How to Get So Rich You Never Have to Worry About Money Again

Discover the 5 key steps to build lasting wealth, generate passive income, and achieve true financial freedom—starting from where you are today.

Most people live their lives trapped in a financial cycle of paycheck-to-paycheck survival, constantly stressed about bills, debt, and unexpected expenses. But what if you could escape that loop completely? What if you could build so much wealth that money stops being a daily concern?

This article breaks down a simple but powerful philosophy based on one principle:

If you want to stop worrying about money forever, you must build systems that make money work for you.

Here’s how the wealthy do it—and how you can apply it, even if you're starting with little.

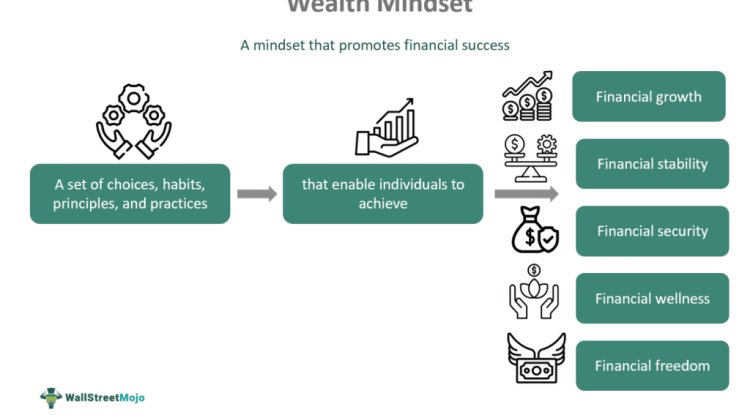

1. Shift Your Mindset: From Earning to Owning

The rich think about money differently. They don't work for money—they make money work for them.

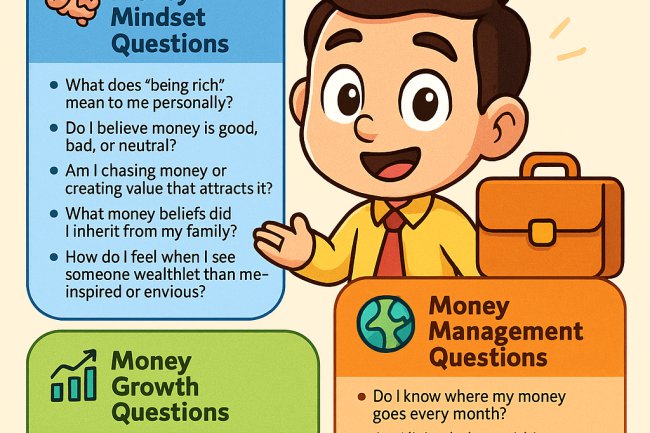

Key Mindset Shifts:

-

Money is a tool, not a goal.

-

Wealth is built on ownership, not labor.

-

Focus on assets, not just income.

-

Long-term thinking beats short-term thrills.

Kenyan Example:

Instead of thinking, “How can I earn more salary?” ask:

“How can I own something that continues to earn for me—like a rental unit, a boda boda fleet, or a digital product?”

2. Build Predictable Cash Flow Streams

Wealthy people prioritize stable income streams over flashy wins. They focus on predictability, not just potential.

What Is Predictable Cash Flow?

Income that comes in regularly, regardless of your time input. Examples include:

-

Rent from property

-

Dividends from investments

-

Interest from SACCO savings

-

Royalties, licenses, or online product sales

This steady flow gives you peace of mind and the ability to invest even more.

Lesson: Your first goal is to build a monthly passive income that covers your basic expenses. From there, you’re financially free.

3. Invest Strategically, Not Emotionally

Getting rich is not about jumping on every trend or quick-win scheme. It’s about disciplined, consistent investing in things that grow.

Where the Wealthy Invest:

| Asset Class | Why It Works |

|---|---|

| Real Estate | Appreciation + Rental income |

| Stocks & ETFs | Long-term growth + Dividends |

| Private Businesses | High returns + control |

| Digital Assets | Scalable, recurring income |

Warning: Don’t Copy Blindly!

-

Don’t buy real estate you can’t afford.

-

Don’t invest in crypto without research.

-

Don’t start a business without strategy.

Start small, test, then scale.

4. Automate Your Wealth-Building Systems

The rich don’t rely on memory or willpower. They build systems that automatically build wealth, even while they sleep.

Examples of Wealth Systems:

-

Automatic savings deductions into investment accounts

-

Standing orders for insurance, SACCO contributions

-

Digital platforms for passive business income

-

Delegation: Hiring people to run parts of their businesses

5. Follow This 5-Step Wealth Blueprint

Here’s a simplified version of how to go from broke to worry-free wealth:

Step 1: Educate Your Mind

Read, listen, and learn. Understand what assets, cash flow, debt, and compound interest truly mean.

Step 2: Fix Your Finances

Eliminate bad debt. Track your expenses. Create a basic budget.

Step 3: Increase Your Income

Start a side hustle, learn a high-income skill, or find ways to scale your current work.

Step 4: Invest What You Save

Don’t just save. Invest in income-generating assets—property, stocks, or businesses.

Step 5: Repeat and Automate

Set up standing instructions, reinvest profits, and let systems take over.

Real-Life Application: From Hustle to Wealth

Let’s say you earn KES 30,000/month. Here’s how to start:

-

Save 20% (KES 6,000) monthly for 6 months = KES 36,000

-

Use it to start a small boda boda or e-commerce hustle

-

Reinvest profits. Build into a business

-

Use profits to buy land or invest in REITs

-

Automate your savings to grow even more

Within 3–5 years, you can build a system that frees you from the paycheck grind.

Final Reminder

Getting rich isn’t about luck, talent, or inheritance. It’s about:

-

Shifting your mindset

-

Creating cash-flowing systems

-

Investing with discipline

-

Thinking long-term

The rich don’t worry about money not because they’re lucky—but because they’ve built a foundation that pays them over and over again.

Your Turn

Ready to start building wealth and stop worrying about money forever?

Begin with your first savings.

Learn about income-producing assets.

Set financial goals—and take small, consistent action daily.

Share Your Journey

How are you working toward financial freedom?

Comment below or share this with someone who needs a shift from survival to sustainable wealth.

What's Your Reaction?