15 Rules of Money — The Wealth Code They Don’t Teach in School

Discover 15 powerful money rules that separate the rich from the average. Learn how to master money, grow wealth, and achieve true financial freedom.

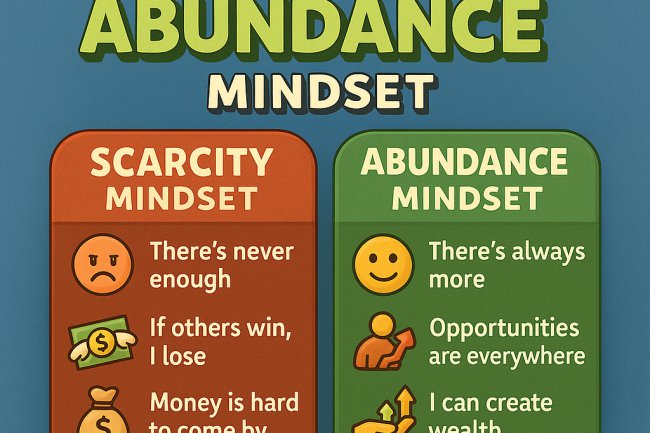

Money isn’t just paper — it’s energy, discipline, and mindset.

Some people chase it endlessly, others multiply it effortlessly.

Let’s break down 15 timeless rules that separate the rich from the average — the builders from the dreamers.

1️⃣ Money Flows to Those Who Respect It

If you waste money, money avoids you.

Track every coin, no matter how small—because small leaks sink big ships.

Tip: Create a budget like a boss. Even Safaricom audits every cent—why shouldn’t you?

2️⃣ Never Work Just for Money

The poor trade time for cash.

The rich trade ideas for income.

Build systems, not shifts. Build equity, not wages.

3️⃣ Make Money Work Harder Than You

Every shilling must have a job.

Invest it in assets that multiply — land, stocks, SACCOs, or even digital products that sell while you sleep.

4️⃣ Learn the Language of Money

The rich read financial statements like novels.

Learn how profits, expenses, taxes, and interest work — that’s your financial alphabet.

Books like “Rich Dad Poor Dad” or “The Richest Man in Babylon” are your free MBA.

5️⃣ Pay Yourself First

The broke pay bills first. The rich pay themselves first — through saving and investing.

Automate 10–20% of your income into an investment account or SACCO before touching the rest.

6️⃣ Protect Your Money

If you don’t protect it, someone will take it — scammers, bad friends, or bad deals.

Invest only in what you understand. And never give loans you can’t afford to lose.

7️⃣ Don’t Chase Fast Money

Quick money burns faster than it comes.

Wealth built slowly — through patience and purpose — lasts generations.

8️⃣ Use Debt Wisely

There’s good debt (that builds wealth) and bad debt (that builds stress).

Borrow to grow, not to show.

Example: A loan for a business = asset. A loan for luxury = liability.

9️⃣ Build Multiple Streams of Income

One income is too close to zero.

Have at least three — salary, investments, and a side hustle.

In Africa, that could be land leasing, Airbnb, or online content monetization.

Live Below Your Means, But Think Above Them

Rich people don’t try to look rich — they build wealth quietly.

The goal isn’t to impress strangers; it’s to create freedom for your family.

11️⃣ Money Rewards Value

You’re paid in proportion to the problems you solve.

Solve bigger problems, earn bigger checks.

From a boda rider to a fintech founder — both work hard, but one scales solutions.

12️⃣ Invest in Yourself First

The highest ROI isn’t in crypto — it’s in knowledge.

Learn new skills, master your craft, upgrade your mind.

???? Because no one can steal your wisdom.

13️⃣ Give to Grow

Money multiplies through generosity.

Giving isn’t losing—it’s planting seeds for future harvests.

14️⃣ Time Is More Valuable Than Money

You can always make more money, but never more time.

Outsource tasks, delegate, and automate—protect your hours like gold.

15️⃣ Money Is a Game—Learn to Play, Not to Fear

The poor fear risk; the rich study it.

You can’t win the money game if you don’t learn the rules — investing, saving, compounding, and discipline.

Final Word: Build Wealth That Outlives You

Money isn’t evil — ignorance is.

When you master these 15 rules, money stops being your boss… and starts being your servant.

Remember: the goal isn’t just to make a living — it’s to build a legacy.

What's Your Reaction?