The “Pay Yourself First” Experiment

Discover what happens when you save before you spend. Learn how the “Pay Yourself First” principle transforms your mindset, builds discipline, and helps you automate financial growth in just 30 days.

What Happens When You Save Before You Spend

Introduction: The Rule That Separates the Wealthy from the Worried

Most people live by a simple but dangerous formula:

Income → Expenses → Save What’s Left.

It sounds reasonable — until you realize there’s never anything left.

That’s why the wealthy follow the opposite approach:

Income → Save First → Spend What’s Left.

This is the principle known as “Pay Yourself First.”

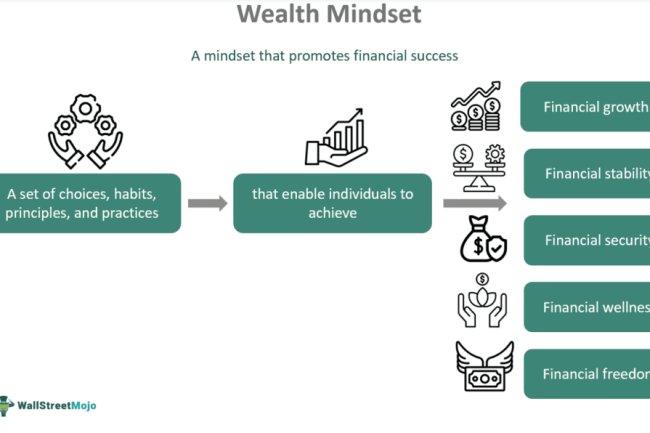

It’s not a budgeting trick. It’s a mindset shift — a declaration that your financial goals are not negotiable.

And if you commit to this rule for just 30 days, it can completely change how you think about money.

Why Most People Never Build Wealth

The biggest reason people struggle financially isn’t lack of income — it’s lack of intention.

Every dollar you earn already has a plan waiting for it — rent, bills, groceries, entertainment. You work hard, but your money leaves faster than it arrives.

When you always “save later,” you depend on discipline. But when you “pay yourself first,” you depend on structure.

And structure wins every time.

What “Pay Yourself First” Really Means

The idea is simple:

Before you pay your landlord, your utility company, or your favorite restaurant — you pay you.

You treat savings and investing as a mandatory bill, not an optional act of willpower.

It’s your future rent, your future comfort, your future freedom — paid in advance.

The Formula:

Income → Pay Yourself First (Savings/Investments) → Cover Expenses → Enjoy the Rest

Step 1: Set the Percentage

Decide how much of your income goes to you first.

Start small — 10% is a great beginning. As you grow, aim for 20% or even 30%.

If you earn $4,000 a month:

-

$400 (10%) goes immediately to your savings or investment account.

-

You live on the remaining $3,600.

This small shift guarantees that you’re growing wealth before you spend.

Step 2: Automate It

Automation is the secret weapon of successful savers.

The less you rely on willpower, the more consistent you become.

Set up automatic transfers from your main account to a dedicated savings or investment account on payday.

Think of it as your personal tax — except this time, you are the government, and every dollar goes toward building your future.

When you automate wealth, you eliminate excuses.

Step 3: Make It Invisible

The best money management systems make saving effortless and invisible.

Use a separate account or financial app for your “Pay Yourself First” funds — one that isn’t linked to your debit card.

You shouldn’t see that money daily, or you’ll find reasons to “borrow” it.

Remember: what’s out of sight becomes out of temptation.

Step 4: Redirect, Don’t Restrict

Paying yourself first doesn’t mean living miserably. It means redirecting money toward future freedom instead of temporary pleasure.

For example:

-

Instead of spending $50 on impulse purchases, redirect it to your investment app.

-

Instead of financing a new gadget, invest in a high-yield ETF.

-

Instead of saving what’s left, save first — and adjust your lifestyle around what remains.

It’s not about deprivation. It’s about priorities.

What Happens After 30 Days

Once you apply this experiment for a month, a few things begin to shift:

1. You Feel in Control

For the first time, you’re not just reacting to bills — you’re directing your money.

2. You Build Momentum

Watching your savings grow triggers a psychological reward. You want to keep it going.

3. You Spend More Consciously

Because your disposable income is smaller, you naturally question unnecessary expenses.

4. You Start Thinking Long-Term

Instead of asking, “Can I afford this now?” you begin asking, “Will this delay my goals?”

That’s when your financial mindset transforms.

Real-Life Example: The 30-Day “Pay Yourself First” Challenge

Case 1: The Employee

Sarah earns $3,500 a month. She automates $350 into a savings account every payday.

After 6 months, she’s built an emergency fund and started investing in ETFs.

Case 2: The Freelancer

Mark’s income fluctuates, so he saves a percentage instead of a fixed amount — 15% of every project payment.

Within a year, he’s created enough cushion to handle slow months without stress.

Case 3: The Entrepreneur

Jasmine pays herself first by reinvesting 20% of her profits into a growth fund for her business.

Her company scales faster, and she never faces a cash crunch.

No matter your income type, the principle stays the same:

The first person your money should serve is you.

Why “Pay Yourself First” Works

This strategy is rooted in behavioral finance — it rewires your brain to view saving as normal, not optional.

When you prioritize yourself first, you build a foundation of security and self-respect.

It also leverages the most powerful financial force: automation.

You remove emotion, hesitation, and excuses — and replace them with habit.

Ultimately, wealth isn’t about having more money. It’s about managing what you already have with intention and consistency.

The Takeaway: Start With One Decision

The “Pay Yourself First” experiment is not about perfection — it’s about priority.

Try it for 30 days.

Set your percentage.

Automate it.

Forget about it.

And in one month, you’ll realize that wealth is not built through luck or discipline — but through systems that protect your goals before your impulses.

Because the truth is simple:

If you don’t pay yourself first, you’ll spend your life paying everyone else.

What's Your Reaction?