The Psychology of Growth and Wealth: How to Rewire Your Mind for Financial Evolution

Discover how to rewire your money mindset for lasting financial growth. Learn the psychology behind wealth, mindset shifts, and habits that create financial evolution.

Before money sits in your account, it lives in your mindset.

Think about it. Two people can earn the same income, yet one ends up financially free while the other stays broke. The difference isn’t luck or education — it’s psychology.

Money moves toward those who think clearly about it.

It drains from those who react emotionally to it.

The truth is, financial freedom starts long before you open an investment account. It begins in how you see yourself — your worth, your beliefs, your habits. The wealthiest people in any society are rarely those who just know how to make money. They’re the ones who know how to think about money.

The mind is the first bank you must master.

1. The Four Stages of Financial Awareness

Financial awareness doesn’t happen overnight. Everyone evolves through four emotional stages on their journey toward clarity. Understanding where you are is the first step to moving forward.

Stage 1: Denial — “I’ll start when I earn more.”

This is the comfort zone disguised as ambition. You tell yourself that you’ll save or invest “when things get better.” The truth? The habit of waiting becomes the habit of staying stuck.

Denial is expensive — not just financially but emotionally. It keeps you blind to your true capacity.

Shift: Start now, with what you have. Discipline beats perfect timing.

Stage 2: Confusion — “Why isn’t saving enough?”

You’ve started saving, budgeting, maybe even cutting expenses — yet you feel stagnant. That’s because saving alone doesn’t build wealth. Money that doesn’t grow slowly loses value.

Shift: Move from “saving” to “strategizing.” Learn where your money works best.

Stage 3: Correction — “Budgeting actually gives freedom.”

At this stage, you realize control isn’t restriction — it’s empowerment. Budgeting isn’t a punishment; it’s clarity. You finally see where your money goes and how to redirect it toward goals that matter.

Shift: Use structure to create space for freedom.

Stage 4: Clarity — “Money isn’t the goal. Control is.”

This is where peace replaces panic. You no longer chase wealth — you guide it. You understand that money doesn’t create meaning; meaning creates money.

Shift: Build systems, not stress. True wealth is control over your time, not just numbers on a screen.

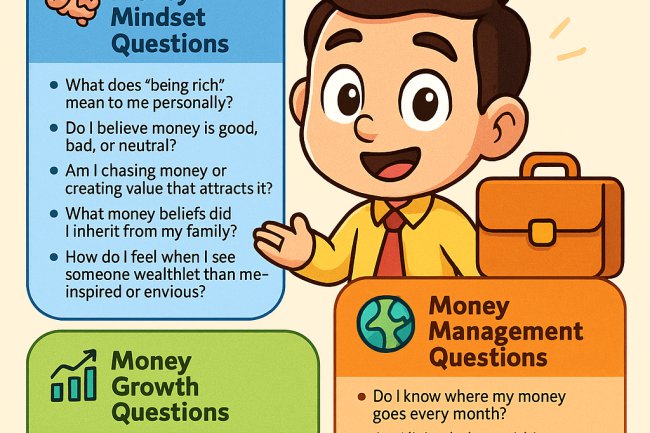

2. Reprogramming Your Money Mindset

T. Harv Eker often says: “Your income can only grow to the extent that you do.”

Your mindset is your financial operating system. If you inherited beliefs like “money is evil,” “rich people are greedy,” or “I’m not good with money,” those scripts quietly control your financial ceiling.

To create new results, you must update your internal software.

Here’s how:

1️⃣ Unlearn Limiting Beliefs

Ask yourself: Where did my beliefs about money come from?

If they were passed down from fear, scarcity, or survival — they no longer serve your future. Replace guilt with growth.

2️⃣ Forgive Your Financial Past

Your past mistakes were tuition for your financial education. You’re not behind — you’re experienced. Let go of shame; it blocks new opportunities.

3️⃣ Shift from Scarcity to Abundance

Scarcity says, “There’s never enough.”

Abundance says, “There’s always another way.”

