Debt Management in Africa: A Step-by-Step Framework to Break Free from Loans, Digital Credit, and High-Interest Traps A Corporate-Grade Debt-Elimination System for African Households and Professionals

A step-by-step debt-elimination system for Africans facing loans, digital credit, and high-interest traps. Learn restructuring, refinancing, and behavior change.

INTRODUCTION: THE NEW FACE OF DEBT IN AFRICA

Debt in Africa has evolved dramatically over the last decade. What used to be formal bank loans and cooperative-based borrowing has expanded into a sprawling ecosystem of:

• Digital lending apps with triple-digit annualized interest

• Mobile-money overdrafts

• Buy-now-pay-later schemes

• Salary-backed loans

• Credit cards with hidden fees

• SACCO loans exceeding members’ repayment capacity

• Informal lending networks

• Loan sharks that operate outside regulatory limits

For millions of African households, debt is no longer a temporary financial setback—it has become a structural constraint. Rising inflation, currency depreciation, stagnant salaries, and high cost of living amplify the burden. The new reality demands a disciplined, data-driven, behavioral, and strategic approach to debt elimination, not motivational advice.

This framework delivers an institutional-level debt management strategy tailored to African markets.

SECTION 1: THE MACROECONOMIC CONTEXT DRIVING DEBT GROWTH IN AFRICA

Before solving debt, you must understand why it grows so aggressively in African economies.

1.1 Inflation Outpaces Income

Across East, West, and Southern Africa, inflation runs at 8–30 percent while salary increments average 3–6 percent. This drives individuals to borrow to bridge consumption gaps.

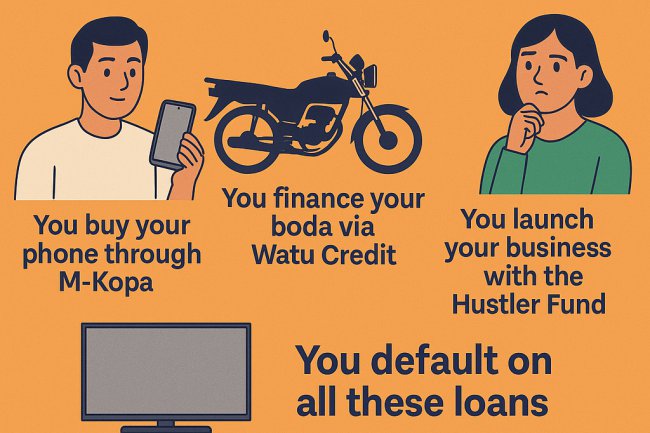

1.2 Digital Lending Expansion

Africa now has over 500+ digital credit providers. Their value proposition—“instant loans”—hides:

• High-interest structures

• Short repayment windows

• Penalty surcharges

• Data blacklisting

• Psychological pressure via SMS reminders

1.3 Currency Depreciation

A depreciating currency makes imported goods more expensive, increasing reliance on credit to maintain lifestyle standards.

1.4 Lack of Formal Financial Planning

Research shows over 70 percent of African consumers do not use structured budgeting or long-term planning tools.

SECTION 2: THE AFRICAN DEBT PYRAMID — UNDERSTANDING YOUR POSITION

To manage debt effectively, classify it by risk and urgency.

Tier 1: Toxic Debt (High Interest + Short Tenor + High Penalties)

• Digital loans

• Loan apps

• Mobile-money overdrafts (Fuliza, M-Pesa overdraft equivalents)

• Salary advances

• Loan sharks

This category must be eliminated first.

Tier 2: Pressure Debt (Moderate Interest + Medium Tenor)

• SACCO loans

• Personal bank loans

• Hire-purchase

• Credit cards

Needs structured repayment.

Tier 3: Constructive Debt (Low Interest + Long Tenor + Asset-Linked)

• Mortgages

• Education loans

• Business loans tied to revenue

• Agricultural loans

These are manageable and sometimes wealth-creating.

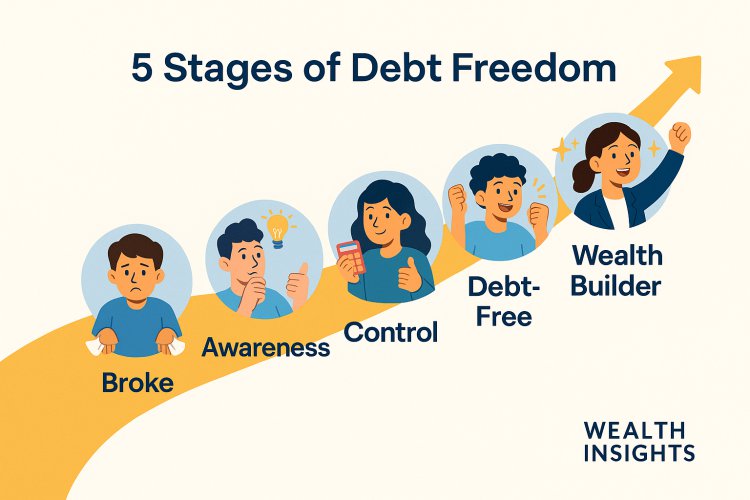

SECTION 3: THE CORPORATE-GRADE DEBT ELIMINATION SYSTEM (8 STEPS)

This blueprint leverages corporate finance principles, restructuring techniques, and behavioral economics.

STEP 1: Conduct a Full Debt Audit

List every debt including:

• Principal amount

• Interest rate

• Penalties

• Tenor

• Minimum monthly payment

• Consequences of default

• Collateral (if any)

• Current balance

Then calculate:

Effective Annual Rate (EAR) to understand true cost.

Debt-to-Income Ratio (DTI) = Total monthly debt payments / Monthly income.

