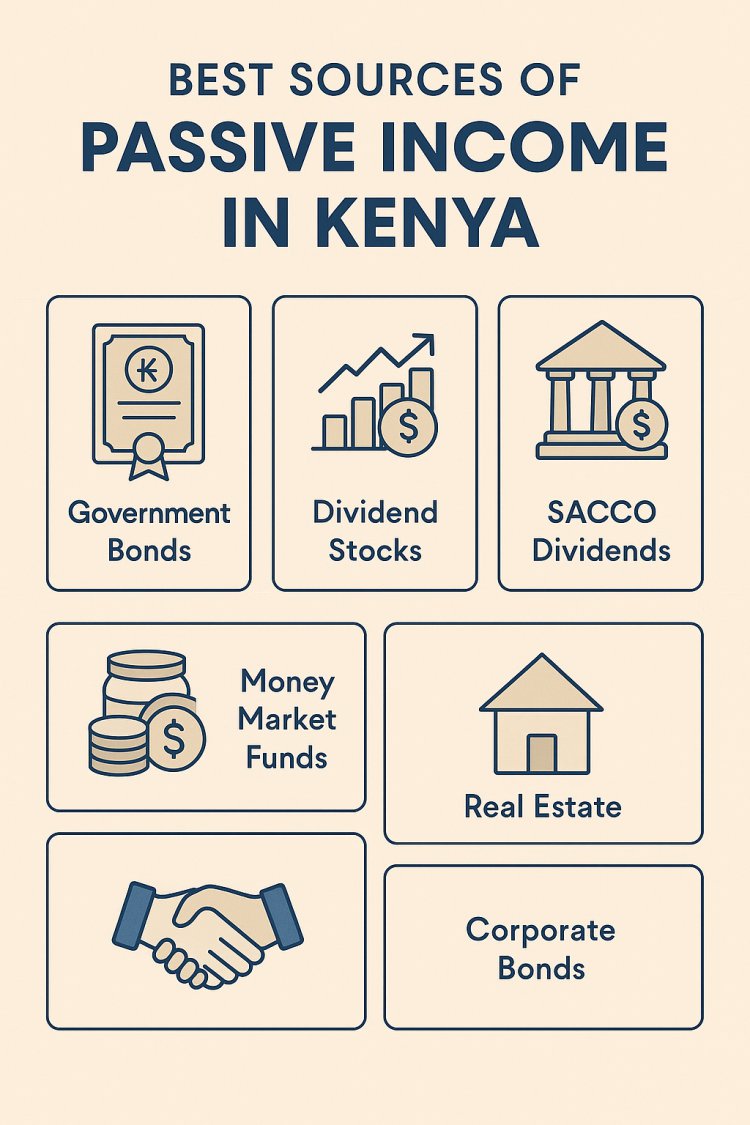

The 5 Best Sources of Passive Income in Kenya (Ranked 2025)

Discover how to build steady cash flows in Kenya through bonds, dividend stocks, and SACCO investments. Detailed analysis for investors seeking financial freedom

Introduction – Why Passive Income Matters Now

Every Kenyan wants financial stability — but most still chase active income: working for money.

True wealth, however, comes from passive income — when your money works for you.

With inflation rising, job security shrinking, and living costs climbing, it’s no longer enough to depend on a salary or side-hustle. You need cash-flows that arrive even when you sleep.

Let’s explore the top 5 sources of passive income in Kenya, ranked from the least effective to the most powerful — and understand what makes each unique.

1️⃣ Rental Income – Overrated but Still Useful

For decades, Kenyans viewed real estate as the “holy grail” of passive income. But in reality, rental yields average only 4–6 %, far below the returns on bonds and dividend stocks.

Why It Ranks Low

-

Low Yields: Residential property in Nairobi typically nets 4–6 % per year after tax and maintenance.

-

Vacancies: Occupancy rates hover around 80–85 %, cutting consistency.

-

High Loan Costs: Mortgage rates of 12–16 % wipe out profits.

-

Taxes: Rental income faces 7.5 % withholding tax — higher than dividends (5 %).

-

Management Headaches: Repairs, defaulting tenants, and agents erode returns.

When It Still Works

-

Prime commercial locations (e.g. Westlands, Kilimani).

-

Furnished Airbnb-style units earning 8–12 %+.

-

Long-term capital gains in fast-growing towns like Nakuru or Eldoret.

Verdict: A stable asset class — but not Kenya’s best passive-income generator.

2️⃣ Dividend Stocks – Earning from Profitable Companies

Owning dividend-paying shares turns you into a silent business partner. When firms like BAT, Stanbic, KCB, or Safaricom post profits, they share part of the earnings with shareholders.

What to Look For

-

Dividend Yield = Dividend per Share ÷ Price per Share.

Example: If BAT pays Ksh 50 on a Ksh 300 share, the yield is 16.6 %. -

Dividend Payout Ratio: How much of profits is paid out (>70 % is strong).

-

Consistency & Track Record: “Dividend Kings” have paid every year for a decade+.

