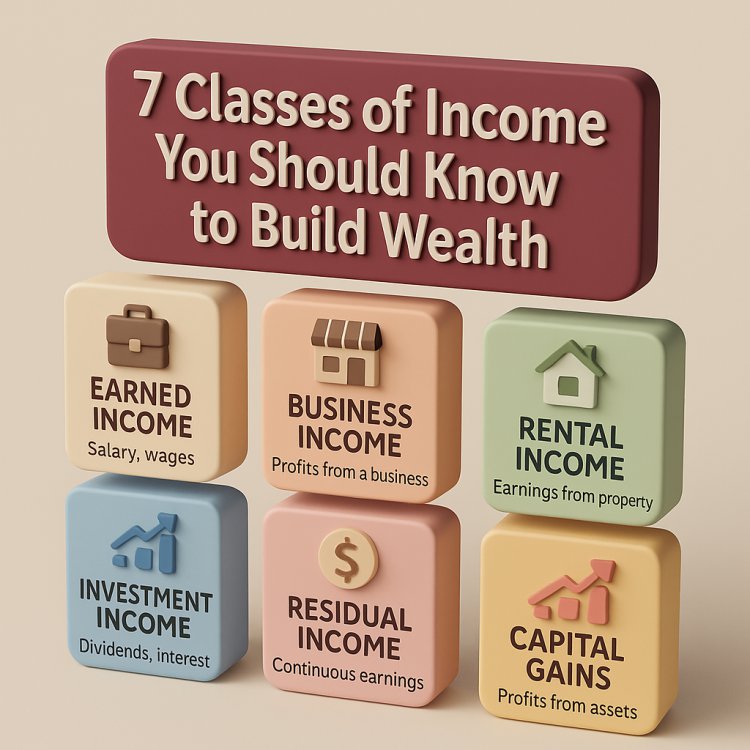

7 Classes of Income You Should Know to Build Wealth

Discover the 7 essential classes of income that can help you build sustainable wealth and achieve financial freedom. Learn how to diversify your income streams—from earned and business income to passive and portfolio earnings—and unlock a smarter path to financial success.

Understanding the Path to Financial Freedom

We all want financial freedom. But for most people, this goal remains elusive simply because they rely on only one or two streams of income. In today’s economy, understanding and utilizing the different classes of income is the foundation for sustainable wealth. Whether you're a professional, entrepreneur, student, or retiree, diversifying your income sources can dramatically enhance your financial security and growth.

This comprehensive guide breaks down the 7 major classes of income you should understand, build, and maximize if you're serious about achieving financial independence.

1. Earned Income – The Foundation of Most People’s Finances

Earned income is what you make from active work. It includes salaries, hourly wages, tips, and commissions. If you work a job or run a service-based business where your time equals money, you are earning income in this category.

Examples:

-

Salary from employment

-

Hourly wage work

-

Commissions from sales

-

Freelancing or consulting services

Pros:

-

Predictable and steady

-

Often comes with benefits (healthcare, retirement)

Cons:

-

Requires time and effort

-

Limited scalability

While this form of income is the most common, it’s also the most limiting in terms of wealth creation. That’s why it’s essential to reinvest your earned income into other income classes.

2. Business Income – Creating Value at Scale

Business income is money earned from a venture or enterprise that provides a product or service. Unlike earned income, business income can scale without directly tying your time to your earnings.

Examples:

-

Running an e-commerce store

-

Owning a service business (salon, restaurant)

-

Online digital products (courses, ebooks)

Pros:

-

High scalability

-

Tax advantages

-

Potential for automation

Cons:

-

Requires capital, risk-taking, and strong management

-

Time-intensive during setup

Building a business helps you move from being an employee to being an owner — a key wealth mindset shift.

3. Rental Income – Turning Assets into Earnings

Rental income is generated when you lease out property or assets you own. It’s a powerful class of income that can be both passive and predictable.

Examples:

-

Residential rental properties

-

Commercial buildings

-

Renting equipment, vehicles, or tools

Pros:

-

Passive income stream

-

Asset appreciation over time

-

Hedge against inflation

Cons:

-

Requires capital to acquire assets

-

Property management responsibilities

Rental income allows your assets to work for you, producing monthly cash flow even while you sleep.

