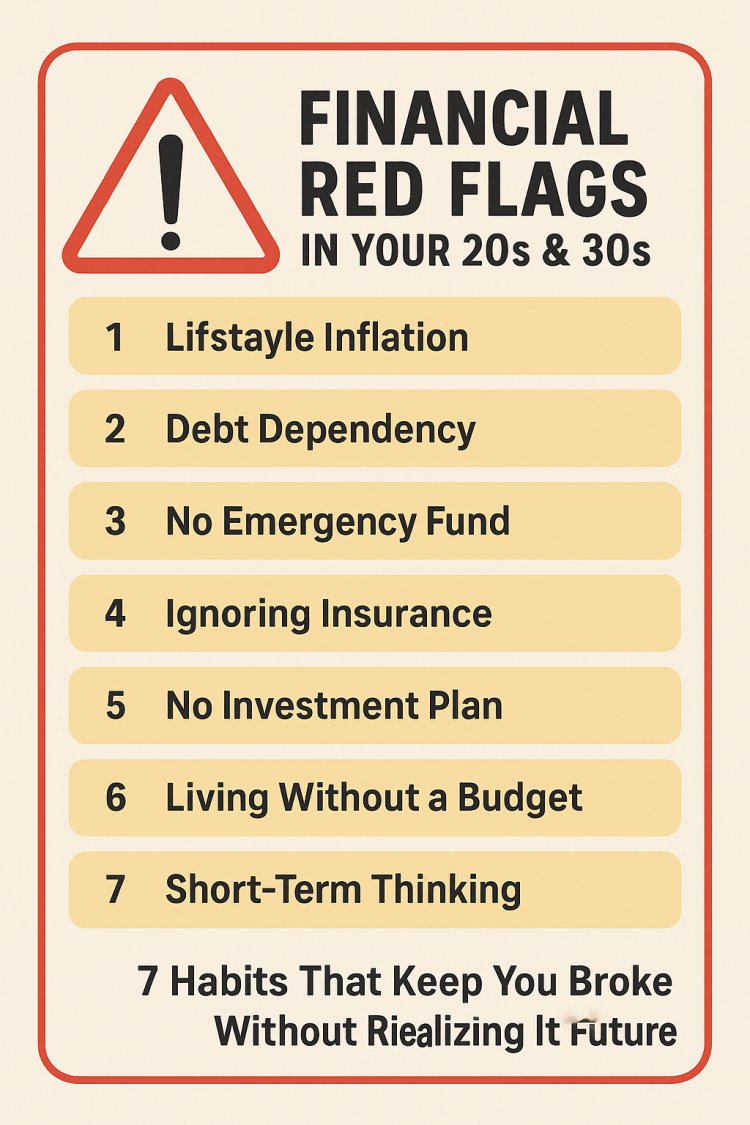

Financial Red Flags in Your 20s and 30s

Discover the 7 financial red flags that can quietly keep you broke in your 20s and 30s. Learn how to overcome lifestyle inflation, debt dependency, and poor financial habits to secure your financial future

7 Habits That Keep You Broke Without Realizing It

Introduction: The Silent Money Mistakes

Your 20s and 30s are the most powerful years for building wealth. You have energy, time, and opportunity on your side.

But they are also the most dangerous years for financial mistakes that quietly sabotage your future.

Most people don’t go broke overnight. They go broke slowly, through small daily decisions that feel normal, yet compound into long-term damage.

This article exposes seven financial red flags that can silently hold you back—and how to fix them before they become permanent habits.

1. Lifestyle Inflation: Spending More as You Earn More

The Red Flag:

Every time your income rises, your expenses rise with it. New job? New car. Promotion? New apartment. Bonus? Shopping spree.

This pattern is called lifestyle inflation, and it’s one of the biggest reasons high-income earners still live paycheck to paycheck.

Why It Hurts:

When you increase your standard of living instead of your investments, you trap yourself in a financial treadmill. More money comes in, but nothing stays.

Fix It:

Set a rule: when your income increases, save or invest at least 50 percent of the raise.

Upgrade your lifestyle only after your investments can pay for it.