-

Policy & Stability: Prefer companies with predictable earnings (BAT, Stanbic).

Tax Advantage

Dividends attract only 5 % withholding tax, making them among the most tax-efficient passive-income sources in Kenya.

Risks

-

Market volatility may reduce capital value.

-

Companies can cut dividends during downturns.

Verdict: Solid option with 10–16 % yields for those comfortable with stock-market fluctuations.

3️⃣ Fixed Coupon Government Bonds – Reliable Cash Flow

Government bonds are essentially IOUs from the Kenyan state. You lend money and receive semi-annual coupon payments (interest).

How They Work

-

Typical coupon: 12–14 % per year.

-

Maturities: 2 – 30 years.

-

Coupons paid twice a year — directly to your bank account.

Example

Invest Ksh 1 million in a 10-year bond at 13 %.

You earn Ksh 130 000 yearly (≈ Ksh 117 000 after tax), split into two payments.

Pros

-

Predictable income.

-

Virtually no default risk (local currency debt).

-

Zero management hassle.

Cons

-

Price fluctuations in secondary market.

-

Inflation may erode real returns if shilling weakens.

Verdict: Ideal for conservative investors and retirees seeking steady returns with low risk.

4️⃣ Infrastructure Bonds – The Tax-Free Champion

Infrastructure Bonds (IFBs) are a special type of government bond that funds roads, energy, and public projects — and their biggest advantage is tax exemption.

Key Benefits

-

Tax-Free Income: No withholding tax on coupons.

-

Attractive Rates: 12–14 % net return (fully yours).

-

Low Risk: Backed by the Government of Kenya.

-

Predictable: Biannual coupon payments guaranteed.

Smart Strategy – Bond Laddering

Buy IFBs with different maturities (e.g. 3, 6, 9, 12 years) so you receive coupon payments every month. Over time, this can replace a salary with consistent income.

Limitation

CBK issues new IFBs only about four times a year; secondary market prices may be less favorable.

Verdict: Kenya’s most predictable, tax-efficient passive income option.

5️⃣ Corporate Bonds & Commercial Paper – High Return, Higher Risk

Corporate bonds let you lend directly to companies like Safaricom or East African Breweries in exchange for regular coupon payments.

Why They Top the List

-

High Yields: 17–20 % annual returns.

-

Short Tenures: Most mature within 6–24 months.

-

Diversification: Different sectors — telecom, manufacturing, real estate.

Drawbacks

-

High Entry Point: Minimum investment ≈ Ksh 5–7.5 million.

-

Credit Risk: Companies can default; always check credit ratings.

-

Limited Access: Available mainly through investment banks or asset-management firms.

Due Diligence Checklist

-

Review credit rating (A or above).

-

Examine company’s debt-to-asset ratio and cash flows.

-

Confirm coupon schedule and security of repayment.

Verdict: The highest-paying passive-income vehicle in Kenya — but suited for seasoned or high-net-worth investors.

Honourable Mentions

SACCOs

Provide dividends (5–10 %) on share capital and rebates (6–8 %) on deposits. Great for members who also borrow cheaply, though liquidity is limited.

Money Market Funds (MMFs)

Excellent for short-term savings and emergency funds. Return ≈ 9–11 % p.a. Not a growth asset, but reliable for cash parking.

Special Funds & Unit Trusts

Blend of equities and bonds; good for capital growth more than steady income.

Quick Ranking Table

| Rank | Passive Income Source | Typical Return (Annual) | Risk Level | Liquidity | Tax Rate | Ideal For |

|---|---|---|---|---|---|---|

| 1 | Corporate Bonds / Commercial Paper | 17–20 % | High | Low | 15 % | Wealthy Investors |

| 2 | Infrastructure Bonds (IFBs) | 12–14 % (net tax-free) | Low | Medium | 0 % | Retirees & Conservatives |

| 3 | Fixed Coupon Govt Bonds | 12–14 % (gross) | Low | Medium | 10–15 % | Long-term Savers |

| 4 | Dividend Stocks | 10–16 % | Medium | High | 5 % | Informed Investors |

| 5 | Rental Income | 4–6 % | Medium-High | Low | 7.5 % | Real-estate Fans |

Building a Balanced Passive Income Portfolio

| Goal | Suggested Allocation |

|---|---|

| Stability | 60 % Government & Infrastructure Bonds |

| Growth | 25 % Dividend Stocks |

| Liquidity | 10 % Money Market Funds |

| High Return (Optional) | 5 % Corporate Bonds / Commercial Paper |

This structure ensures income + security + liquidity.

Final Thoughts – Make Money Work for You

Passive income is not magic — it’s a system.

Whether you start with Ksh 10 000 or Ksh 10 million, the principle is the same: build assets that pay you without daily effort.

Kenya’s top passive-income opportunities — corporate bonds, infrastructure bonds, government securities, dividend stocks, and rental income — offer different risk-return profiles. Pick what fits your goals, risk tolerance, and time horizon.

“The goal isn’t to work for money forever — it’s to let money work for you.”

Start building your passive income streams today — one asset at a time.

What's Your Reaction?