Markets Overview: How to Read, Understand, and Leverage the Markets in Kenya and Africa

A detailed guide to understanding financial markets in Kenya and Africa. Learn how to interpret the NSE, sector trends, and economic indicators to make smarter investment decisions.

The financial markets are the heartbeat of an economy. Every rise or fall, every headline about the Nairobi Securities Exchange or global oil prices, is a signal about where money is moving — and where opportunity lies.

For most people, markets seem complex or far removed from daily life. But in truth, the market is simply a reflection of human behaviour — of how people buy, sell, save, and invest. The more you understand it, the better your financial decisions become.

This comprehensive guide breaks down the essentials of market awareness and shows you how to interpret trends, identify opportunities, and invest confidently in Kenya and Africa’s fast-evolving financial environment.

1. What Is a Market Overview and Why It Matters

A market overview is a snapshot of how the economy, businesses, and investors are performing over a given period. It tracks changes in stock prices, interest rates, currencies, inflation, and key sectors.

In Kenya, for example, the Nairobi Securities Exchange (NSE) provides updates on the performance of top companies like Safaricom, KCB Group, Equity Bank, BAT Kenya, and Co-operative Bank.

Understanding these updates helps you:

-

Predict where the economy is heading

-

Choose better investments

-

Protect your wealth from inflation

-

Make informed business and personal finance decisions

Markets are not reserved for economists or traders; they’re for every person who earns, saves, or invests.

2. The Structure of Financial Markets

Financial markets can be divided into several categories, each serving a different function. Understanding these helps you see where your opportunities lie.

(a) Money Markets

Short-term, low-risk investment platforms — ideal for saving and liquidity.

Examples: Money Market Funds (MMFs) like CIC MMF, Zimele, Britam, or Absa MMF.

(b) Capital Markets

Long-term investment vehicles, including stocks and bonds.

Example: Investing in Safaricom, KCB, Equity, or KenGen shares on the NSE.

(c) Foreign Exchange (Forex) Markets

Where currencies are traded. Currency strength affects import costs, inflation, and corporate profits.

(d) Commodity Markets

Include goods like oil, gold, coffee, tea, and agricultural produce — key exports in Africa.

(e) Real Estate & Alternative Markets

Cover property, REITs (Real Estate Investment Trusts), and digital assets.

Each market has its own rhythm, and successful investors learn to read these movements to spot timing and opportunity.