One locks you in fear. The other keeps you creative. Practice gratitude daily — it rewires your brain for optimism.

4️⃣ Believe You Deserve Wealth

Your financial ceiling is tied to your self-worth. You’ll only allow yourself to earn at the level you believe you deserve. Build confidence by learning, executing, and proving your capability to yourself.

5️⃣ Stop Comparing Yourself

Comparison turns progress into pressure. Your pace is yours. Focus on consistency, not competition.

6️⃣ Align Money with Purpose

Money is a tool, not a trophy. When your financial goals align with personal purpose — family, legacy, freedom — consistency becomes effortless.

7️⃣ Take Imperfect Action

Perfection kills progress. Every wealthy person started clumsily. Clarity comes through motion, not meditation.

8️⃣ Protect Your Environment

Surround yourself with voices that stretch your thinking. If everyone around you complains about money, it’s time to change your circle.

9️⃣ Practice Gratitude

You can’t expand what you resent. Gratitude builds perspective — it’s the emotional foundation of abundance.

10️⃣ Keep Learning

Financial literacy compounds like interest. Read books, watch interviews, and challenge your assumptions. The more you understand money, the calmer you’ll become with it.

3. Developing a Growth Mindset for Wealth

Money responds to growth — and growth starts in how you think about challenge, failure, and learning.

A fixed mindset says, “This is who I am.”

A growth mindset says, “This is who I’m becoming.”

T. Harv Eker identifies five practical shifts that fuel personal and financial evolution.

1️⃣ Start with Confidence

Confidence isn’t arrogance — it’s permission. Give yourself permission to grow. You can’t expand from a place of self-doubt.

2️⃣ Be Present

Growth happens now, not someday. Manage today’s choices well, and tomorrow takes care of itself.

3️⃣ Add Value, Even While Starting Small

Wealth follows value. Solve problems for others. Start where you are — teach, write, build, create — and let your work scale.

4️⃣ Define the Meaning of Every Event

Things don’t happen to you; they happen for you. Reframe setbacks as signals. Every loss carries a lesson that pushes you closer to mastery.

5️⃣ Turn Setbacks into Training

Pain becomes progress when processed correctly. Don’t hide from difficulty — study it. That’s how entrepreneurs, investors, and innovators grow.

4. Habits to Avoid and Habits to Adopt

Bad habits are silent thieves. They don’t destroy you overnight; they slowly drain your capacity to grow.

Let’s examine the seven common habits that quietly sabotage long-term financial security — and what to do instead.

| Habits to Avoid | Habits to Adopt |

|---|---|

| Building your life on assumptions (“things will work out”) | Build on facts and numbers; track data monthly. |

| Tying your self-worth to spending | Measure worth by discipline, not display. |

| Postponing financial planning | Start small, automate savings, begin now. |

| Treating debt as income | Borrow only to grow capacity or invest. |

| Ignoring your earning power | Invest in skills that increase your value. |

| Assuming you have time | Begin before you’re “ready.” Time compounds. |

| Going it alone | Learn from mentors, communities, and professionals. |

5. The Psychology of Long-Term Success

Financial success is 20% mechanics and 80% mindset.

Most people overestimate what they can do in a year — and underestimate what they can do in a decade. The key to sustained growth lies in emotional endurance: your ability to stay consistent when motivation fades.

Principles for Longevity:

-

Awareness: Know where your money goes.

-

Discipline: Stick to your plan longer than your emotions last.

-

Adaptability: Evolve as technology and markets shift.

-

Health: Protect the body and mind that earn the income.

-

Purpose: Build wealth that outlives your ego.

6. Wealth as Self-Mastery

Money doesn’t change who you are — it magnifies it.

When you master your mind, you master your money. When you master your habits, you master your future.

The goal isn’t just to earn more — it’s to become more.

Financial evolution isn’t about luck. It’s about awareness, action, and alignment.

By Maertin K | WealthInsights.co.ke

Building Africa’s Financially Free Generation.

What's Your Reaction?