FINANCIAL MARKETS 101: A COMPLETE GUIDE TO STOCKS, BONDS, ETFs, FOREX, MARKET ANALYSIS & SMART INVESTMENT STRATEGIES

Learn how financial markets work—stocks, bonds, ETFs, forex, market analysis, and proven investment strategies. A complete beginner-friendly guide to building wealth.

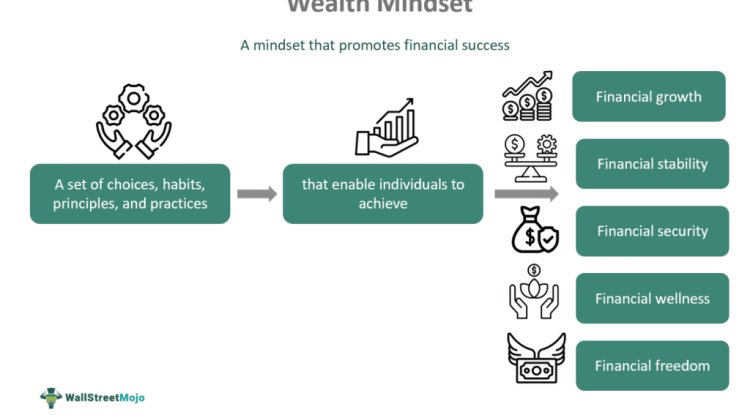

Financial markets are the engine room of the global economy. They determine how capital moves, how wealth grows, how companies expand, and how individuals—whether beginners or seasoned investors—build long-term financial freedom. Understanding how markets work is one of the most critical steps in your journey toward financial mastery.

This comprehensive guide breaks down complex financial systems into simple, actionable insights. Whether you're in Kenya, Nigeria, South Africa, or anywhere across the globe, this knowledge applies universally—because money follows the same rules everywhere.

This guide covers:

-

What financial markets are and why they matter

-

Stocks

-

Bonds

-

ETFs

-

Forex trading basics

-

Market analysis (Fundamental & Technical)

-

Investment strategies you can apply immediately

Let’s go deep.

1. UNDERSTANDING FINANCIAL MARKETS

A financial market is a platform where buyers and sellers trade financial instruments such as stocks, bonds, commodities, currencies, and derivatives.

Functions of Financial Markets

Financial markets exist to:

-

Facilitate capital raising for companies and governments

-

Provide investors opportunities to grow their money

-

Enable liquidity, allowing investors to buy and sell quickly

-

Promote price discovery—the real value of assets

-

Manage risk through diversification and hedging tools

Types of Financial Markets

-

Capital Markets – Stocks, Bonds

-

Money Markets – Treasury Bills, Commercial Paper

-

Foreign Exchange (FX) Markets – Currencies

-

Commodity Markets – Oil, Gold, Agriculture

-

Derivatives Markets – Futures, Options

These markets are interconnected. A movement in one—for example, interest rate changes—can affect all the others.

2. STOCKS (EQUITIES)

Stocks represent ownership in a company. When you buy shares, you own a piece of the business and benefit from its growth and profitability.

Why Companies Issue Stock

Companies sell shares to:

-

Raise capital for expansion

-

Pay off debt

-

Fund new projects

Why Investors Buy Stocks

-

Capital appreciation (price goes up)

-

Dividends (profit sharing)

-

Inflation protection

-

Wealth-building over decades

Historically, stock markets have delivered 7–10% annual returns over long periods—better than savings accounts or bonds.

Types of Stocks

-

Common Stock – Voting rights + dividends

-

Preferred Stock – Higher claim on dividends but no voting

-

Growth Stocks – Fast-growing firms like tech companies

-

Value Stocks – Undervalued relative to earnings

-

Blue-Chip Stocks – Big, stable companies (e.g., Safaricom, MTN, Coca-Cola)

Where Stocks Are Traded

-

NYSE (US)

-

NASDAQ (US)

-

LSE (UK)

-

NSE Kenya

-

NGX Nigeria

3. BONDS

Bonds are loans that investors give to governments or corporations. In return, the issuer pays interest (coupon) and later repays the principal.

If stocks are ownership, bonds are IOUs.

Why Investors Buy Bonds

-

Stability and predictable returns

-

Portfolio diversification

-

Lower risk than stocks

-

Income generation

Types of Bonds

-

Government Bonds – Most secure

-

Corporate Bonds – Higher risk, higher reward

-

Municipal Bonds – Issued by counties/local authorities

-

Zero-Coupon Bonds – Sold at discount, no periodic interest

Bond Risks

-

Interest rate risk

-

Inflation risk

-

Default risk

Bonds perform well during economic uncertainty, making them excellent balancing tools.

4. EXCHANGE-TRADED FUNDS (ETFs)

ETFs are investment funds that hold multiple assets—stocks, bonds, commodities—and trade like a single stock.

An ETF gives you instant diversification, even with a small budget.

Why ETFs Are Popular

-

Low cost

-

Diversified

-

Beginner-friendly

-

Easy to buy and sell

-

Professional management

Types of ETFs

-

Equity ETFs – S&P 500, NASDAQ 100

-

Bond ETFs – Government or corporate

-

Sector ETFs – Tech, energy, healthcare

-

Commodity ETFs – Gold, oil

-

Global ETFs – Africa, Europe, Asia-focused

Example:

Instead of buying 500 separate U.S. companies, you can buy one S&P 500 ETF and instantly own all of them.

