Money Mindset: How to Think, Act, and Build Wealth Like the Financially Free

Discover how to build a powerful money mindset for long-term financial success in Kenya and Africa. Learn how beliefs, habits and smart thinking shape wealth creation.

Every significant financial transformation begins with one key shift: the way you think about money. Before you can save more, invest wisely, or scale your income, you must first master your money mindset.

Too many people in Kenya, Nigeria and across Africa work hard, earn well for their region—but still feel stuck. The reason? Not lack of income, but limiting beliefs, habits and thinking patterns around money.

This article will show you:

-

What a money mindset really is

-

How mindset differs between survival, security and freedom

-

Key principles to adopt for wealth building

-

Practical steps to shift your mindset today

What Is a Money Mindset?

Your money mindset is the internal lens through which you view earning, spending, saving, investing and risk. It influences:

-

How you react to an unexpected expense

-

Whether you view a side-hustle as a burden or an opportunity

-

If you think your income is fixed or expandable

-

Whether debt scares you—or motivates you

A strong money mindset doesn’t depend solely on how much you make. It depends on how you manage and multiply what you already have.

Two Dominant Money Mindsets

Scarcity Mindset

When you act from scarcity:

-

You believe money is limited and opportunities few

-

You avoid risks—even when rewarded

-

You spend reactively (“I just had to”), rather than proactively

-

You often focus on cost not value

Abundance Mindset

When you act from abundance:

-

You see money as a tool you can grow, not just preserve

-

You welcome calculated risk and learning

-

You spend strategically and invest purposefully

-

You build systems, not symptoms

The shift from scarcity to abundance is less about changing your salary and more about reprogramming your beliefs, actions and habits.

Why Mindset Shapes Outcomes

Consider two professionals in Nairobi each earning KES 80,000/month.

-

Person A focuses on “keeping up” — gets salary, spends to match peers, has little savings and carries incrementing debt.

-

Person B treats income as a launch pad — budgets aggressively, automates savings, invests, and builds assets.

Five years later, Person B’s net worth overtakes Person A’s by a wide margin—not because the salary was higher, but because the mindset and behaviour were different.

Simply put: Mindset drives behaviour; behaviour creates wealth.

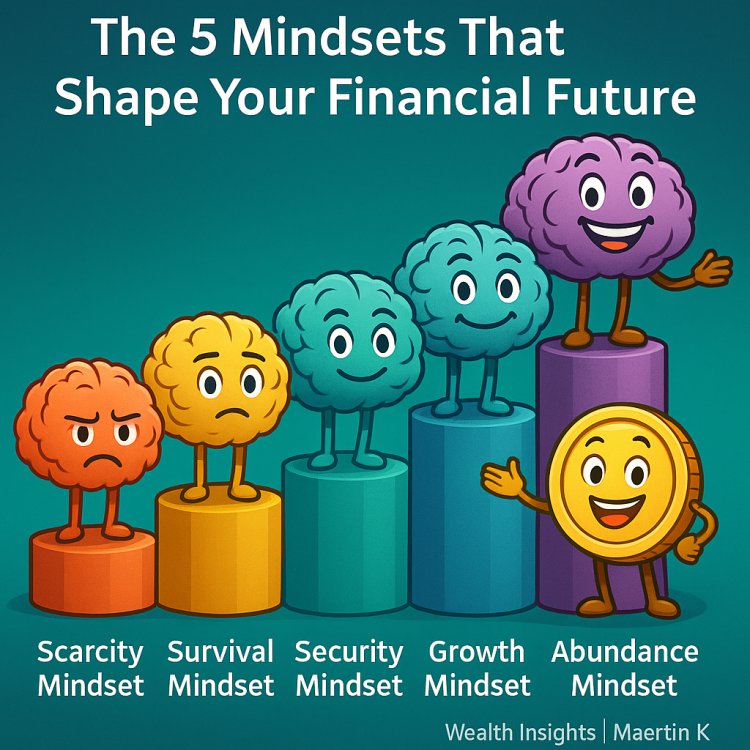

The Three Wealth-Mindset Stages

1. Survival Mindset

Focus: "Will the next paycheck cover everything?"

Typical features: living pay-cheque to pay-cheque, borrowing when short, little planning for future.

2. Security Mindset

Focus: “I have some buffer and I want stability.”

Features: budgeting, saving, but often still trading time for money rather than making money work for you.

3. Growth & Freedom Mindset

Focus: “How can I make my money work for me?”

