How Dividends Build Passive Income:

Learn how dividends work, why they’re powerful for passive income, and how to build long-term wealth through dividend investing.

When most people hear the word "investing," they think of buying and selling stocks for quick profits. But true wealth isn’t built through speculation—it’s built through steady streams of passive income.

One of the most powerful (and often overlooked) ways to earn passive income is through dividends. These are cash payments that companies distribute to shareholders simply for owning their stock. Imagine being paid regularly—not because you worked more hours, but because you owned a slice of a company.

This blog will explore in detail what dividends are, how they work, and how you can build lasting passive income streams that grow over time—step by step.

1. What Are Dividends?

Dividends are a portion of a company’s profits paid out to its shareholders. They’re the company’s way of saying, “Thank you for investing in us—here’s your share of the success.”

-

If you own 100 shares of a company that pays $2 per share annually, you earn $200 per year—without lifting a finger.

-

Dividends can be paid quarterly (most common), annually, or even monthly.

Types of Dividends

-

Cash Dividends – Direct payments to your brokerage account.

-

Stock Dividends—Extra shares instead of cash.

-

Special Dividends – One-time bonuses when a company has surplus profits.

2. Why Dividends Are Passive Income

Passive income means earning money without actively working for it. Dividends are the purest form of passive income because:

-

They flow automatically into your account.

-

You don’t need to trade or sell your stock.

-

As long as the company performs well, dividends keep coming.

Unlike a side hustle or freelancing, dividends require no daily effort once you’ve invested.

3. The Power of Dividend Reinvestment (DRIP)

One of the secrets to building wealth with dividends is the Dividend Reinvestment Plan (DRIP).

Instead of taking dividends as cash, you automatically reinvest them into buying more shares. More shares = more dividends = faster growth.

Example:

-

You invest $10,000 in a stock that pays a 5% dividend yield.

-

Year 1: You earn $500 in dividends.

-

Reinvest them, and now you own more shares.

-

Year 2: You earn dividends on $10,500.

-

Over 20 years, reinvested dividends can double or triple your returns.

This is the magic of compounding.

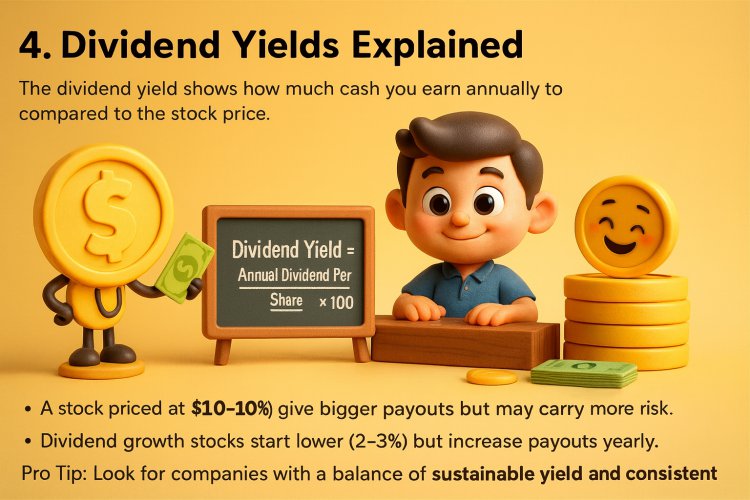

4. Dividend Yields Explained

The dividend yield shows how much cash you earn annually compared to the stock price.

-

A stock priced at $100 paying $5 annual dividend has a 5% yield.

-

High-yield stocks (6–10%) give bigger payouts but may carry more risk.

-

Dividend growth stocks start lower (2–3%) but increase payouts yearly.

Pro Tip: Look for companies with a balance of sustainable yield and consistent growth.

5. How Dividends Build Long-Term Wealth

Dividends aren’t just about monthly or quarterly income. Over decades, they transform your portfolio.

Benefits:

✅ Steady Cash Flow – Perfect for covering bills in retirement.

✅ Protection Against Inflation – Dividend growth often outpaces inflation.

✅ Lower Risk – Dividend-paying companies are usually stable, profitable businesses.

✅ Compounding Effect – Reinvested dividends snowball wealth faster.

6. Real-Life Examples

-

Coca-Cola (KO): Has paid dividends for over 60 years, increasing payments every single year. A $1,000 investment in the 1980s is worth tens of thousands today—plus ongoing dividends.

-

Johnson & Johnson (JNJ): Another “Dividend King” with 50+ years of uninterrupted dividend growth.

-

S&P 500 Index Funds: Many ETFs pay quarterly dividends, giving you exposure to hundreds of companies at once.

7. Building a Dividend Portfolio

Here’s how to start:

-

Choose Reliable Companies

-

Dividend Aristocrats (25+ years of growth)

-

Sectors like utilities, consumer goods, healthcare

-

-

Diversify Across Industries

Don’t rely on one stock. Spread risk across 10–20 companies or ETFs. -

Reinvest Early

Use DRIP to maximize compounding. -

Set a Goal

Example: Want $1,000/month passive income? With an average 4% yield, you’ll need about $300,000 invested.

8. Dividends vs Other Passive Income Streams

-

Rental Income: Great, but requires property management.

-

Online Businesses: Profitable, but need ongoing work.

-

Royalties (books, music, patents): Unpredictable.

Dividends stand out because they are stable, reliable, and hands-off.

9. Common Mistakes to Avoid

-

Chasing High Yields Only – A 12% yield stock may collapse tomorrow.

-

Not Diversifying—Putting all your money in one dividend stock is risky.

-

Ignoring Taxes – Dividend income is taxable in most countries.

-

Withdrawing Too Early – Reinvest for growth before taking payouts.

10. The Future of Dividend Investing

With global inflation, uncertain markets, and automation changing jobs, passive income will become even more critical. Dividend investing is a strategy that:

-

Works across generations

-

Provides consistent income in retirement

-

Builds generational wealth for your family

Final Word

Dividends are proof that you don’t have to work forever for money — your money can work for you.

By carefully choosing dividend-paying stocks, reinvesting consistently, and being patient, you can create a reliable stream of passive income that grows year after year.

Start small. Be consistent. Let compounding do the magic. One day, your dividends could pay for your rent, your groceries, or even your retirement lifestyle.

Action Step: Research 3 dividend-paying companies or ETFs today and commit to building your passive income portfolio.

What's Your Reaction?