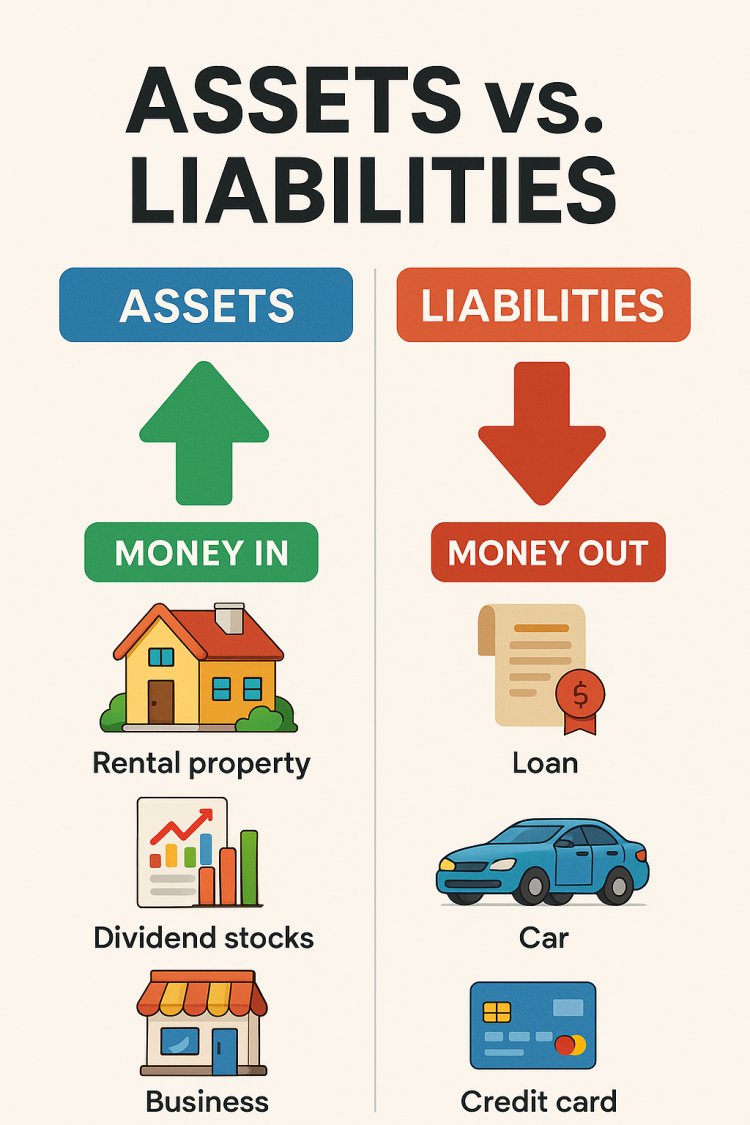

Assets vs. Liabilities: The Difference That Builds or Breaks Wealth

Learn the key difference between assets and liabilities. Discover how assets build wealth, liabilities drain it, and practical steps to focus on income-generating assets.

One of the simplest but most powerful money lessons is understanding the difference between assets and liabilities. Many people earn good money but remain broke because they confuse the two. Wealthy people focus on acquiring assets, while poor and middle-class people often accumulate liabilities, thinking they are assets.

As Robert Kiyosaki (author of Rich Dad Poor Dad) famously said:

“The rich buy assets. The poor only have expenses. The middle class buy liabilities they think are assets.”

What Is an Asset?

An asset is anything that puts money in your pocket. It generates income, increases in value, or saves you money over time.

Examples of Assets:

-

Rental properties (bringing in monthly rent).

-

Dividend-paying stocks (like Safaricom or Equity Group shares on NSE).

-

Businesses that generate cash flow.

-

Intellectual property (books, courses, music royalties).

-

SACCO shares or money market funds in Kenya and Nigeria.

In short: Assets work for you, even when you’re sleeping.

What Is a Liability?

A liability is anything that takes money out of your pocket. It may give temporary comfort or status, but it drains your cash flow.

Examples of Liabilities:

-

Loans (car loans, credit cards, payday loans).

-

Luxury cars lose value the moment you drive them.

-

A big house you live in but don’t rent out (it costs money without generating income).

-

Consumer goods bought on debt (TVs, gadgets, clothes).

In short: Liabilities work against you, keeping you in financial struggle.

Common Confusions

-

Your House: If it costs you money every month (mortgage, repairs, taxes) and doesn’t generate income, it’s a liability.

-

Your Car: Unless it’s a taxi/Uber generating income, it’s a liability, not an asset.

-

Education: A degree is an asset only if it increases your earning power—otherwise it’s just an expense.

Why This Matters

-

Wealthy Mindset—Wealthy people prioritize acquiring assets first.

-

Cash Flow Freedom—Assets bring in passive income, reducing dependence on salary.

-

Generational Wealth – Assets can be passed down; liabilities often become burdens to children.

-

Financial Stability—Assets protect you in emergencies; liabilities expose you.

Practical Steps to Build Assets

-

Track Your Spending—Identify whether purchases are assets or liabilities.

-

Start Small—Invest in SACCOs, stocks, or unit trusts.

-

Reinvest Profits – Use cash flow from one asset to buy another.

-

Cut Down Liabilities—Delay buying luxury cars or fancy gadgets until your assets pay for them.

-

Focus on Passive Income—Aim for income sources that don’t depend on your daily effort.

Conclusion

Understanding the difference between assets and liabilities is the first step toward financial freedom. The poor focus on income, the middle class on possessions, but the wealthy focus on assets.

Your challenge: Before your next purchase, ask yourself—will this put money in my pocket or take it out? That single question can transform your financial future.

What's Your Reaction?