How to Start Investing: A Complete Beginner’s Guide to Building Wealth Safely and Confidently

This beginner-friendly guide explains how to start investing the right way — from setting goals and building an emergency fund to choosing the best investment options, managing risk, and avoiding costly mistakes. It teaches simple, practical steps anyone can follow to grow wealth steadily, invest confidently, and build long-term financial security.

Investing is one of the most misunderstood subjects in personal finance. Many people want to invest, but they hesitate because they feel unprepared, afraid of losing money, or unsure where to begin. Others jump in too quickly, chasing hype or “hot tips,” and end up discouraged when things go wrong.

The truth is simple:

Investing is not gambling, magic, or luck.

It is a disciplined process of building wealth over time.

This guide is designed to give you a clear roadmap — from your first step to more advanced strategies — so you can invest with confidence, reduce risk, and make decisions grounded in logic rather than emotion.

Whether you’re in your first job, running a business, planning for retirement, or simply tired of watching money sit idle in a savings account, this article will help you move forward wisely.

Part 1: Understanding the Purpose of Investing

What investing really means

Investing means putting money into assets that have the potential to:

-

grow in value, or

-

produce income, or

-

do both at the same time.

Unlike saving (which keeps money safe but mostly inactive), investing lets your money work for you. That is how people fund education, buy homes, retire comfortably, and create generational wealth.

Why investing matters now more than ever

Today, the cost of living rises faster than most savings accounts earn. Inflation quietly erodes purchasing power. If money remains idle for years, it buys less and less.

Investing helps you:

-

Outpace inflation

-

Build additional income streams

-

Prepare for unexpected life events

-

Gain financial independence rather than relying only on salary

Investing does not require large amounts. It requires consistency, patience, and a strategy.

Part 2: Setting the Right Foundation Before You Invest

The strongest buildings sit on strong foundations — and wealth is no different.

Step 1: Clarify your goals

Goals determine your investment choices. Ask:

-

Am I investing for the next 3 years, 10 years, or 30 years?

-

Do I want income, growth, or security?

-

What will this money be used for?

Typical goals include:

-

Emergency protection

-

Education funds

-

Business expansion

-

Buying property

-

Retirement security

-

Wealth transfer to children

Clear goals prevent emotional decisions and guide asset selection.

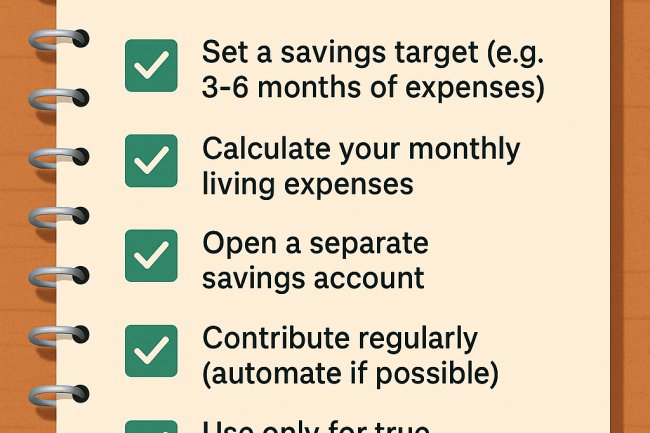

Step 2: Build an emergency fund

Before buying investments, create a safety cushion. Aim for:

3–6 months of essential living expenses

stored in a safe, accessible account such as a money market fund or savings account.

This prevents panic-selling when emergencies arise and stabilizes your financial life.

Step 3: Manage high-interest debt

If you owe debt with high interest (credit cards, payday loans, mobile loans), pay it down aggressively. The interest is often higher than expected investment returns.

A balanced approach works well:

keep investing small amounts to build the habit while accelerating debt repayment.

Part 3: Understanding Risk — and Controlling It

Every investment carries risk. But risk is not something to fear — it is something to manage.

Types of investment risk

-

Market risk – values fluctuate.

-

Inflation risk – money loses value if returns are too low.

-

Liquidity risk – difficulty accessing funds fast.

-

Behavioral risk – emotional decisions (panic buying or panic selling).

Your personal risk tolerance

Ask yourself:

-

“How would I react if my investment temporarily dropped 15%?”

-

“Am I investing money I need soon?”

-

“Do I understand what I’m buying?”

The longer your time horizon, the more risk you can generally tolerate, because markets historically recover over time.