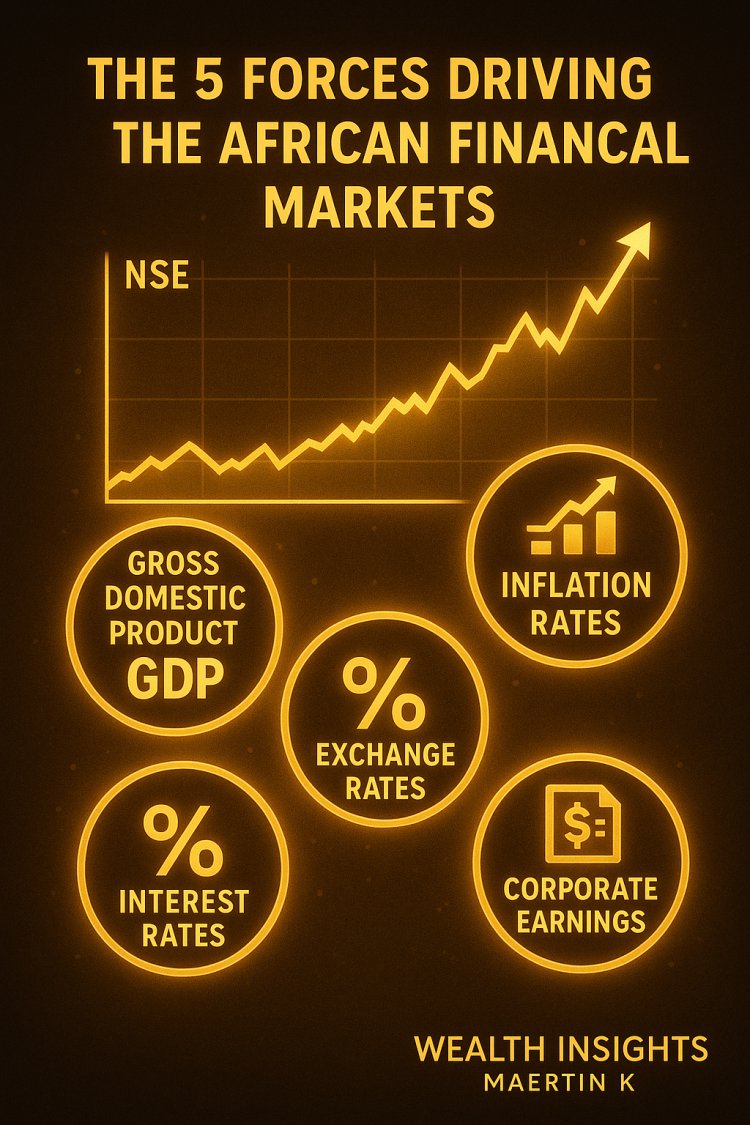

3. Key Indicators That Drive Market Movements

Markets move because of forces — and understanding those forces is like reading a financial weather forecast.

1. Gross Domestic Product (GDP)

GDP growth reflects economic expansion. Kenya’s GDP growth rate has averaged 4–5% in recent years, supported by services, agriculture, and manufacturing.

2. Inflation Rates

High inflation reduces purchasing power, forcing investors toward real assets like property and stocks.

3. Interest Rates

When rates rise, borrowing becomes expensive, and stock prices may drop. When rates fall, credit and spending increase.

4. Exchange Rates

A weaker shilling or naira increases import costs but boosts exporters. Currency trends affect company profits and investment returns.

5. Corporate Earnings

Company performance drives share prices. Safaricom’s profitability or Equity Bank’s dividends can influence overall market sentiment.

6. Global Trends

African markets don’t exist in isolation. U.S. interest-rate policy, oil prices, and China’s demand for raw materials all impact African growth.

4. The Nairobi Securities Exchange (NSE): Kenya’s Market Pulse

The NSE is one of Africa’s leading stock exchanges, providing investors access to public companies and diverse investment instruments.

Key Segments

-

Equities Market: Ordinary and preference shares

-

Bonds Market: Government and corporate bonds

-

Derivatives Market: Futures and other advanced instruments

-

ETFs (Exchange-Traded Funds): Allow diversification in a single product (e.g., NSE 25 ETF)

Major Kenyan Blue Chips

-

Safaricom PLC: Telecommunications and mobile-money leader (M-Pesa).

-

KCB Group PLC: Regional banking powerhouse.

-

Equity Group Holdings: Known for innovation and regional expansion.

-

BAT Kenya: Dividend-reliable manufacturer.

-

KenGen PLC: Energy generation backbone.

NSE Indexes

-

NSE 20 Share Index: Tracks the top 20 listed companies.

-

NSE 25 Share Index: Broader index of 25 companies.

-

NASI (All Share Index): Captures total market performance.

Tracking these indices gives a snapshot of investor confidence and national economic momentum.

5. Market Performance Snapshot: Kenya in Context

Over the past decade, Kenya’s market has seen cycles of volatility and recovery.

-

The COVID-19 period (2020-21) caused temporary declines.

-

2022-2024 saw stabilization with renewed local investor activity.

-

The rise of fintech, green energy, and digital commerce has fueled fresh opportunities.

Key Sectors Leading Growth

-

Telecommunications: Safaricom continues to dominate.

-

Banking: KCB, Equity, Absa showing steady returns.

-

Energy: KenGen and Kenya Power benefiting from infrastructure projects.

-

Agriculture & Manufacturing: Revival through export and processing.

-

Fintech & Tech Startups: New growth engine for youth employment and capital markets.

Kenya’s market remains resilient due to innovation, regional trade, and the rise of digital investors using apps like Hisa, Chumz, Absa Invest, and Bamboo.

6. The African Market Perspective

Beyond Kenya, Africa’s financial markets are expanding rapidly.

-

Nigeria: Africa’s largest economy with the Nigerian Exchange (NGX).

-

South Africa: Most mature capital market (JSE).

-

Egypt, Morocco, Ghana, Rwanda: Emerging hubs.

Regional integration under the African Continental Free Trade Area (AfCFTA) could soon create a massive, interconnected investment ecosystem.

