The Digital Wealth Revolution: How to Build Online Income Streams That Set You Free

Learn how to build online income streams and digital assets for financial freedom. Discover proven models, tools, and systems to create wealth online.

We are living in the greatest financial migration in human history — the shift from physical labor to digital leverage. For the first time, ordinary people can create wealth without permission, hierarchy, or geography. A smartphone, internet connection, and skill are now the new tools of freedom.

Yet most people still treat the internet as entertainment rather than an economy. They scroll where they could build, consume where they could create, and work for platforms instead of owning them. This guide will help you change that by understanding how digital wealth works, how to build systems that pay you online, and how to structure your digital life so it becomes an asset — not a distraction.

1. The New Rules of Wealth

From Effort to Leverage

Traditional wealth relied on labor — you traded time for money. Digital wealth relies on leverage — one effort, infinite reach. A YouTube video, e-book, or app you build once can earn revenue for years. That’s scalable wealth.

From Local to Global

A local business serves one town. A digital business serves the world. With fintech and e-commerce platforms, a designer in Nairobi can sell to New York. Global exposure means global income potential.

From Ownership to Access

You no longer need factories or offices. You can rent tools (Canva, Shopify, Substack), outsource production, and still own the brand and profit. Ownership is now intellectual and digital.

2. The Digital Wealth Framework

Think of online income like a pyramid:

Level 1 – Learn a Monetizable Skill

Every digital asset begins with a skill. Popular high-ROI skills include:

-

Copywriting and digital marketing

-

Graphic design and brand identity

-

Web development and automation

-

Video editing and storytelling

-

Data analysis and AI integration

Your first income online will likely come from service work using one of these skills.

Level 2 – Productize Your Skill

Instead of selling hours, package results. Create templates, guides, mini-courses, or software tools. Digital products scale because they require no new labor per sale.

Level 3 – Build Distribution

A great product unseen earns nothing. Build audience ecosystems:

-

Website or blog (your digital headquarters)

-

Email newsletter (your owned community)

-

Social media (your marketing channel)

Consistency builds trust; trust builds conversion.

Level 4 – Automate & Scale

Use automation to detach income from time. Tools like Zapier, Mailchimp, or Notion connect systems so sales and marketing run 24/7.

At this stage, your online presence becomes a machine — earning while you rest.

3. Seven Proven Online Income Models

1. Content Creation (YouTube, Podcasts, Blogs)

Content is the new property. It compounds audience attention — the currency of the digital age. Monetize through ads, sponsorships, digital products, or subscriptions.

Principle: Create once, distribute forever.

2. Affiliate Marketing

Promote other companies’ products and earn commissions on sales. It’s simple but requires trust and traffic.

Example: Recommending investment apps like Bamboo or Hisa on your finance blog.

Pro Tip: Focus on evergreen products that people always need — software, finance tools, or education platforms.

3. Freelancing & Consulting

The gateway for most digital earners. Offer expertise on platforms like Upwork, Fiverr, or directly through your website.

Use freelancing as capital generation, not a life sentence.

Goal: Transition from freelancer → business owner → brand.

4. Digital Products & Courses

Create once, sell infinitely. E-books, courses, or paid guides are the most scalable model.

Use Teachable, Gumroad, or Kajabi to host and deliver.

Framework: Teach what you’ve mastered; simplify what others overcomplicate.

5. E-Commerce & Dropshipping

Sell products online without holding inventory. You handle marketing; suppliers handle logistics.

Africa’s platforms like Jumia, Shopify Africa, and Selar are driving local adoption.

Warning: Start small and focus on niche markets — not generic gadgets.

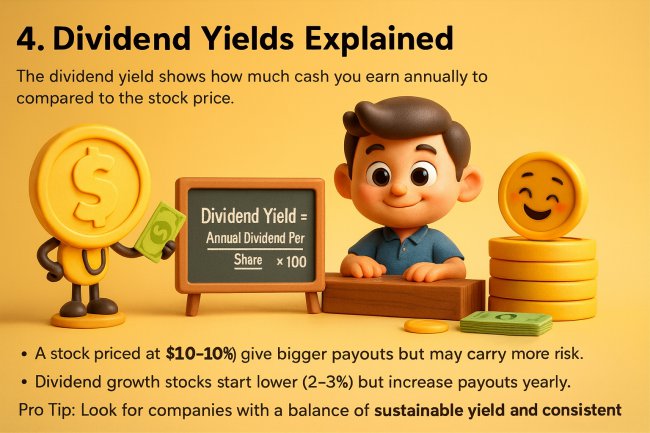

6. Investing & Trading Digitally

Investing is the passive twin of digital entrepreneurship. You can trade stocks, ETFs, crypto, or commodities directly from your phone.

Use platforms like Hisa, Bamboo, Etoro, or Interactive Brokers.

Golden Rule: Investing multiplies discipline, not greed.

7. Licensing, Royalties, and Intellectual Property

If you create art, music, photography, or writing — you own digital IP. Sell usage rights or earn royalties via Patreon, Getty Images, or SoundCloud Monetization.

Digital truth: Every idea that can be digitized can be monetized.