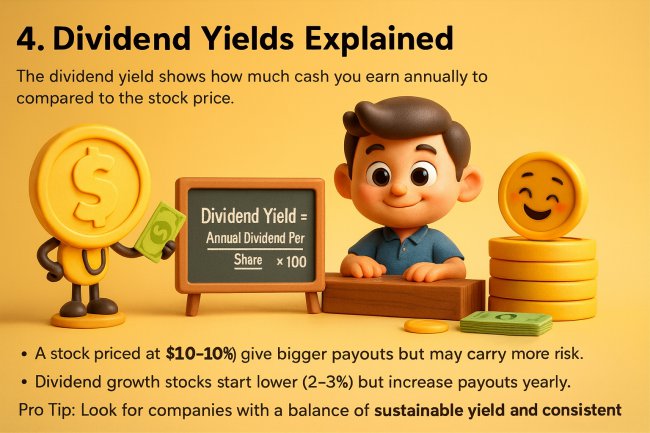

4. Investment (Portfolio) Income – Letting Your Money Work for You

Portfolio income is money earned from investments. This can come in the form of dividends, interest, and capital gains. It is often the income class of the wealthy.

Examples:

-

Dividends from stocks

-

Interest from bonds or savings accounts

-

Mutual funds, ETFs

-

Gains from selling appreciated investments

Pros:

-

Passive and scalable

-

Compound interest boosts returns

-

Accessible through various platforms (e.g., brokerage apps)

Cons:

-

Requires financial literacy

-

Market risk

To build long-term wealth, learning how to invest wisely is essential.

5. Passive Income – The Dream of Effortless Earnings

Passive income is revenue earned with little to no daily involvement. While it often requires upfront work or investment, it can deliver ongoing cash flow for years.

Examples:

-

Royalties from books or music

-

Affiliate marketing

-

Dropshipping or automated e-commerce

-

Monetized YouTube channels or blogs

Pros:

-

Long-term earning potential

-

Location and time freedom

-

Minimal maintenance once established

Cons:

-

Setup can be time-consuming

-

Takes patience to become profitable

Many people mistakenly assume passive income means easy income. In reality, it’s about building systems that work for you.

6. Residual Income – Get Paid Repeatedly for One-Time Work

Residual income is similar to passive income but often comes from work or value you create once and continue to benefit from over time.

Examples:

-

Subscription-based services

-

Licensing a patented product or software

-

Monthly membership sites

-

Network marketing commissions

Pros:

-

Predictable and ongoing

-

Incentivizes quality work upfront

-

Highly profitable in the long run

Cons:

-

Often misunderstood or confused with passive income

-

Depends on recurring customer engagement

Residual income gives you the ability to scale both your income and impact.

7. Capital Gains – Grow Your Wealth by Buying and Selling Smart

Capital gains arise when you sell an asset for more than you paid for it. It can come from real estate, stocks, cryptocurrencies, or collectible items.

Examples:

-

Selling shares after market growth

-

Flipping properties

-

Selling high-value collectibles

-

Cryptocurrency trading

Pros:

-

Can generate large one-time profits

-

Favorable tax treatment in some countries

-

Encourages strategic investing

Cons:

-

Not always consistent or predictable

-

Subject to market timing and taxes

Capital gains require a solid understanding of asset appreciation and timing your exits wisely.

How to Build a Balanced Income Portfolio

Relying on only one type of income can put your finances at risk. A smart wealth strategy involves combining several income streams. Here’s a simple blueprint:

-

Start with Earned Income: Use your job to create stability.

-

Save and Reinvest: Build a savings buffer and fund your first investment.

-

Launch a Side Business: Convert skills into income.

-

Invest Consistently: Diversify into stocks, bonds, or real estate.

-

Build Passive Systems: Create content, courses, or automation.

By slowly stacking income types, you create a resilient and growing financial ecosystem.

The Wealthy Don’t Work Harder – They Earn Smarter

The key difference between the financially successful and everyone else isn’t just hard work — it’s income diversity. The wealthy understand how to leverage their time, money, and resources across multiple income types.

Here’s what wealthy people prioritize:

-

Scalable income sources

-

Passive and residual income

-

Asset ownership

-

Financial literacy and discipline

Anyone can follow these principles with the right mindset, plan, and consistency.

Your Path to Multiple Streams of Income Starts Today

Understanding the 7 classes of income is your first step toward unlocking real financial freedom. By diversifying your earnings, you not only increase your income but also reduce financial risk and build wealth that lasts for generations.

Take action:

-

Evaluate your current income types

-

Set a goal to build at least 3 streams this year

-

Learn, invest, and grow consistently

Remember, it’s not about how much you make from one source — it’s about how many sources are making money for you.

#WealthInsightsGlobal | #MultipleStreamsOfIncome | #FinancialFreedom | #SmartMoneyMoves

What's Your Reaction?