2. Debt Dependency: Using Credit to Fund Your Lifestyle

The Red Flag:

You depend on credit cards, buy-now-pay-later plans, or personal loans to cover everyday expenses.

Why It Hurts:

Debt is not income — it’s a future burden disguised as convenience. High-interest rates quietly drain your cash flow, leaving you working to pay interest instead of building assets.

Fix It:

Use credit strategically, not emotionally.

Pay off your balances monthly and build an emergency fund so you don’t rely on debt to survive.

Mindset Shift:

Credit should build wealth, not buy comfort.

3. No Emergency Fund: Living One Crisis Away from Disaster

The Red Flag:

You rely on luck or borrowing whenever an unexpected expense arises — car repair, medical bill, or job loss.

Why It Hurts:

Without an emergency fund, every setback becomes a financial crisis.

You lose stability, and stress replaces security.

Fix It:

Save at least three to six months of living expenses in a high-yield savings account.

Start small: even $1,000 in a separate account can protect you from panic.

Rule of Thumb:

Build safety before growth.

4. Ignoring Insurance: Protecting Your Assets Last

The Red Flag:

You treat insurance as optional. Health, life, or disability coverage feels like “money wasted.”

Why It Hurts:

One accident or illness can erase years of financial progress. Insurance isn’t an expense; it’s a shield for your hard work.

Fix It:

-

Get health insurance first — medical debt is the number one cause of bankruptcy globally.

-

If you have dependents, buy life insurance to protect them.

-

Consider renter’s, home, or income protection coverage if applicable.

Quote:

You don’t buy insurance because you expect disaster — you buy it because you respect your future.

5. No Investment Plan: Letting Time Slip Away

The Red Flag:

You save money, but it sits idle in a checking account earning nothing.

Why It Hurts:

Inflation silently erodes your savings. You lose purchasing power every year your money doesn’t grow.

Fix It:

Start investing early, even with small amounts. Use diversified instruments like:

-

Low-cost index funds or ETFs

-

Retirement accounts (401(k), IRA, or equivalents)

-

Bonds or money market funds for lower risk

Mindset Shift:

The earlier you start, the less you need to invest later. Compounding rewards the patient.

6. Living Without a Budget: “I’ll Figure It Out Later”

The Red Flag:

You don’t know exactly how much you spend each month. You just “check the balance” and hope it’s enough.

Why It Hurts:

Without visibility, money slips through the cracks. You can’t improve what you don’t measure.

Fix It:

Use the 50/30/20 rule as a simple guide:

-

50% for needs

-

30% for wants

-

20% for savings or debt repayment

Use budgeting apps or even a spreadsheet to track expenses weekly.

Awareness is the first step toward control.

7. Short-Term Thinking: Valuing Pleasure Over Progress

The Red Flag:

You chase immediate gratification — new gadgets, nights out, trends — but postpone wealth-building decisions.

Why It Hurts:

Every dollar you spend today has the potential to grow tenfold tomorrow. By prioritizing consumption, you sacrifice long-term freedom for temporary satisfaction.

Fix It:

Before making a purchase, ask:

“Will this bring me happiness now, or freedom later?”

Train your mind to value ownership over appearance.

Quote:

Wealth is not about impressing others. It’s about buying time, peace, and choice.

The Turning Point: Awareness Creates Freedom

If you recognized yourself in any of these habits, don’t panic — awareness is progress.

You can’t change what you don’t acknowledge.

The key is to shift from reactive to proactive money management.

Start small:

-

Open a savings account.

-

Pay off one debt.

-

Automate an investment.

-

Review your spending weekly.

Small, consistent actions compound just like money does.

Your 20s and 30s are not for perfection—they are for preparation.

The choices you make today will define the options you have tomorrow.

Conclusion: Don’t Be Casual About Your Future

Financial maturity isn’t about how much you earn—it’s about how you manage, protect, and grow what you have.

The biggest mistake isn’t making errors; it’s ignoring the red flags when you see them.

Start now. Build clarity, not confusion.

Build assets, not appearances.

And build a future that rewards discipline, not denial.

What's Your Reaction?