Debt Severity Score (DSS) using a 3-tier ranking system (Toxic, Pressure, Constructive).

This transforms emotional debt into a manageable financial spreadsheet.

STEP 2: Stop Borrowing Immediately (Debt Freeze Protocol)

You cannot exit debt while injecting new debt.

Implement a 90–180 day debt freeze, including:

• Delete loan apps

• Block mobile overdrafts

• Disable auto-advance features

• Stop using credit cards

• Pause all non-essential purchases

This is the operational equivalent of stopping the financial bleeding.

STEP 3: Restructure and Negotiate Existing Debt

African lenders respond positively to restructuring requests.

Negotiate:

• Lower interest rates

• Extended repayment period

• Removal of penalties

• Consolidation of multiple digital loans

• Settlement discounts for lump-sum payments

• Grace-period arrangements

Corporate finance teams treat restructuring as a standard tool. It is not a weakness—it's strategic execution.

STEP 4: Build a 30–60 Day Emergency Buffer

This may seem counterintuitive, but without liquidity, you will relapse into borrowing.

Use:

• Money Market Funds

• SACCO deposits

• Low-risk cash reserves

Target: One month of expenses before aggressively repaying debt.

STEP 5: Deploy the Two-Track Repayment Engine

Track A: Avalanche Method (Mathematically Optimal)

Pay off debts with highest interest first (digital loans, overdrafts).

Track B: Snowball Method (Psychologically Optimal)

Pay off small debts first to create progress momentum.

Corporate Hybrid Model (Recommended)

• Prioritize high-interest digital loans

• Clear small debts simultaneously

• Maintain minimum payments on larger structured loans

This keeps financial momentum intact while minimizing total interest paid.

STEP 6: Refinance Into Lower-Cost Vehicles

Shift from high-interest instruments to cheaper ones:

• Use SACCO loans to clear digital loans

• Use secured loans to replace unsecured ones

• Use long-tenor bank loans to replace short-tenor pressure loans

• Convert variable-rate loans into fixed-rate when possible

This method is used widely in corporate treasury management.

STEP 7: Behavioral Economics — Rewire Your Financial Conduct

Debt is not just numbers—it is behavior.

Behavioral shifts include:

1. Spend Using Cash or Debit Only

Removes the psychological distortion of credit-based consumption.

2. Automate Debt Payments

Reduces temptation to reallocate funds.

3. Introduce Friction on Spending

Uninstall mobile shopping apps

Use a 24-hour decision delay

Keep money in MMFs (not M-Pesa balance)

4. Create Accountability Systems

Partner, mentor, or SACCO discipline mechanisms.

Behavioral economics strengthens long-term financial re-engineering.

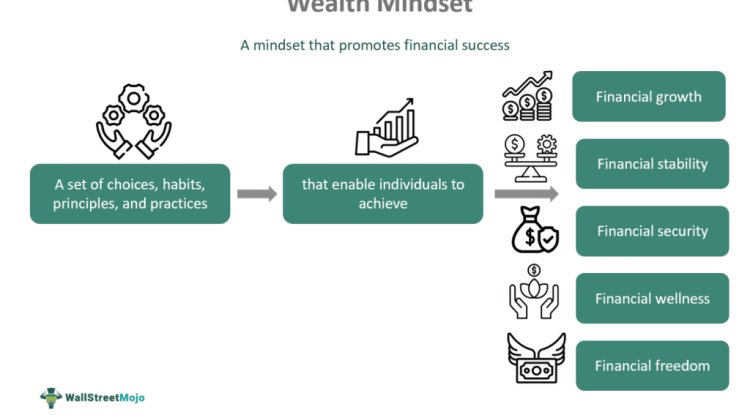

STEP 8: Build a Post-Debt Wealth System

The end goal is not “zero debt”—it is financial capability.

Once debt is cleared:

1. Redirect former debt payments into:

• Emergency fund

• SACCO savings

• MMFs

• T-Bills

2. Begin moderate investing:

• ETFs

• Pension funds

• Real estate micro-investments

3. Build long-term wealth architecture:

• 5-bucket system

• Offshore diversification

• Insurance and risk protection

Debt-free consumers have higher lifetime wealth trajectory.

SECTION 4: COUNTRY-SPECIFIC DEBT DYNAMICS

Kenya

• High digital loan penetration

• M-Pesa overdraft dependence

• Strong SACCO ecosystem for refinancing

Nigeria

• High inflation drives borrowing

• Salary-backed loans common

• Digital credit adoption rising

Ghana

• Currency weakness increases cost of imports

• Higher reliance on bank loans

• Restructuring essential due to interest volatility

South Africa

• Credit cards and store credit dominate

• Strong formal banking structure

• Debt counselling legally supported

SECTION 5: THE AFRICAN DEBT-FREE ACTION PLAN

-

Audit all debts for full visibility

-

Freeze borrowing for 90–180 days

-

Negotiate, restructure, consolidate

-

Build a liquidity buffer

-

Execute the Avalanche + Snowball hybrid

-

Refinance into cheaper instruments

-

Implement behavioral controls

-

Build a post-debt wealth infrastructure

This system is structured, repeatable, and proven across both corporate finance and personal financial behaviour models.

CONCLUSION: THE PATH TO A DEBT-FREE AFRICAN FUTURE

Debt is not a moral failure. It is a system—and systems can be redesigned. African markets are volatile, but they also offer some of the most accessible refinancing, cooperative finance, and savings vehicles globally.

With strategic execution, disciplined behaviour, and the right tools, any individual—from a young professional to a small business owner—can transition from chronic debt survival to long-term financial capability.

What's Your Reaction?