liquidating long-term investments.

What you need:

-

6 to 12 months’ worth of living expenses

-

Stored in a high-yield savings or money market account

-

Easily accessible but separate from everyday spending

Why it matters:

-

Prevents high-interest debt accumulation

-

Protects your investment and retirement accounts from early withdrawals

-

Gives you peace of mind during life’s uncertainties

Pro Tip: Automate a small percentage of your income into your emergency fund until you reach your target. Then, only tap into it for real emergencies.

2. Primary Residence (Ideally Paid Off)

Homeownership is a cornerstone of financial stability. By age 50, you should either fully own your home or be close to paying off your mortgage. This reduces your monthly expenses and adds to your net worth.

Benefits:

-

Eliminates rent/mortgage expenses

-

Builds equity that can be borrowed against

-

Appreciates over time, increasing your asset base

-

Provides housing stability during retirement

Strategy: Consider refinancing for better terms earlier in your mortgage and avoid cash-out refinances unless for productive investments.

3. Rental or Investment Real Estate

Real estate is one of the most reliable income-producing and appreciating assets. It also offers multiple tax advantages.

Options:

-

Residential rental properties (apartments, single-family homes)

-

Commercial properties (office spaces, shops)

-

Land or vacation rentals

Benefits:

-

Monthly cash flow

-

Long-term appreciation

-

Tax deductions and depreciation

Pro Tip: Consider working with a property manager or using short-term rental platforms like Airbnb to maximize cash flow.

Note: Real estate investing involves market research, location analysis, and sometimes property renovations. Build your knowledge before diving in.

4. Investment Portfolio (Stocks, Bonds, Mutual Funds)

A well-diversified investment portfolio is essential for long-term, passive wealth growth. It should reflect your risk tolerance, investment goals, and time horizon.

Key elements:

-

Stocks: Equities for growth

-

Bonds: Stability and income

-

ETFs and Index Funds: Low-cost diversification

-

Dividend-paying stocks for passive income

Target by age 50:

-

3–5x your annual income invested in long-term accounts

-

Balanced between growth and conservative holdings

Tip: Rebalance your portfolio annually. Avoid emotional investing. Time in the market beats timing the market.

5. Retirement Accounts (401(k), IRA, NSSF, etc.)

Retirement accounts are the backbone of financial independence. They provide tax-deferred or tax-free growth depending on the type of account.

Ideal characteristics:

-

Regular contributions with employer match (if applicable)

-

Max out contribution limits when possible

-

Diversified across asset classes

Common Types:

-

401(k) / 403(b): Employer-sponsored plans

-

IRA (Traditional and Roth): Individual accounts with tax benefits

-

Pension or provident funds (NSSF in Kenya, etc.)

Strategy: The earlier you start contributing, the more you benefit from compounding interest. Consider consulting a financial advisor for allocation planning.

6. Income-Producing Skills or Intellectual Property

In the knowledge economy, your skills can become assets that produce income far beyond the time you invested to learn them.

Examples:

-

Writing a book or ebook that generates royalties

-

Creating an online course or training program

-

Licensing a patented product or software

-

Owning media content (e.g., YouTube monetization)

Why you need it:

-

High earning potential with minimal overhead

-

Can scale without major time commitment

-

Builds credibility and brand equity

Action Step: Identify a skill you’ve mastered. Package it into a teachable or sellable format and launch it online.

7. Profitable Business or Side Hustle

Having your own business or income-generating side hustle offers incredible leverage, tax advantages, and even exit opportunities.

Types of businesses to consider:

-

Product-based (eCommerce, dropshipping, local retail)

-

Service-based (coaching, graphic design, repairs)

-

Digital-based (subscription sites, affiliate blogs)

Advantages:

-

Unlimited income potential

-

You own an appreciating asset

-

You control your schedule

Exit strategy: Build your business to a stage where it can be sold, franchised, or delegated to a team.

8. Insurance Protection

Insurance doesn’t directly generate income, but it protects your wealth. Without it, a single incident can wipe out years of savings.

Essential types of insurance:

-

Health insurance (critical illness and comprehensive cover)

-

Life insurance (term or whole-life)

-

Property insurance (home, car, valuable assets)

-

Disability and income protection

-

Business insurance (if self-employed)

Pro Tip: Periodically review your coverage to ensure it matches your current life stage.

9. Estate Plan (Will, Trust, Power of Attorney)

Estate planning ensures your assets are distributed according to your wishes. It also protects your loved ones from lengthy legal processes and financial confusion.

Components of a solid estate plan:

-

Will: Legal document detailing asset distribution

-

Living trust: Avoids probate and protects privacy

-

Durable power of attorney: Someone to handle your affairs if incapacitated

-

Healthcare directive: Medical instructions in emergencies

Benefits:

-

Ensures your wealth benefits your heirs

-

Minimizes taxes and fees

-

Provides peace of mind

Reminder: Estate planning is not just for the rich. Every adult should have basic legal documents in place.

10. Alternative or Tangible Investments

Diversification is a hallmark of a strong financial plan. Alternative assets provide additional streams of wealth generation and can hedge against inflation and volatility in traditional markets.

Types of alternatives:

-

Gold and silver

-

Cryptocurrencies (e.g., Bitcoin, Ethereum)

-

Farmland, art, antiques, or collectibles

-

Private equity or startup investments

Why they matter:

-

Uncorrelated with stock market trends

-

Can offer high returns

-

Great hedge in times of uncertainty

Caution: Always invest in alternatives with proper research and never more than 10–15% of your portfolio.

Bonus: Strong Financial Habits as Invisible Assets

Beyond tangible and financial assets, there are behavioral assets you must own:

-

A written budget and financial plan

-

Consistent saving and investing habits

-

Discipline to avoid lifestyle inflation

-

A network of mentors, advisors, and peers

-

A growth mindset toward money

These habits determine your ability to grow, preserve, and enjoy your wealth.

Final Thoughts: Build Assets, Build Freedom

Financial freedom is not only about how much money you make—it’s about how many income-generating and security-enhancing assets you control.

By age 50, you should aim to have:

-

Paid-off or low-debt residence

-

Multiple income streams

-

Solid retirement savings

-

Insurance and legal safeguards

-

Smart, diversified investments

Every asset you build today adds a layer of financial independence tomorrow. And remember: it’s never too late to start. The journey to financial freedom is a marathon, not a sprint.

#WealthInsightsGlobal | #AssetBuilding | #FinancialFreedomBy50 | #SmartMoneyMoves | #RetireWealthy

What's Your Reaction?