Features: investing, building multiple income streams, thinking long-term, shifting from hours-for-shillings to assets-for-returns.

Your goal is to move from survival → security → freedom. The mindset shift happens before the income shift.

Ten Core Principles of a Wealth-Building Mindset

-

Pay yourself first – Save/invest before you spend.

-

Live below your means – Income rise should not force expense rise.

-

Invest in knowledge – Skill + financial education compound even when money is small.

-

Small steps + consistency – In Kenya you don’t need KES 1 million to start; you need habits.

-

Think long term – Wealth accrues over years, not weeks.

-

Take calculated risks – Entrepreneurship, investing, side-income—when done smartly.

-

Own assets, not liabilities – Ask: “Does this cost me or make me money?”

-

Automate your progress – Automatic transfers to savings/investments remove the “choice” trap.

-

Track progress – Numbers tell the truth: net worth, savings rate, investment growth.

-

Surround yourself with growth-mindset people – Your environment influences your behaviour.

Money Mindset in a Kenyan/African Context

In Africa, your money mindset faces unique challenges and opportunities.

Challenges:

-

Cultural pressure to spend on status, appearance, events

-

High-interest mobile/instant loans that trap people in consumption debt

-

Informal economy uncertainties and lack of predictable income

Opportunities:

-

Digital finance and affordable investing platforms (MMFs, SACCOs, mobile apps)

-

Young, growing population open to new models of wealth

-

Emerging markets where disciplined savers/investors can gain outsized advantage

For example: Instead of borrowing high-interest mobile loans, wary investors redirect that impulse into small monthly investments via Money Market Funds or SACCOs—a mindset shift from “I need now” to “I build for tomorrow.”

How to Rewire Your Money Mindset

Step 1: Examine your money story

Ask: What beliefs around money did you inherit? Write down any negative or limiting thoughts (“Money is hard to get,” “Rich people are greedy,” etc.).

Step 2: Challenge those beliefs

Find evidence to contradict them. For example: “In Kenya, people have built businesses from KES 50,000 starting capital.”

Step 3: Build new positive habits

Start with micro-actions:

-

Move KES 1,000 monthly to savings/investment.

-

Track one expense you will cut this week.

-

Read one finance article every week.

Step 4: Set goals and review them

Define what financial freedom means to you. Make it measurable and time-bound (e.g., “I want KES 500,000 invested within 5 years”). Review monthly.

Step 5: Visualise and act

See yourself at the future stage. Ask: “How would I spend my money differently then?” Then act as if you are already there—choose value, delay consumption, invest.

Habits That Reflect a Healthy Money Mindset

-

Weekly review of where your money went

-

Monthly check of savings/investment performance

-

Avoiding impulsive purchases without “cool-off” period

-

Automation of transfers into savings or investment vehicles

-

Engaging in conversations about money growth, not just money stress

The Mindset & Behaviour Link

Many Kenyans know they should save or invest—but still don’t. The missing link isn’t information but mindset. As one Kenyan blog put it: “The biggest culprit in money problems is the mindset. You are living the life your subconscious mind wants!” growthhubke.com

Mindset influences both the what and the why of money behaviour. Once you align why you do something (wealth, freedom, growth) with what you must do (save, invest, delay gratification), your path becomes clearer.

Building Wealth Starts in the Mind

Wealth is not just about income, assets or lucky breaks. It’s about thinking differently.

When your thinking changes:

-

You look for income streams not just pay-checks

-

You view spending as a choice, not an obligation

-

You build systems instead of struggles

It’s a long game—but a fair one. In Kenya and Africa, those who master mindset first often pull ahead of those who chase high incomes without structure.

Your Next 30-Day Money Mindset Plan

| Week | Focus | Action Step |

|---|---|---|

| Week 1 | Awareness | Track every shilling you spend this week. |

| Week 2 | Habit building | Automate KES 1,000/month savings/investment transfer. |

| Week 3 | Belief change | Write down one limiting belief and its positive replacement. |

| Week 4 | Growth & review | Read one finance book or article; review your savings and goals. |

Commit to the cycle. Mindset shifts take consistent small steps—not giant leaps.

Conclusion

Your money mindset doesn’t require more salary, a new job or a lucky break. It requires focused thinking, intentional action and small habits.

Change your beliefs. Update your habits. Align with long-term goals.

When you do, the mindset change will reflect in your bank account, your investment portfolio, and your level of freedom.

You don’t need to wait for your “big break.” You need to shift your mind now.

— Maertin K | Wealth Insights Kenya

What's Your Reaction?