Trends Shaping African Markets

-

Mobile-money penetration (e.g., M-Pesa, Flutterwave, Paystack).

-

Infrastructure spending on roads, ports, and energy.

-

A young, tech-savvy population driving entrepreneurship.

-

Gradual shift from informal savings to regulated investments.

The future is bright — but the winners will be those who understand how to analyze and respond to market trends.

7. How to Read Market Data Like a Pro

Step 1: Follow Index Movements

Watch the NSE 20, NSE 25, or NASI indices weekly. Rising indices = confidence; falling indices = caution.

Step 2: Study Company Reports

Review annual reports, dividend declarations, and earnings summaries.

Step 3: Watch Economic Announcements

Budget speeches, CBK rate adjustments, or inflation updates directly affect market performance.

Step 4: Learn Technical vs Fundamental Indicators

-

Fundamental Analysis: Examines profits, growth, and debt.

-

Technical Analysis: Studies price patterns and market momentum.

Step 5: Compare With Global Markets

See how U.S., European, and Asian market moves influence African capital flows.

Step 6: Track Currency and Commodity Trends

For example, oil and coffee prices impact Kenya’s trade balance and investor sentiment.

8. How to Apply Market Knowledge to Your Investing Strategy

1. Identify Market Cycles

Every economy has upswings and corrections. Buy quality assets when markets are undervalued.

2. Align Goals With Conditions

If markets are volatile, use defensive strategies like MMFs or bonds. When stable, accumulate long-term assets.

3. Mix Local and Global Exposure

Diversify between Kenyan investments and international ETFs through apps like Bamboo.

4. Manage Risk

Use stop-loss rules, emergency funds, and insurance to protect gains.

5. Stay Educated

Keep learning about economics, sectors, and companies. The more informed you are, the safer your decisions.

9. Tools and Platforms to Track the Market

Modern investors have digital tools at their fingertips:

-

NSE App & Website: Live market data and updates.

-

Absa Invest Platform: Unit trusts, bonds, and equities.

-

Hisa App: Buy local and global stocks from one dashboard.

-

Bamboo App: Invest in U.S. stocks and ETFs.

-

Cytonn Investments: Weekly market analysis and reports.

These platforms make professional-grade information accessible to anyone with a smartphone.

10. Common Market Mistakes to Avoid

-

Emotional Trading: Making decisions based on fear or excitement.

-

Over-Concentration: Investing all your money in one sector or stock.

-

Ignoring Fundamentals: Buying because of hype instead of value.

-

Neglecting Risk: No stop-loss plan or emergency fund.

-

Short-Term Thinking: Expecting overnight success instead of compounding.

-

Ignoring Costs: Brokerage, transaction, and management fees eat into profit.

-

Skipping Education: Failing to learn means repeating costly mistakes.

Market awareness turns fear into power — if you learn how to interpret signals rationally.

11. The Future of African Markets

Africa is entering a new financial era.

-

Fintech Integration: Easier investing and cross-border transactions.

-

ESG (Responsible Investing): Growing focus on sustainable business.

-

Youth Participation: Millions of young Africans entering capital markets through digital apps.

-

Regional Linkages: Joint listings and shared exchanges increasing liquidity.

The combination of technology, knowledge, and long-term mindset will define the next generation of African investors.

12. How to Build Your Personal Market Routine

-

Every Morning:

Check NSE indices, currency rates, and top-gainer/loser lists. -

Weekly:

Read one market summary or newsletter (NSE, Absa Insights, Cytonn Reports). -

Monthly:

Review portfolio returns vs. market averages. -

Quarterly:

Rebalance allocations; adjust for new trends. -

Yearly:

Study economic forecasts, set new investment goals, and evaluate long-term growth.

Consistency builds competence — and competence builds confidence.

Conclusion: The Market Is Your Mirror

Markets are not against you — they are reflections of your own decisions, habits, and patience.

When you study the market, you’re not just watching prices; you’re learning human behaviour, global economics, and the rhythm of opportunity.

For Kenyan and African investors, this is the time to move from spectators to participants. The world is digitized, knowledge is free, and opportunities are borderless.

Stay informed. Stay focused. Stay invested.

— Maertin K | Wealth Insights Kenya

What's Your Reaction?