Why Hard Workers Retire Poor — And How to Break the Cycle

Many people work hard their entire lives but retire broke — not because they lacked effort, but because they misunderstood money. This story-driven article explores why hard work alone doesn’t build wealth, how the system keeps workers trapped, and how you can break free by thinking like an investor, not an employee. It’s a mindset shift from earning income to creating assets, written for the modern African dreamer ready to build financial freedom.

There’s a quiet tragedy in the modern world that most people don’t notice until it’s too late. It’s the story of men and women who spend forty years working hard, saving a little, paying bills on time, and believing that someday, their effort will translate into freedom. They follow the rules, show up early, leave late, and still retire broke, anxious, or dependent.

It’s not because they were lazy. It’s because the system never taught them how money truly works.

Let’s start with a story that echoes across generations.

The Tale of Wanjiku and the Promise of Hard Work

Wanjiku was born in a small town in Kenya in the 1970s. Her parents drilled one lesson into her head: work hard in school, get a good job, and your life will be better than ours.

She did exactly that. She studied, graduated, and became a civil servant. For decades she worked diligently, raising three children and paying school fees on time. She contributed to the national pension fund, tithed faithfully at church, and avoided debt whenever she could. She was the model citizen.

But as retirement approached, Wanjiku noticed something unsettling. Her pension couldn’t sustain her lifestyle. Prices kept rising faster than her savings. Her children, burdened with their own bills, could only help occasionally. She realized that although she had earned millions over her lifetime, she didn’t own assets — only memories of hard work.

Her story is not unique. It’s the same in Nairobi, Lagos, Accra, and even New York. Millions of honest workers spend their lives chasing financial security, only to retire dependent, disillusioned, or quietly broken.

Why?

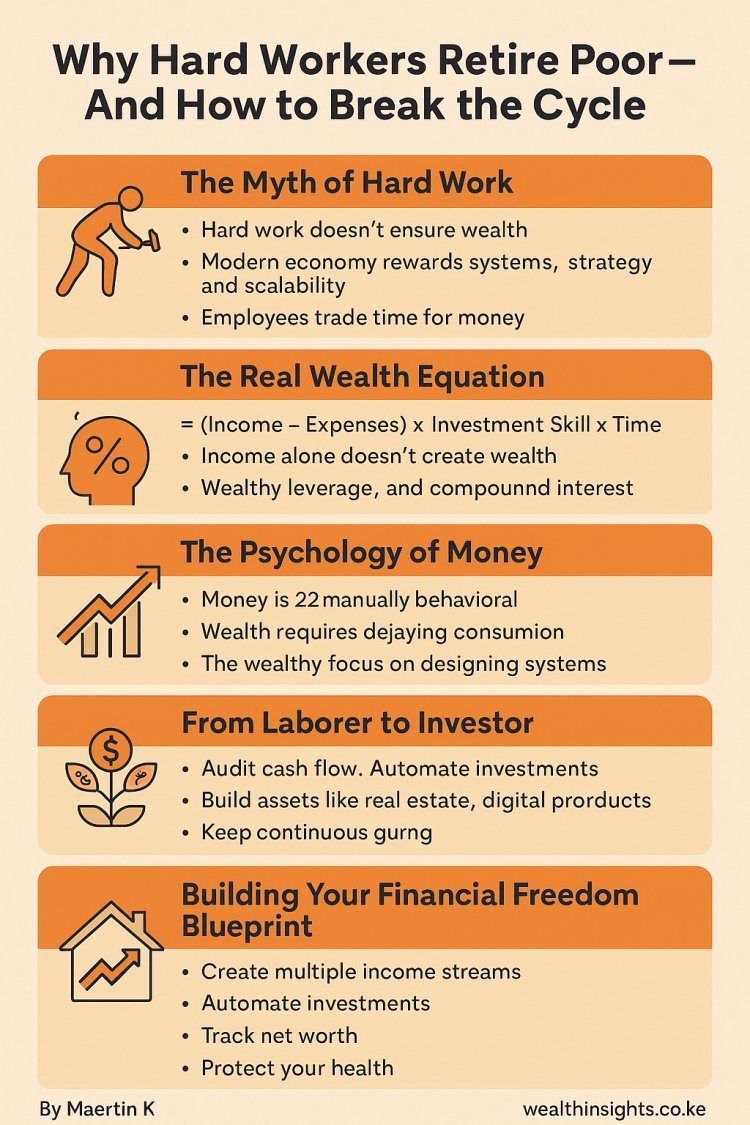

The Myth of Hard Work

From the time we are young, society programs us to worship hard work. It’s the moral backbone of our culture: the idea that effort equals success. The problem is, that rule stopped working decades ago.

Hard work pays your bills, but it rarely builds your wealth. The global economy doesn’t reward sweat; it rewards systems, strategy, and scalability. The people who grow rich in the 21st century are not those who work the longest hours — they’re the ones who understand how to make money work for them.