Part 4: Core Investment Options Explained

Let’s explore common investments beginners use.

1. Money Market Funds

-

Low risk

-

Ideal for short-term savings

-

More returns than ordinary savings accounts

Best for: emergency funds, short-term saving buckets.

2. Bonds

-

Lend money to governments or companies

-

Paid back with interest

-

Lower risk than stocks, but moderate returns

Best for: stability and income.

3. Stocks (Equities)

-

Ownership in real companies

-

Higher long-term growth potential

-

Short-term price swings are common

Best for: long-term goals like retirement or children’s education.

4. Mutual Funds and ETFs

-

Professional managers pool investor money

-

Diversified across many assets

-

A simple way to invest without picking individual stocks

Best for: beginners who want diversification instantly.

5. REITs (Real Estate Investment Trusts)

-

Invest in property without buying physical buildings

-

Earn through rental income and property appreciation

Best for: steady income with medium risk.

6. Retirement Accounts

-

Designed for long-term wealth

-

Benefit from compounding and sometimes tax advantages

-

Should be funded consistently and left untouched

Best for: future financial independence.

Part 5: Diversification — Your Built-In Risk Shield

Diversification means spreading investments across:

-

asset classes

-

industries

-

regions

-

time

If one asset underperforms, others balance it out.

Think of diversification as insurance for your portfolio. It won't guarantee profits, but it significantly reduces the chance of major loss.

Part 6: The Power of Compounding

Compounding occurs when investment returns generate additional returns. Over many years, small steady contributions snowball dramatically.

Example:

-

Invest a modest amount monthly

-

Reinvest earnings instead of withdrawing

-

Allow time to do the heavy lifting

Compounding rewards patience and discipline more than intelligence or timing.

Part 7: How to Actually Start — Step-By-Step

Here is a simple, practical roadmap:

-

Create emergency fund

-

Pay off high-interest debt

-

Define goals and time horizons

-

Choose a diversified mix suited to risk tolerance

-

Automate monthly contributions

-

Review once or twice a year

-

Avoid emotional decisions during market swings

You don’t need to be perfect. You just need to be consistent.

Part 8: Avoid These Costly Beginner Mistakes

-

Chasing “get rich quick” schemes

-

Investing money needed soon

-

Following hype from friends or social media

-

Ignoring fees and taxes

-

Over-concentrating in a single investment

-

Trying to time the market

-

Reacting emotionally to short-term changes

Disciplined investors build more wealth than impulsive ones — even if they earn slightly lower returns.

Part 9: Growing From Beginner to Confident Investor

Once you master the basics, you can gradually expand into:

-

growth portfolios

-

dividend strategies

-

real estate opportunities

-

global markets

-

business reinvestment

-

retirement optimization

-

estate and legacy planning

Education should be ongoing. Every year, refine your plan and deepen your understanding.

Part 10: Investing Mindset — The Human Side of Money

Successful investors focus on:

-

Patience — wealth grows slowly, then suddenly

-

Discipline — follow the plan even during volatility

-

Learning — understand what you own and why

-

Long-term perspective — ignore noise, prioritize progress

-

Responsibility — invest ethically and wisely

Investing is as much psychological as financial.

A Simple Model Portfolio Example (for illustration only)

A balanced beginner portfolio might include:

-

Money Market Fund — safety and liquidity

-

Bond Fund — stability and interest income

-

Equity Fund/ETF — growth potential

-

REIT — passive property income exposure

Percentages should match risk tolerance and goals, and regularly reviewed.

Review & Rebalance

Over time, markets move and allocations drift. “Rebalancing” means adjusting back to your target mix. This keeps risk aligned with your plan and protects gains.

Taxes, Fees, and Hidden Costs

Many investors ignore costs — but fees compound against you.

Watch for:

-

management fees

-

withdrawal penalties

-

transaction costs

-

taxes on gains

A lower-cost portfolio often outperforms over time purely because it loses less to expenses.

Final Thoughts: Start Small, Start Now, Stay Consistent

You do not need perfect timing. You do not need advanced knowledge. You simply need:

-

a plan,

-

discipline,

-

and time.

The earlier you start, the less money you need.

The later you start, the more discipline you must build.

If you begin today — even with a small amount — you have already placed yourself ahead of millions of people who postpone investing year after year.

What's Your Reaction?