The Richest Man in Babylon: Timeless Lessons on Building Wealth

Discover timeless personal finance principles from The Richest Man in Babylon. Learn how to save, invest, and grow wealth through ancient wisdom that still applies today.

Ancient Wisdom for Modern Wealth

In a world where financial freedom often seems elusive, The Richest Man in Babylon offers a beacon of hope. Written by George S. Clason, this classic uses simple yet powerful parables from ancient Babylon to teach timeless principles of money management. Despite being set thousands of years ago, the lessons are more relevant than ever—especially for anyone seeking financial independence today.

Meet Arkad: Babylon’s Wealthiest Man

The central figure in the book is Arkad, once a humble scribe, who became the richest man in Babylon. Curious neighbors and friends asked how he achieved such prosperity while others struggled. Arkad responded by sharing his seven key lessons—pillars that anyone can follow to accumulate wealth over time.

The 7 Cures for a Lean Purse (Key Lessons)

1. Start Thy Purse to Fattening

Save at least 10% of your income.

Before you spend, pay yourself first. This simple act lays the foundation for wealth.

2. Control Thy Expenditures

Live within your means.

Avoid spending everything you earn, even on things that seem necessary. Budget wisely.

3. Make Thy Gold Multiply

Let your money work for you.

Invest in income-generating assets like businesses, stocks, or property. Don’t let your savings sit idle.

4. Guard Thy Treasures from Loss

Be cautious and wise with investments.

Avoid schemes that promise high returns with low risk. Consult knowledgeable people before making financial moves.

5. Make of Thy Dwelling a Profitable Investment

Own your home if you can.

Renting can be expensive long-term. Owning gives you financial and emotional security.

6. Insure a Future Income

Plan for old age, emergencies, and dependents.

Invest in retirement accounts or passive income sources that will support you when you're no longer working.

7. Increase Thy Ability to Earn

Never stop learning.

Upgrade your skills. The more valuable you are in the marketplace, the more you’ll earn.

Memorable Quotes from the Book

“A part of all I earn is mine to keep.”

“Our acts can be no wiser than our thoughts.”

“Opportunity is a haughty goddess who wastes no time with those who are unprepared.”

These statements serve as powerful financial reminders: save, think smart, and stay prepared.

Why This Book Still Matters Today

While Babylon’s walls are long gone, its financial principles remain timeless. In a world of credit cards, digital currencies, and instant gratification, the discipline taught in this book is even more critical.

Whether you're in Nairobi, New York, or anywhere in the world, the principles in The Richest Man in Babylon apply:

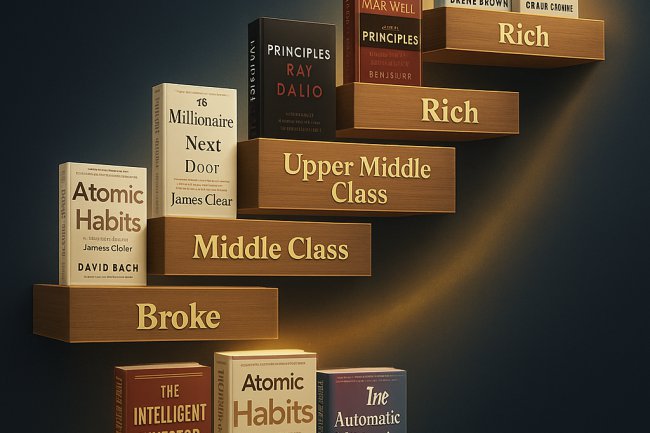

Save consistently

Spend wisely

Invest with intention

Prepare for the future

Grow your income-generating ability

Final Thoughts: Wealth Is Built, Not Wished For

You don’t need a lottery win to become financially free—you need discipline, wisdom, and action. The Richest Man in Babylon teaches that anyone can become wealthy by following a set of proven, simple principles.

Start now. Save a portion of what you earn. Invest it wisely. And never stop learning. Wealth is within your reach.

Ready to Build Wealth?

Follow us on social media for daily financial tips and resources:

Facebook |

Instagram |

Twitter

Visit: https://wealthinsights.co.ke for more insightful content on personal finance, investing, and financial literacy.

Files

What's Your Reaction?