In the industrial age, effort was everything. A factory worker could climb the ladder, buy land, and retire comfortably. But in the digital and financial age, capital works faster than labor. The stock market grows while you sleep. Real estate appreciates while you’re at work. Business systems scale while you rest.

Yet most people are stuck trading hours for income, living month to month, and calling it “stability.”

The System Was Never Designed for You to Win

It’s uncomfortable, but true: the modern financial system is designed to keep the majority working for the minority. Salaries keep people predictable. Debt keeps them obedient. Consumption keeps them distracted.

Think about it. Every pay raise comes with a new lifestyle upgrade — a better phone, a bigger house, a new car loan. The system quietly ensures that as income grows, expenses grow faster. It’s not a conspiracy; it’s psychology. Humans equate comfort with progress.

The credit card companies, insurance firms, and advertising agencies understand this perfectly. They sell dreams wrapped in convenience. The more you earn, the more they convince you to spend. Before long, you’re a slave to your own image — working for your status, not your freedom.

That’s why so many retirees look back and realize they’ve built a comfortable cage, not a fortress.

Why Saving Alone Doesn’t Work

“Save money,” they told us. And yes, saving is good — but it’s not enough.

If you had saved 1 million shillings in 2000, by 2025 inflation would have quietly stolen most of its power. The money would buy less food, less fuel, less peace. Saving without investing is like collecting rainwater in a bucket with holes.

The poor and middle class save to feel safe. The wealthy invest to stay free.

Money is not meant to sit idle; it must flow, multiply, and compound. The earlier you understand this, the sooner you step off the treadmill. That’s why financial literacy — not income — is the real dividing line between workers and wealth builders.

The Hidden Cost of Financial Illiteracy

Financial illiteracy isn’t just ignorance. It’s expensive. It’s the reason a teacher earning KSh 70,000 a month ends up with nothing after 30 years, while an investor earning the same amount turns it into millions.

Because the teacher only knows how to earn money, not how to grow it.

Schools teach algebra, history, and grammar, but not how to buy an asset, build credit, or calculate compound interest. We graduate fluent in theory but illiterate in money.

Without this knowledge, people make predictable mistakes:

-

They buy liabilities thinking they’re assets.

-

They invest too late and too little.

-

They chase quick profits instead of long-term value.

-

They depend entirely on a single income stream.

Financial illiteracy guarantees that even hardworking people retire broke — not because they didn’t earn enough, but because they never learned to multiply what they earned.

The Power of Financial Education

Every wealthy person you admire — from Warren Buffett to local entrepreneurs — built wealth not by luck but by understanding how the game works. They learned the rules, then stopped playing like employees.

The first rule of wealth is simple: money is a tool, not a goal.

When you see money as a tool, you stop hoarding it and start deploying it. You put it in assets that produce income — real estate, stocks, SACCO dividends, digital businesses, royalties, or intellectual property. Each shilling becomes a worker employed by you.

The second rule: wealth is built in silence.

While the masses chase flashy lifestyles, the wealthy accumulate assets quietly. They understand delayed gratification — living below their means so their money can grow beyond their years.

The third rule: time matters more than talent.

Compounding doesn’t care about your degree or your job title. It only rewards consistency. The earlier you start investing, the more time your money has to multiply. A 25-year-old who invests KSh 5,000 a month can outperform a 40-year-old investing KSh 15,000, simply because of time.

How Hard Work Becomes a Trap

There’s a dangerous comfort in the paycheck.

At first, it feels empowering — a symbol of achievement. But over time, it becomes a leash. You get used to the rhythm: work, earn, spend, repeat. The job becomes an identity. The routine becomes a cage.

People stop taking risks, stop learning new financial skills, stop thinking like owners. They fear losing income more than they fear losing time. And slowly, they trade freedom for familiarity.

By the time retirement arrives, they discover the harsh truth — the paycheck was never the prize; it was the illusion.

The Real Wealth Equation

Let’s simplify wealth into one equation:

Wealth = (Income – Expenses) × Investment Skill × Time

Most people only focus on the first variable — income. They work harder to earn more. But without mastering investment skill and time, the equation never compounds.

A high salary without investment is a treadmill.

A small salary with wise investing is a staircase.

The wealthy understand leverage — how to make other people’s time, money, and systems work for them. They study assets like ordinary people study entertainment. They let compound interest do the heavy lifting.

That’s why Warren Buffett says: “If you don’t find a way to make money while you sleep, you’ll work until you die.”

The Psychology of Money

Money is 80% behavior and 20% knowledge.

Even with access to information, most people fail to act because of fear, ego, or impatience. They want quick returns and instant gratification. But wealth grows slowly, invisibly, and silently.

The poor chase luck; the wealthy design systems.