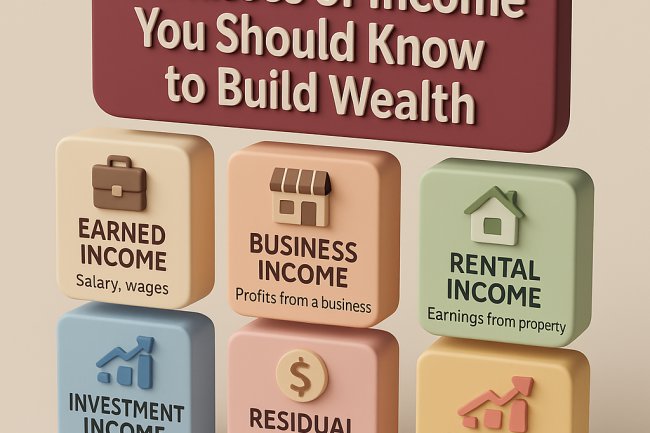

4. The Income Automation Ladder

Building online wealth is like climbing a ladder — each step replaces labor with leverage.

| Stage | Focus | Tools | Outcome |

|---|---|---|---|

| 1. Manual | Freelancing, side gigs | Fiverr, Canva, Upwork | Cash flow generation |

| 2. Semi-Automated | Digital products & email funnels | Gumroad, Mailchimp | Scalable income |

| 3. Automated | Memberships, recurring revenue | Substack, Patreon | Predictable monthly cash flow |

| 4. Passive Systems | Investments, royalties | ETFs, REITs, YouTube | Financial independence |

5. The “Asset Factory” Principle

Every online creator should think like a digital manufacturer.

Each month, build one new asset that can produce income without you:

-

January → e-book

-

February → mini-course

-

March → YouTube video series

-

April → Affiliate system

Within a year, you’ll have twelve digital assets compounding attention, sales, and authority.

6. Tools of the Digital Wealth Era

| Function | Tools | Description |

|---|---|---|

| Design | Canva, Figma, Adobe Express | Create professional visuals fast |

| Automation | Zapier, Notion, Airtable | Connect tasks and databases |

| E-Commerce | Shopify, Jumia, Selar | Sell physical and digital goods |

| Finance & Investment | Hisa, Bamboo, Absa App | Track portfolios and automate savings |

| Email & CRM | Mailchimp, ConvertKit | Manage audiences and marketing |

| Education & Courses | Teachable, Gumroad, Kajabi | Host and sell your knowledge |

Use tools to multiply effort — not to avoid it.

7. Risk and Reality

1. Expect a Slow Start

Digital income grows exponentially, not instantly. The first year builds systems; the second compounds returns.

2. Protect Your Brand

Register domains, copyright your content, and use watermarks. Your digital reputation is your new collateral.

3. Manage Taxes

Even digital income is taxable. Keep clean records, separate business accounts, and learn your jurisdiction’s tax laws.

4. Diversify Across Models

If YouTube dries up, your e-book still sells. Diversification protects digital entrepreneurs the same way it protects investors.

8. The Mindset of Digital Wealth Builders

-

Think Systems, Not Hustles: Build repeatable processes, not temporary gigs.

-

Value Knowledge Over Trends: Skills compound faster than fads.

-

Prioritize Ownership: Platforms can ban you; your website can’t.

-

Invest in Community: Audiences turn into buyers when they feel belonging.

-

Reinvest in Growth: Use profits to improve tools, ads, or education.

Digital wealth isn’t about doing everything — it’s about doing the right few things consistently.

9. Sample Path: From Employee to Digital Investor

Year 1: Learn a digital skill and freelance for income.

Year 2: Launch a personal brand website + newsletter.

Year 3: Create digital products or online courses.

Year 4: Automate email funnels and launch recurring revenue.

Year 5: Invest profits into dividend stocks or ETFs.

After five years, you own multiple streams of digital income and an investment engine that compounds even while you rest.

10. The Digital Freedom Equation

Digital Wealth = (Skill × System × Scale) ÷ Time Dependence

-

Skill creates value.

-

System automates delivery.

-

Scale expands reach.

-

Time Dependence must approach zero.

The closer your income gets to independence from time, the closer you are to freedom.

11. The Global Case for Africa’s Digital Future

Africa has the youngest, most connected population on the planet. Every smartphone user is a potential digital entrepreneur. With rising fintech infrastructure and mobile banking, the continent can skip traditional capitalism and leap straight into digital capitalism.

Those who master digital systems now will dominate the next decade of economic growth.

12. Building Digital Wealth Sustainably

-

Start with Purpose: Solve a problem that matters.

-

Document the Journey: Transparency builds trust faster than perfection.

-

Focus on Evergreen Value: Create content and products that age well.

-

Build Partnerships: Collaborate with complementary creators.

-

Keep Learning: The algorithms change; principles don’t.

Digital wealth is not just about money — it’s about freedom of time, place, and purpose.

Conclusion

The internet has democratized opportunity but not discipline. You can’t outsource patience, curiosity, or execution. But if you commit to building digital assets — month by month, year by year — you’ll wake up one day and realize your income no longer depends on your presence.

That’s not just wealth. That’s autonomy.

By Maertin K | WealthInsights.co.ke

Building Africa’s Financially Free Generation

Join the Wealth Insights community to start your digital freedom journey.

What's Your Reaction?