Financial Education: The Key to Unlocking Wealth and Freedom

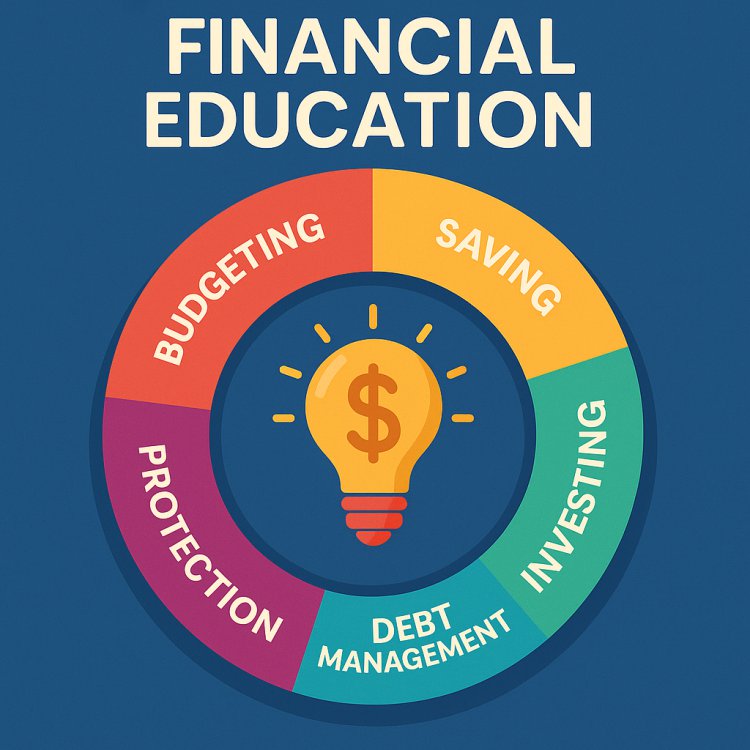

Discover why financial education matters and how it builds wealth. Learn the core pillars — budgeting, saving, investing, debt management, and protection — for financial freedom.

Money touches every part of our lives — yet many people leave school knowing algebra, history, and grammar, but not how to budget, save, or invest. This is why financial education is so powerful: it gives ordinary people the tools to make extraordinary progress.

Whether you are a student in Nairobi, an entrepreneur in Lagos, or a professional in London, financial education is the foundation of wealth and long-term security.

What Is Financial Education?

Financial education is the knowledge and skills that help you make smart decisions about money. It covers:

-

Earning—understanding income streams.

-

Saving & Budgeting – planning where your money goes.

-

Investing—multiplying your wealth.

-

Borrowing—managing debt responsibly.

-

Protecting—using insurance and risk management.

In simple terms: it’s about learning how money works and how to make it work for you.

Why Financial Education Matters

-

Prevents Costly Mistakes – like debt traps, poor investments, or overspending.

-

Builds Confidence – you stop fearing money and start controlling it.

-

Enables Wealth Creation – with knowledge, even small amounts can grow.

-

Empowers Communities – financially literate families raise financially smart children.

-

Drives National Growth – countries with educated citizens build stronger economies.

The Core Pillars of Financial Education

1. Budgeting & Money Management

A budget is a financial compass. Rules like the 50/30/20 (needs/wants/savings) or 70/20/10 (spend/invest/give) help structure spending.

2. Saving & Emergency Funds

Build a safety net of 3–6 months of expenses. In Africa, Money Market Funds (MMFs) and SACCOs are great tools for disciplined saving.

3. Debt Awareness

Understand the difference between good debt (mortgages, business loans) and bad debt (credit cards, payday loans).

4. Investing Basics

Learn about stocks, bonds, ETFs, real estate, and digital assets. For example, Kenyans can invest in NSE shares like Safaricom, while globally one can invest in S&P 500 ETFs.

5. Insurance & Risk Protection

Protect wealth with life, health, and business insurance. Without protection, years of progress can be wiped out overnight.

6. Retirement & Long-Term Planning

Use the 25X Rule: save 25 times your annual expenses for retirement. Starting early gives compound interest time to work its magic.

Financial Education in Africa: Opportunities

-

Mobile Money Revolution: Platforms like M-PESA, Flutterwave, and Chipper Cash are teaching millions how to transact digitally.

-

Community Learning: SACCOs and investment clubs spread financial knowledge in practical ways.

-

Youth Engagement: With 60% of Africa’s population under 25, financial education for young people is critical to break poverty cycles.

How to Build Financial Education Daily

-

Read Books – Rich Dad Poor Dad, The Richest Man in Babylon, The Psychology of Money.

-

Follow Trusted Sources – blogs, podcasts, and financial educators.

-

Practice – open a savings account, try a budget, buy your first stock.

-

Teach Others – share what you learn with family, friends, and kids.

-

Stay Curious – money evolves; keep up with fintech, digital assets, and new opportunities.

Infographic Ideas

-

Financial Education Wheel – Earning, Saving, Spending, Investing, Protecting.

-

Steps Ladder – From Budgeting → Saving → Investing → Retirement.

-

Africa’s Money Revolution Map – highlighting mobile money and stock exchanges.

Conclusion

Financial education is more than numbers — it’s freedom. It allows you to say “yes” to opportunities, “no” to debt traps, and “not yet” to instant gratification. With financial knowledge, you don’t just survive — you thrive.

The best investment you can ever make is in learning how to manage money. Start today, and teach the next generation — because financial freedom begins with financial education.

What's Your Reaction?