One of the greatest psychological shifts is learning to delay consumption. Every shilling you invest is a seed — not a sacrifice. When you start seeing money as energy, not currency, you start directing it into productive flows instead of emotional purchases.

The African Reality

Let’s ground this in our context. In Kenya, Nigeria, and Ghana, the story is the same: people work hard, but financial systems favor the few who understand how to play the asset game.

The average worker joins a SACCO, but rarely studies how to leverage it. They contribute just enough to withdraw loans — not to build capital. They open savings accounts instead of investment portfolios.

Meanwhile, a small percentage quietly buy stocks in Safaricom, KCB, Equity Bank, Dangote Cement, or MTN. They collect dividends every year, and those dividends pay their bills long after retirement.

The lesson? Wealth in Africa is not about earning more — it’s about thinking differently.

From Laborer to Investor

Here’s the turning point.

To break the cycle, you must transition from working for money to making money work for you.

That transition starts with awareness, but it’s completed by systems.

-

Audit your cash flow. Track every shilling. Know where it goes. Awareness is control.

-

Pay yourself first. Automate 20–30% of your income into investments before you spend.

-

Build assets deliberately. Every income stream should create an asset — rental property, digital product, business shares, or intellectual property.

-

Diversify intelligently. Mix safe assets (money market funds, SACCOs) with growth assets (stocks, ETFs, real estate).

-

Protect your capital. Insurance and emergency funds are shields, not expenses.

-

Keep learning. Read The Psychology of Money, Rich Dad Poor Dad, and local authors like Centonomy’s Personal Finance Guide.

Wealth is built on behavior, not brilliance.

The Compounding Mindset

Imagine a mango tree. The first few years, it looks unproductive — small, vulnerable, almost pointless. Then one day, it starts bearing fruit, and never stops. That’s what compounding feels like.

Every smart decision multiplies future outcomes. Every foolish one steals them.

The tragedy is that most people uproot their tree before it bears fruit. They withdraw investments too early, chase trends, or give up when returns seem small. But compounding only works for the patient.

That’s why the wealthy seem “lucky” — they simply started early and stayed consistent.

The Cultural Problem: Success as Consumption

In Africa, success is often measured by appearance — cars, houses, weddings, designer clothes. That’s not success; that’s theater.

Real success is measured by how long you can sustain your lifestyle without working. If you stopped earning today, how many months could you live comfortably? That’s your true wealth score.

We don’t need more consumers. We need more creators, investors, and thinkers who understand that wealth is invisible before it’s visible.

The Power of Ownership

Ownership is the cornerstone of freedom.

When you own assets — a business, stock portfolio, real estate, or intellectual property — you stop trading time for survival. Ownership gives you leverage.

The problem is, most people rent their lives — homes, cars, ideas, even time. They build other people’s empires and call it security.

The rich own; the poor owe.

You don’t have to be born rich to start owning. Begin small. Buy one share of a solid company. Start a micro-business. Create digital content that pays you royalties. Every ownership step, however small, moves you closer to freedom.

Breaking Generational Poverty

Generational poverty is not just financial — it’s mental. It’s passed down through beliefs: “jobs are safer than business,” “investing is risky,” “money is evil.”

Breaking it starts with education and example. When children see parents budgeting, investing, and discussing money openly, they inherit confidence instead of fear. When they see you prioritize assets over image, they learn what real wealth looks like.

Legacy isn’t what you leave for them; it’s what you leave in them.

Redefining Retirement

Retirement should not mean “stop working.” It should mean “stop depending.”

The goal is not to quit the game, but to change how you play it. True retirement is when your passive income exceeds your living expenses. That can happen at 35 or 65 — it depends on how you design your systems.

Imagine having rental income, dividends, royalties, and digital products covering your bills. You could still work, but by choice, not necessity. That’s freedom — not the illusion of a pension, but the reality of autonomy.

Building Your Financial Freedom Blueprint

Let’s bring this full circle.

If Wanjiku could go back in time, she’d change just three things:

-

Start investing the first year she earned income.

-

Spend less on things that fade and more on things that grow.

-

Learn the language of money as seriously as she learned her career.

Those three shifts would have rewritten her future.

You can still make them today. Whether you’re 25 or 55, you can start designing your Financial Freedom Blueprint:

-

Create multiple income streams.

-

Automate investments.

-

Track your net worth.

-

Learn continuously.

-

Protect your health.

Wealth is not luck; it’s structure.

The New Definition of Success

Success in this century is not about titles or cars; it’s about control. The ability to wake up and decide how to spend your day without worrying about the bills. That’s the ultimate luxury.

Working hard is honorable. But working smart — intentionally, strategically, and with purpose — is transformational.

The poor chase salaries.

The middle class chase comfort.

The wealthy chase freedom.

Choose your chase wisely.

By Maertin K | WealthInsights.co.ke

Building Africa’s Financially Free Generation

Join the Wealth Insights community to start your financial freedom journey.

What's Your Reaction?