Taxation 101: A Complete Guide to Understanding and Managing Taxes

Master the basics of personal and business taxation. Learn how to reduce tax liability, stay compliant, file returns accurately, and take advantage of legal deductions. Ideal for employees, freelancers, and business owners looking to grow their income and avoid penalties.

Taxes are an essential but often misunderstood part of personal finance. Whether you're an employee, entrepreneur, investor, or retiree, your ability to understand and manage taxes effectively can significantly impact your long-term financial success. This section dives deep into the types of taxes, strategies for minimizing them legally, and tips for staying compliant while maximizing your income.

Why Understanding Taxes Is Vital

Taxes affect nearly every financial decision you make. From your salary and purchases to investments and property ownership, taxes can erode your wealth if you’re not proactive. Learning how taxes work isn’t just for accountants—it’s a financial life skill.

Benefits of Tax Literacy:

-

Increases your take-home income

-

Reduces your chances of penalties and audits

-

Helps you plan your finances more strategically

-

Ensures compliance with local and international tax laws

The Fundamentals of Taxation

What Is a Tax?

A tax is a compulsory financial charge imposed by a government to fund public services, infrastructure, and other state functions. Taxes are collected on different types of income and activities, depending on the jurisdiction.

Direct vs. Indirect Taxes

-

Direct Taxes are imposed directly on individuals and organizations. Examples include income tax, property tax, and corporate tax.

-

Indirect Taxes are levied on goods and services. The consumer pays the tax as part of the purchase price, such as VAT or sales tax.

Understanding the difference helps you plan both personal and business-related finances.

Key Types of Taxes to Understand

1. Income Tax

This is the most common tax and usually the largest deduction from a paycheck. It applies to wages, bonuses, business profits, rental income, and pensions. Governments often use a progressive tax system, where higher income is taxed at a higher rate.

How It’s Calculated:

-

Based on tax brackets

-

May include personal reliefs or exemptions

Example (Kenya 2024):

-

Income below KES 24,000/month may be tax-exempt

-

Income between KES 24,001–32,333 taxed at 25%

-

Income above KES 32,334 taxed at 30%

2. Value Added Tax (VAT)

VAT is an indirect tax on the consumption of goods and services. In Kenya, the standard VAT rate is 16%, but some essential items may be zero-rated or exempt.

Key VAT Categories:

-

Standard-rated: General goods and services (16%)

-

Zero-rated: Exported goods, certain food and pharmaceutical products (0%)

-

Exempt: Educational and financial services

3. Capital Gains Tax (CGT)

Charged on the profit earned from selling a capital asset such as land, stocks, or a business.

Tips to Manage CGT:

-

Keep accurate records of purchase and sale transactions

-

Use legal exemptions like property rollover relief

4. Property Tax (Rates)

This is charged by county governments on land and buildings based on the property’s market value or rental income potential.

Importance of Compliance:

-

Avoids legal disputes

-

Maintains clean property ownership records

5. Withholding Tax (WHT)

A tax deducted at the source on payments made to suppliers, consultants, landlords, or investors.

Common WHT Scenarios:

-

5% on dividends

-

10% on professional services

-

15% on royalties or management fees

6. Turnover Tax (TOT)

Applicable to small businesses with gross income below a certain threshold. In Kenya, TOT is 1% of gross sales for businesses earning less than KES 5 million annually.

How to Stay Tax Compliant

1. Register with Tax Authorities

-

In Kenya, register with KRA and obtain a PIN certificate

-

Register for VAT if your business income exceeds KES 5 million/year

2. Maintain Proper Records

-

Keep receipts, invoices, contracts, and bank statements

-

Use accounting software for accuracy and ease of filing

3. File Returns Accurately

-

File income tax returns annually (due by June 30th)

-

File VAT returns monthly if registered

-

File PAYE returns monthly if you employ staff

4. Use the Right Tax Portal

-

Kenya’s iTax system allows online filing, registration, and status checking

5. Make Timely Payments

-

Avoid interest and penalties by paying before deadlines

6. Know Your Filing Status

-

Individual

-

Sole proprietor

-

Partnership

-

Limited company

How to Legally Reduce Your Tax Burden

Reducing taxes doesn’t mean avoiding them—it means using legal strategies to minimize liability.

