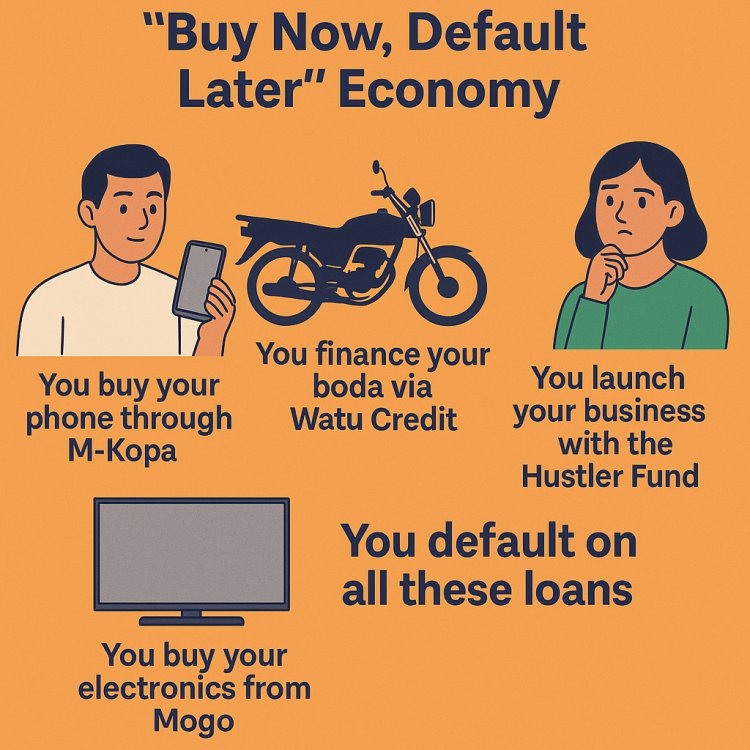

The Rise of the "Buy Now, Default Later" Economy in Kenya

Explore how digital credit, asset financing, and mobile loans have fueled a debt culture in Kenya. This in-depth guide reveals the causes, effects, and solutions to the rising trend of defaults in the new economy.

Kenya has emerged as one of Africa's most vibrant economies, particularly in the realm of digital finance. With the proliferation of fintech solutions, mobile money platforms, and flexible lending schemes, more citizens now have access to financial tools than ever before. However, this accessibility has given rise to a concerning trend—the normalization of defaulting on debts. It is becoming increasingly common for individuals to finance everything from mobile phones to motorcycles, electronics, and even businesses on credit, only to default shortly after.

This blog delves into the root causes, the enabling systems, the socio-economic impact, and possible solutions for this rapidly evolving “Buy Now, Default Later” economy in Kenya. Our goal is not just to highlight the issue but to initiate a national conversation around accountability, discipline, and sustainable financial growth.

1. The Explosion of Digital Credit in Kenya

Kenya is internationally recognized for its fintech revolution, with innovations like M-Pesa changing the way people interact with money. Building on this, numerous lending platforms have emerged offering products that target the everyday Kenyan.

-

M-Kopa allows individuals to acquire smartphones and solar systems and pay in small daily installments via mobile money.

-

Watu Credit provides motorcycles to boda boda riders, who pay gradually from their earnings.

-

Mogo extends financing for electronics, vehicles, and even logbook loans.

-

The Hustler Fund, introduced by the government, offers microloans to support small business ventures.

These innovations are valuable. They empower low-income earners and small business owners. But the flip side is a culture of easy borrowing, often without understanding the repayment obligations.

2. The Anatomy of the New Default Culture

Across cities, towns, and rural areas in Kenya, the pattern is repeating:

-

A boda rider acquires a bike through Watu Credit and starts operations.

-

A trader buys a new phone on M-Kopa to run their business.

-

A household purchases a television or cooker on credit.

-

A youth group accesses the Hustler Fund to launch a side hustle.

Within months, defaults occur. The phone is switched off, the motorcycle is hidden or moved to another county, and the business is no longer operational. Repayments cease. Borrowers avoid calls and communication from lenders. For many, default becomes a default option.

Why? The reasons are multi-faceted.

