Most People Get These Money Questions Wrong – Here’s Why

Discover why most people fail financially. Learn 5 key lessons from Olumide Emmanuel’s talk on financial intelligence and practical wealth principles.

“If you are not informed, you will be deformed. If you are not inspired, you will expire. If you are not updated, you’ll be outdated.”

These bold words from Olumide Emmanuel in his powerful message on financial intelligence reveal a brutal truth: many people are financially sincere — but sincerely wrong.

In this blog, we break down the key lessons from his talk and why most people fail not because of laziness or lack of effort, but because of miseducation and poor financial habits.

1. The Real Problem: Miseducation

We’ve all heard of education and illiteracy. But what’s worse than being uneducated is being miseducated. Many people went to school and got certificates, yet never learned how money works.

Olumide explains there are three levels of financial knowledge:

-

Educated

-

Uneducated

-

Miseducated

Most people fall into the third group — believing myths like “hard work is enough,” or “God will do it all,” without understanding their personal role in building wealth.

2. Faith Without Action Is Frustration

There’s a spiritual aspect to money, but spirituality must combine with practical wisdom.

“The supernatural is a combination of the super and the natural,” Emmanuel teaches.

Praying for money while ignoring principles of budgeting, saving, investing, and planning is a fast track to frustration. God provides inspiration, but it’s your job to obey the instruction and take action.

3. The Financial Intelligence Test

In his session, Emmanuel walks the audience through 26 life-changing money questions designed to assess their financial IQ. A few examples:

-

Do you know your net worth right now?

-

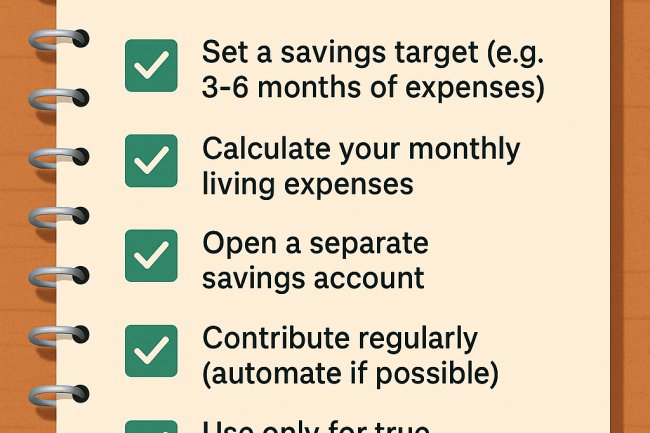

Do you have 6–8 months of emergency savings?

-

Do you have documented financial goals?

-

Do you track your income and expenses?

-

Do you spend less than you earn?

-

Do you own any assets or investments?

-

Have you planned for your retirement?

-

Do you have life insurance?

-

Have you written a will?

Most people couldn’t answer YES to even half of the questions. That reveals the gap — not of effort, but of financial understanding.

4. Practical Wisdom Most People Ignore

Here are some of Olumide’s hard-hitting truths that challenge how we think about money:

-

Saving is not optional. If you don’t save, you’re eating your future — “that’s witchcraft,” he jokingly says.

-

Hope is not a strategy. Saying “I want to be rich” without a documented plan is a wish, not a goal.

-

Avoid lifestyle borrowing. Buying clothes, wigs, or holidays on credit is a trap — don’t break your life into installments.

-

Track everything. Record what you earn and where it goes. Know if your effort is producing enough income.

-

Diversify your income. Don’t keep all your investments in one currency or country.

-

Don’t depend on your children for retirement. That’s financial incest. Plan your own retirement.

5. It's Time to Take Control

If you scored high on the “No” or “I don’t know” options from the financial intelligence test — you’re not alone. But you can’t afford to stay there.

Ask yourself today:

-

What financial knowledge am I missing?

-

What steps can I take this month to start saving or investing?

-

Who do I take financial advice from — poor minds or wealth-builders?

-

Am I prepared for a job loss, medical emergency, or economic downturn?

It’s time to stop hoping — and start planning.

Final Thoughts

Olumide Emmanuel’s message is clear:

“Life is not about duration, but donation.”

The goal is not just to live long, but to live with purpose and prosperity. Financial freedom doesn’t come from prayer alone — it comes from aligning your beliefs with wise actions.

Whether you’re young, employed, self-employed, or retired — take the test, be honest with your finances, and start building a wealthier, wiser life.

What About You?

How many of the 26 financial questions can you confidently answer "YES" to?

Leave a comment below or share your score. Let’s grow together.

What's Your Reaction?