How to Stop Living Paycheck to Paycheck

Learn how to break free from the paycheck-to-paycheck cycle. Discover practical strategies for budgeting, saving first, delaying gratification, and starting small investments that lead to long-term financial freedom.

Breaking the Cycle of Just-Enough Living

Introduction: The Illusion of “Next Month It’ll Get Better”

Every payday feels like a relief — until the bills, groceries, and obligations drain your account again within days.

You tell yourself, “Next month I’ll save,” but next month looks exactly the same.

This endless cycle is called living paycheck to paycheck, and it traps millions of people — including high earners — in a quiet financial struggle.

But here’s the truth:

You don’t need more income to break free.

You need a better money plan.

When you master your habits, discipline, and structure, you reclaim control over your finances — and eventually, your life.

Step 1: Face the Numbers — Awareness Before Action

You can’t fix what you won’t face.

Start by writing down your exact monthly income and your average monthly expenses.

Include everything — rent, utilities, subscriptions, food, transportation, and small indulgences.

When you see the numbers clearly, you’ll notice two things:

-

How much is disappearing to things that don’t matter.

-

How much potential you have to redirect toward freedom.

The Rule: What gets measured gets managed.

Many people live in financial fog — guessing, not tracking.

Your first act of power is clarity.

Step 2: Build a Budget That Honors Your Goals

A budget is not a restriction; it’s a permission plan for your priorities.

Start with a simple structure:

-

50% for Needs – rent, utilities, transport, groceries.

-

30% for Wants – dining, entertainment, small pleasures.

-

20% for Savings and Investments – non-negotiable.

If your expenses exceed your income, it’s time to adjust.

You can’t out-earn bad financial habits — but you can out-discipline them.

Tip: Use budgeting apps or spreadsheets that automatically categorize expenses. Visibility builds accountability.

Step 3: Delay Gratification — The Wealth Skill Few Master

Wealthy people master the art of waiting for what matters.

Living paycheck to paycheck often comes from emotional spending — chasing instant rewards after hard work.

But each impulse buy delays your freedom.

Mindset Shift:

If it doesn’t move you closer to independence, it’s moving you away from it.

The next time you want to buy something, use the “24-hour rule.”

Wait one day before spending.

If you still want it tomorrow, buy it guilt-free. If not, that’s your wallet thanking you.

Step 4: Pay Yourself First — Automatically

The fastest way to stop living paycheck to paycheck is to prioritize savings first.

Don’t wait to see what’s left — save before you spend.

Set up an automatic transfer the same day your paycheck hits.

Start small if necessary — even 5% of your income builds momentum.

The goal is consistency, not perfection.

When saving becomes automatic, it becomes effortless.

Example:

If you earn $3,000 per month, start by sending $150 to a high-yield savings or investment account before paying any bills.

That single habit will begin shifting your mindset from survival to strategy.

Step 5: Build an Emergency Fund — Your Financial Safety Net

An emergency fund is what separates financial calm from financial chaos.

Living paycheck to paycheck often means one unexpected expense — car repair, medical bill, or job delay — wipes you out.

Start by saving at least one month of expenses, then grow to three to six months.

Keep it in a separate account that’s easy to access but not easy to spend.

Once you have this safety net, financial anxiety drops dramatically.

You’ll stop relying on credit cards or loans to survive emergencies.

Freedom Tip:

Security doesn’t come from earning more — it comes from needing less.

Step 6: Cut Hidden Leaks and “Lifestyle Creep”

Every dollar you don’t control finds a way to escape.

Check your bank statement and cancel:

-

Unused subscriptions and memberships.

-

Automatic renewals you forgot about.

-

“Small” daily expenses that add up (coffee, delivery, impulse buys).

Then, guard against lifestyle creep — the tendency to spend more as you earn more.

When your income increases, upgrade your investments, not your lifestyle.

Wealth grows from what you keep, not what you display.

Step 7: Start Micro-Investing — Let Your Money Work

Even if you have limited income, you can still invest.

Micro-investing platforms and apps allow you to start with small amounts — even $5 or $10 at a time.

What matters most is consistency, not size.

When your money works, you stop being fully dependent on your paycheck.

Examples of micro-investment options:

-

Low-cost ETFs or index funds.

-

Round-up investment apps.

-

Robo-advisors that automate growth.

Every small deposit is a step from survival toward stability.

Step 8: Grow Your Income — The Long-Term Strategy

While discipline fixes the short term, skill growth changes the long term.

Use your evenings or weekends to build new income sources.

Ideas include:

-

Freelancing or consulting.

-

Creating digital products.

-

Learning a new high-income skill.

When your income rises, your next goal is to maintain your old lifestyle and increase your savings rate — not your spending.

Every raise can accelerate your freedom timeline if managed correctly.

Step 9: Redefine Success — Peace Over Pressure

Breaking free from paycheck living isn’t about becoming rich overnight.

It’s about building margin — the space between what you earn and what you spend.

That margin gives you peace, options, and the ability to think long-term.

Success is not the absence of struggle — it’s the presence of structure.

When your money finally starts working for you, the stress that once dominated your life disappears.

Conclusion: From Survival to Strategy

If you want to stop living paycheck to paycheck, don’t start by earning more — start by mastering what you already have.

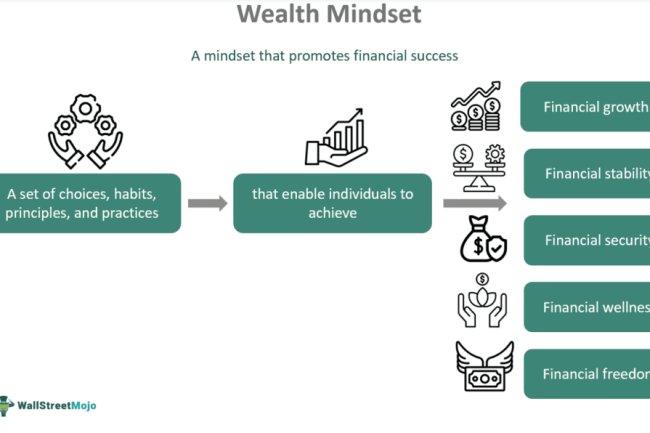

Because wealth isn’t built through income.

It’s built through intentional management, consistent saving, and patient investing.

When you control your habits, you control your financial destiny.

Remember this truth:

You don’t need more money to get ahead.

You need a plan that makes your money behave

What's Your Reaction?