MINDSET FIRST: The Financial Freedom Formula

A step-by-step guide to achieving financial freedom before age 45 on a $100K annual income. Learn how to structure your finances, grow your income, invest wisely, and follow a proven path to early retirement.

Before we go into tactics, understand this simple truth:

Financial freedom = (High Income + High Savings Rate + Smart Investments) × Time

You're already earning $100,000/year—that's a great starting point. Now let's build a system that transforms your income into freedom before 45.

Step-by-Step Plan to Financial Freedom (Target Age: 45 or Earlier)

✅ Phase 1: Set Your Freedom Number

Goal: Calculate how much you need to be financially free

-

Use the 4% Rule to estimate:

-

If you need $40,000/year to live comfortably, you need a $1,000,000 investment portfolio

-

If you need $60,000/year, you need a $1.5M portfolio

-

-

Let’s assume you want $50,000/year to live freely → Target Portfolio: $1.25M

If you save and invest well, this is 100% achievable within 10–15 years.

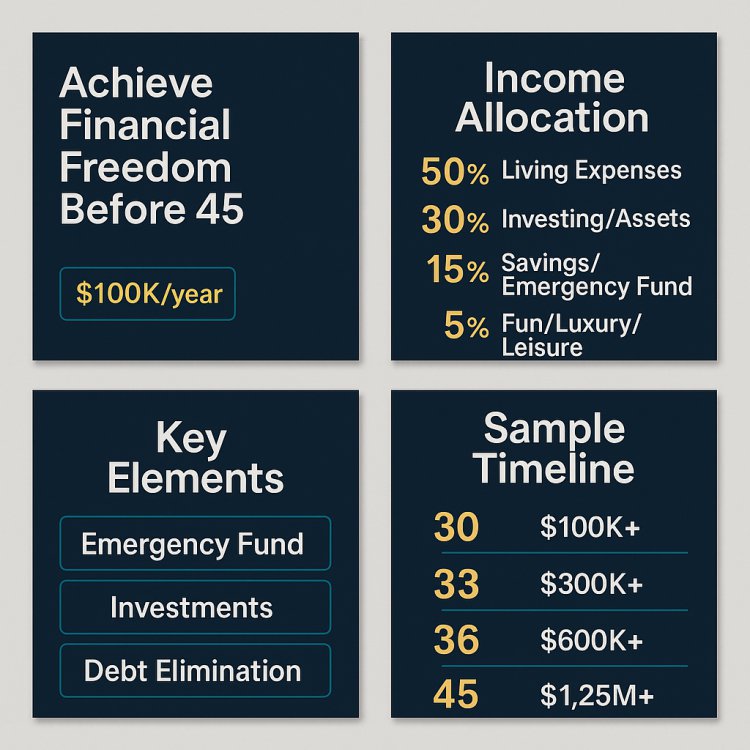

Phase 2: Master the Income Allocation (The 50-30-20 Rule is NOT enough)

We’re going for aggressive wealth building—not average financial advice.

Your Income: $100,000/year

-

50% to Living Expenses → $50,000

-

30% to Investing/Assets → $30,000

-

15% to Savings/Emergency Fund → $15,000

-

5% to Fun/Luxury/Leisure → $5,000

If you want to get to freedom faster, raise your investment rate to 40–50% by reducing lifestyle costs.

Phase 3: Build the 5-Pillar Financial Freedom System

1. Emergency Fund (0–6 Months)

✅ Build this first

✔️ $15K–$20K in a high-yield savings account or money market fund

✔️ Purpose: Protection, not profits

2. High-Income Skill (Accelerator)

✅ Grow your income alongside saving

✔️ Options: Coding, AI automation, copywriting, consulting, sales, digital marketing

✔️ Goal: Increase your earning power to $150K+ within 3 years

“You can't save your way to wealth — you must also earn your way to wealth.”

3. Investments (Your Freedom Engine)

Strategy: 70-20-10 Portfolio

-

70% Long-Term Stocks/Index Funds

-

ETFs: VTI, S&P 500 (VOO), Total Market Index Funds

-

Use tax-advantaged accounts: 401(k), Roth IRA, HSA

-

-

20% Real Estate / Rental Property

-

Use leverage wisely

-

Aim for cash-flowing property, not speculative

-

-

10% Growth/Alternative

-

Crypto, startups, AI tools, REITs, peer-to-peer lending

-

Automate contributions monthly → Dollar-Cost Averaging = wealth on autopilot

4. Debt Elimination (if any)

-

Pay off high-interest debt first (above 7%)

-

Refinance lower-interest debt if possible

-

Never carry balances on credit cards

Debt delays freedom—it’s a wealth leak.

5. Asset Protection + Insurance

✅ Get insured early while premiums are cheap

-

Life insurance (term, not whole)

-

Disability insurance

-

Health insurance

-

Umbrella coverage (for lawsuits or liability)

Wealth without protection is vulnerable.

Phase 4: Track, Optimize & Grow

Monthly Routine:

-

Review spending → cut lifestyle inflation

-

Track net worth → aim for +$5K/month growth

-

Check investment performance

-

Audit subscriptions, fees, & bad habits

Yearly Routine:

-

Rebalance your portfolio

-

Adjust contributions as income grows

-

Review insurance and estate planning

-

Take 1 “Wealth Retreat” weekend to review goals

Bonus Habits to Add (Game-Changers)

-

Invest in self-education (Books, courses, mentors)

-

Avoid lifestyle creep as your income grows

-

Surround yourself with financially free people

-

Build income-generating assets (digital products, real estate, business)

-

Track Net Worth Monthly using apps like Personal Capital, YNAB, or Excel

Sample Timeline to Freedom by 45

| Age | Net Worth Goal | Actions |

|---|---|---|

| 30 | $100K–$150K | High saving, start investing, build 2nd income |

| 33 | $300K | Add real estate or business income |

| 36 | $600K | Scale income, reinvest profits, diversify |

| 40 | $1M+ | Portfolio income = 50% of expenses |

| 45 | $1.25M+ | Financially free — work optional |

Final Advice

You don’t need to get lucky. You need to:

✅ Be disciplined

✅ Invest consistently

✅ Grow income

✅ Delay gratification now to gain freedom forever

"You can work for money, or money can work for you. The choice is made every time you get paid."

What's Your Reaction?