3. Key Drivers Behind the Default Epidemic

a) Economic Pressure and Job Instability

Kenya’s informal economy accounts for over 80% of employment. Most jobs are casual, unpredictable, and underpaid. In such a landscape, any shock—illness, theft, loss of income—can derail repayments.

b) Low Financial Literacy

Many borrowers don’t fully understand loan terms, interest calculations, or what happens in the event of a default. Few know their credit scores or how to build a good one.

c) Social Pressures and Lifestyle Image

Consumerism is on the rise. Smartphones, motorbikes, and flashy electronics are tied to one’s identity. People acquire them even if it means going deep into debt.

d) Perceived Lack of Consequences

Due to poor enforcement mechanisms, some borrowers feel they can default without penalty. When lenders fail to follow up or repossess, the habit spreads.

e) Loan Overlap and Multiple Borrowing

Borrowers often have multiple concurrent loans from different platforms. They use one loan to repay another, creating a cycle that eventually crashes.

4. The Impact of Default Culture on the Economy

a) Rising Non-Performing Loans (NPLs)

Banks and digital lenders are reporting high NPL rates. This makes them more cautious, reducing access for genuine borrowers who need credit to grow.

b) Reputational Damage to Lenders

Repeated defaults make it harder for companies to operate sustainably. It also discourages international fintechs and investors from entering the Kenyan market.

c) Erosion of Trust in Financial Systems

When people lose trust in repayment or the usefulness of credit, the financial ecosystem weakens.

d) Emotional and Mental Strain

Debt pressure contributes to anxiety, depression, and even family conflict. Many defaulters suffer silently due to the stigma and stress of unpaid loans.

e) A Generation of Borrowers, Not Builders

Kenya risks raising a generation that sees credit as a quick fix rather than a tool for disciplined growth.

5. How to Build a Healthy Credit Culture in Kenya

a) Financial Literacy Campaigns

Public and private stakeholders must partner to roll out accessible, engaging financial education. Topics should include:

-

Understanding credit

-

Budgeting and saving

-

Building and maintaining a good credit score

-

Dangers of overborrowing

b) Regulation and Credit Scoring Innovation

The Central Bank of Kenya (CBK) and CMA must enforce stricter guidelines on lending, including:

-

Clear loan terms and total cost visibility

-

Reporting defaults to a centralized credit bureau

-

Incentives for good repayment behavior

c) Responsible Lending Models

Lenders should conduct better risk assessments and offer repayment plans that match income flows (e.g., daily income earners).

d) Technology-Driven Repayment Tools

Apps that allow flexible micro-repayments, reminders, and auto-deductions can enhance repayment compliance.

e) Empower Borrowers to Transition to Builders

Encourage investments in income-generating ventures (e.g., agribusiness, ecommerce, gig work) instead of pure consumption-based borrowing.

6. The Role of Government, Churches, and Influencers

Financial transformation must go beyond apps and banks. It must reach:

-

Churches and mosques, where weekly gatherings can incorporate financial literacy.

-

Schools, where young people are taught personal finance early.

-

Social media influencers, who can change the narrative around debt and discipline.

-

Community-based organizations, which can offer group savings, training, and mentorship.

Kenya’s debt issue is not just financial—it’s cultural.

7. The Opportunity in the Crisis

Every crisis presents an opportunity. As Kenyans confront the consequences of this default culture, there’s a chance to:

-

Rebuild better credit systems

-

Launch ethical, transparent fintech solutions

-

Turn young consumers into wealth creators

-

Make Kenya a model for responsible digital finance in Africa

Lenders, borrowers, regulators, and educators must work together. Because the future of Kenya’s economy isn’t in how fast we borrow—but how wisely we repay.

Conclusion

Kenya is in the midst of a financial identity shift. From a cash economy to a digital one. From a saving culture to a borrowing one. But we must not let credit access destroy personal responsibility.

The future belongs to disciplined investors, responsible borrowers, and financially literate citizens. Let us move from "Buy Now, Default Later" to "Borrow Wisely, Build Boldly."

#WealthInsights #KenyaFinance #DigitalCredit #DefaultCulture #FinancialFreedom

What's Your Reaction?