5. FOREX BASICS (FOREIGN EXCHANGE TRADING)

The forex market is the largest financial market in the world—trading over $7.5 trillion daily.

Forex involves buying one currency while selling another at the same time.

Major Currency Pairs

-

EUR/USD

-

GBP/USD

-

USD/JPY

-

USD/CHF

What Moves Currency Prices

-

Interest rates

-

Economic indicators (GDP, inflation)

-

Political stability

-

Global events

-

Market sentiment

Why People Trade Forex

-

High liquidity

-

24-hour market

-

Leverage (both good and dangerous)

Warning for Beginners

Forex is powerful but risky. Without knowledge, risk management, and emotional control, you can lose money fast. Treat it as a professional skill, not a quick-money scheme.

6. HOW MARKET ANALYSIS WORKS

To succeed, investors use two main types of analysis:

A. FUNDAMENTAL ANALYSIS (FA)

FA evaluates the real value of a company, currency, or asset.

For Stocks

Fundamental analysis looks at:

-

Revenue

-

Earnings

-

Debt

-

Cash flow

-

Management quality

-

Market competition

-

Economic conditions

Key FA Metrics

-

P/E Ratio

-

Earnings Per Share (EPS)

-

Dividend Yield

-

Book Value

-

ROE (Return on Equity)

A fundamentally strong company has:

-

Consistent growth

-

Strong cashflows

-

Low debt

-

Durable competitive advantage

B. TECHNICAL ANALYSIS (TA)

TA focuses on price patterns and market psychology.

It assumes:

"Price moves in trends, and history repeats itself."

Tools and Indicators

-

Support and resistance

-

Moving averages

-

RSI

-

MACD

-

Candlestick patterns

Why TA Matters

It helps investors:

-

Identify entry and exit points

-

Manage risk

-

Understand market momentum

The best investors combine both FA + TA.

7. INVESTMENT STRATEGIES THAT WORK

Below are proven, timeless approaches used by successful investors across the world.

1. Buy and Hold

This strategy involves:

-

Buying quality assets

-

Holding for years or decades

-

Allowing compounding to work

It is ideal for stocks and ETFs.

2. Dollar-Cost Averaging (DCA)

Invest a fixed amount regularly (weekly, monthly).

Benefits:

-

Reduces emotional decision-making

-

Avoids trying to time the market

-

Smooths volatility

3. Value Investing

Popularized by Warren Buffett.

It focuses on buying undervalued companies with strong fundamentals.

4. Growth Investing

Invest in companies rapidly expanding revenue, innovation, and market share.

5. Index Investing

Buy broad-market ETFs like:

-

S&P 500

-

NASDAQ 100

-

MSCI World

Simple, low-cost, high long-term performance.

6. Dividend Investing

Invest in companies that:

-

Pay consistent dividends

-

Have strong cashflows

-

Maintain long-term dividend history

You create passive income while building wealth.

7. Momentum Trading

Trade based on trend direction.

It requires:

-

Technical skills

-

Discipline

-

Strong risk management

8. Defensive Investing

Focus on low-volatility assets such as:

-

Bonds

-

Consumer staples

-

Dividend stocks

Ideal during recessions.

9. Asset Allocation

Spread your investment across:

-

Stocks

-

Bonds

-

Real Estate

-

Cash

-

ETFs

Diversification reduces risk and stabilizes returns.

10. Forex Risk-Managed Trading

Forex is suitable only if you:

-

Use a trading plan

-

Apply strict risk management

-

Avoid over-leverage

-

Focus on learning before earning

HOW TO BUILD A PERSONAL MARKET STRATEGY

-

Define your financial goals

-

Assess your risk tolerance

-

Determine your investment horizon (short, medium, long-term)

-

Choose appropriate markets and tools

-

Diversify your portfolio

-

Start small but stay consistent

-

Track performance and rebalance periodically

Success in financial markets is a marathon—not a sprint.

COMMON MISTAKES BEGINNERS SHOULD AVOID

-

Trying to get rich quickly

-

Emotional decision-making

-

Chasing hype

-

Ignoring fees

-

Lack of diversification

-

Trading without education

-

Overleveraging in forex

-

Following crowd psychology

THE FUTURE OF FINANCIAL MARKETS

Several mega-trends are shaping the next decade:

-

AI-powered trading

-

Blockchain and digital assets

-

Global ETF dominance

-

Automated robo-advisors

-

Increased retail investor participation

-

Africa’s rising investment ecosystem (Nairobi, Lagos, Johannesburg becoming financial hubs)

Those who adapt will lead. Those who ignore will fall behind.

FINAL THOUGHTS

The financial markets are not designed to be mastered in a day—but with consistency, discipline, and a solid understanding of how money moves, anyone can use them to build long-term wealth.

You do not need millions to start.

You only need knowledge, patience, and the courage to begin.

Whether you're buying your first share of Safaricom, investing in a global ETF, or learning forex step by step—this world belongs to those who take action.

If your goal is financial freedom, mastering financial markets is one of the most powerful paths to get there.

What's Your Reaction?