1. Maximize Deductions

-

Pension contributions (e.g., up to KES 20,000/month in Kenya)

-

Mortgage interest

-

Life and medical insurance premiums

2. Claim Tax Reliefs

-

Personal Relief: A fixed monthly deduction for individual taxpayers

-

Insurance Relief: A percentage of premiums paid

-

Home Ownership Savings Plan (HOSP): Up to KES 48,000/year deductible

3. Separate Business and Personal Finances

-

Keep individual and business transactions distinct to improve audit clarity

-

Helps in claiming business expenses as deductions

4. Use Tax-Friendly Investment Accounts

-

Choose pension schemes and unit trusts that defer or lower tax rates

5. Capitalize on Tax Holidays or Special Zones

-

Some areas or sectors (like EPZ or renewable energy) offer tax incentives

Common Tax Mistakes to Avoid

-

Late Filing or Payment

-

Leads to penalties and interest accumulation

-

-

Underreporting Income

-

May trigger audits and legal consequences

-

-

Claiming Invalid Deductions

-

Double-check that expenses qualify

-

-

Mixing Personal and Business Records

-

Makes audits difficult and raises red flags

-

-

Not Keeping Backup Documents

-

Keep records for at least 5–7 years

-

Tax Tips for Different Income Groups

For Employees:

-

Check that your employer remits PAYE correctly

-

Claim all allowable reliefs

-

File returns even if your taxes are deducted at source

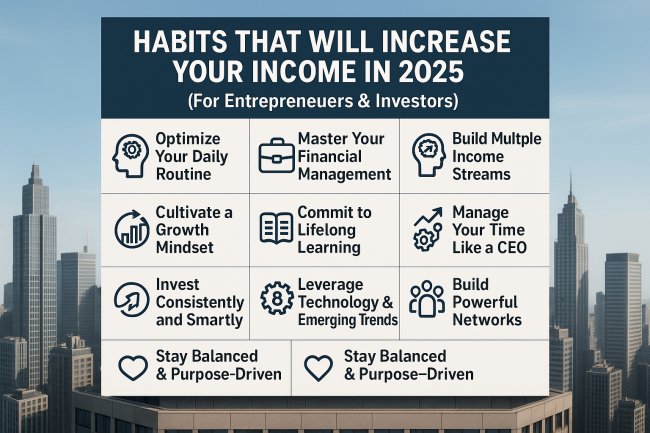

For Entrepreneurs:

-

Track all income and expenses

-

Hire a certified accountant for filings

-

Register for VAT and TOT if eligible

For Freelancers:

-

Invoice with your KRA PIN

-

Set aside tax from every payment received

-

Declare side hustle income

For Investors:

-

Monitor CGT on stock and property sales

-

Use tax-exempt investment vehicles

Tax Planning as a Wealth Strategy

Proper tax planning helps you:

-

Increase your net income

-

Preserve and grow wealth

-

Invest more efficiently

-

Retire with more savings

Annual Tax Planning Checklist:

-

Review income and expenses

-

Forecast potential tax liabilities

-

Re-evaluate investment strategies

-

Contribute to tax-advantaged accounts

-

Consult a tax advisor

Final Word

Taxation is a permanent part of your financial journey—but ignorance is optional. The more you understand how taxes impact your earnings, savings, and investments, the more financially secure you become.

Take the time to stay informed, file correctly, and plan ahead. Whether you're managing a small side hustle or a multi-million-shilling portfolio, tax knowledge is not just about compliance—it’s a key driver of wealth.

Start managing your taxes like a pro today—and let every shilling you earn work harder for your future.

Would you like this in downloadable PDF format or adapted for social media content?

What's Your Reaction?