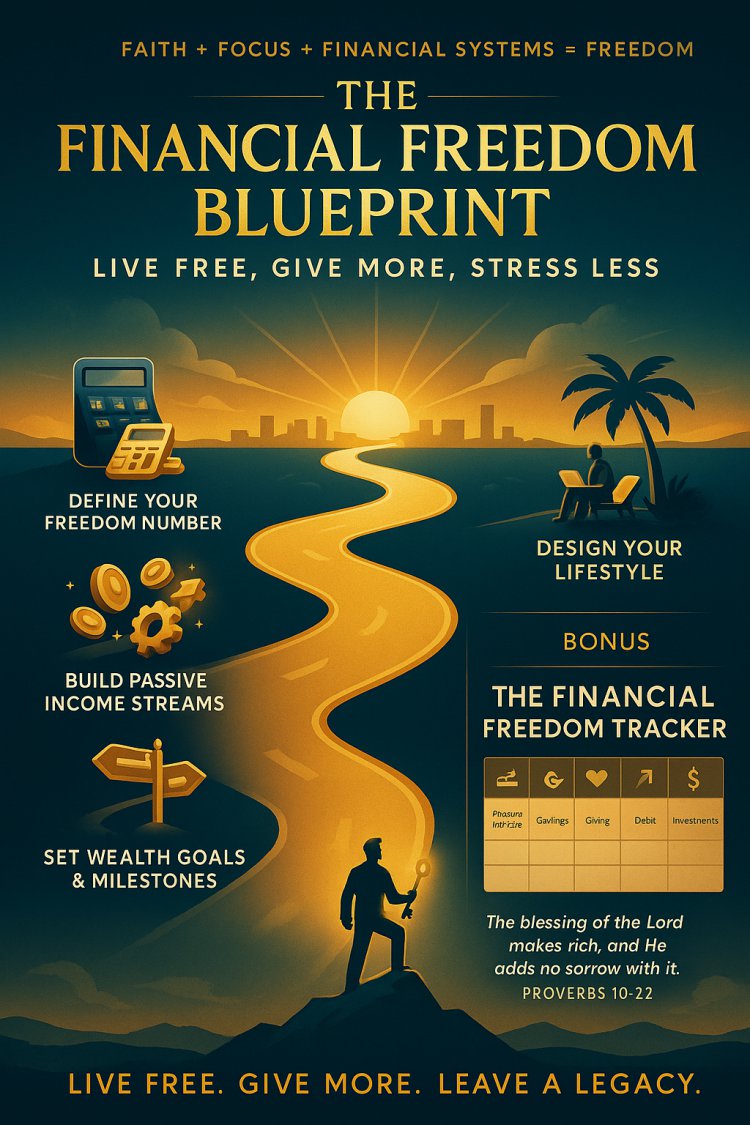

The Financial Freedom Blueprint: A Proven System to Build Wealth, Live Free, and Leave a Legacy

Discover a complete, faith-based financial freedom blueprint that helps you define your freedom number, replace active income with passive streams, set long-term wealth milestones, and design a stress-free lifestyle. Learn how faith, focus, and smart financial systems can unlock lasting wealth and true freedom.

Introduction: What True Financial Freedom Really Means

Financial freedom isn’t just about money — it’s about control. Control over your time, your energy, and your destiny. It’s about waking up every morning with the peace of knowing your bills are paid, your investments are growing, and your life aligns with God’s purpose.

In today’s world — from Nairobi to New York, from Lagos to London — people are chasing wealth but missing the freedom that should come with it. The truth is, you don’t achieve freedom by luck or talent; you achieve it through a blueprint — a deliberate system of faith, focus, and financial discipline.

This guide will help you build that system. You’ll learn how to define your Financial Freedom Number, replace active income with passive streams, set wealth milestones, and design a lifestyle that allows you to live free, give more, and stress less.

Let’s begin your roadmap to lasting wealth.

1. Defining Your Financial Freedom Number

Every journey starts with a destination. For financial freedom, that destination is called your Financial Freedom Number — the exact amount of monthly passive income you need to live comfortably without working actively for money.

How to Calculate It

-

List Your Monthly Expenses:

Include rent, food, transport, utilities, healthcare, entertainment, tithing, and giving. -

Add a Freedom Buffer (25–30%):

Life isn’t static — inflation, emergencies, or lifestyle changes happen. -

Multiply by 12:

That’s your annual freedom target. -

Example:

If your monthly living cost is $2,000, add 30% = $2,600 × 12 = $31,200 per year.

That’s the passive income target you need for total freedom. Once your investments and income streams consistently generate that amount, you’re financially free.

Why This Matters

Without a specific target, you’ll chase random goals forever.

Your Freedom Number becomes your compass — it tells you when to invest, how to scale, and when to transition from working for money to having money work for you.

2. Replacing Active Income with Passive Income

Most people depend entirely on active income — they work, they earn. But if they stop working, the income stops too. The wealthy operate differently. They build systems that pay them whether they work or not.

Understanding Passive Income

Passive income is money that flows in with minimal ongoing effort after the initial setup. It’s not magic — it’s strategy.

Common Passive Income Streams

-

Dividend Stocks and ETFs:

Invest in companies that share profits quarterly. In Kenya, firms like Safaricom, Equity Bank, and BAT are known for solid dividends. Globally, think Apple, Microsoft, or Vanguard ETFs. -

Real Estate Investments:

From Airbnb rentals in Nairobi to REITs (Real Estate Investment Trusts) in the U.S., property remains a timeless wealth pillar. -

Digital Assets & Online Businesses:

E-books, online courses, and affiliate marketing platforms can create ongoing revenue. Build once — earn forever. -

Money Market & SACCO Returns:

SACCOs in Africa (like Stima or Mwalimu) provide steady dividends and loan advantages. -

Business Systems:

Automate your business so it runs without you — using staff, software, or online infrastructure.

Transition Strategy

-

Phase 1: Use your job or business profits to build capital.

-

Phase 2: Invest that capital into income-generating assets.

-

Phase 3: Reinvest returns until passive income exceeds active income.

That’s the path to freedom — not quitting your job overnight, but strategically shifting from worker to owner.

3. Long-Term Wealth Goals and Milestones

Wealth is built in stages. It doesn’t happen overnight — it compounds over time.

Stage 1: Financial Stability

Goal: Cover your basic needs and eliminate high-interest debt.

Actions:

-

Build a 3–6 month emergency fund.

-

Create a zero-based budget.

-

Stop using bad debt to fund lifestyle.

Stage 2: Financial Growth

Goal: Multiply your savings through smart investments.

Actions:

-

Automate monthly investing.

-

Diversify across asset classes.

-

Track net worth quarterly.

Stage 3: Financial Freedom

Goal: Replace all active income with passive income.

Actions:

-

Focus on scalable business models.

-

Build cash-flowing assets.

-

Set systems that generate monthly passive returns.

Stage 4: Financial Legacy

Goal: Transfer wealth and wisdom to the next generation.

Actions:

-

Create a will or trust.

-

Teach financial literacy to your children.

-

Build businesses that outlive you.

As Proverbs 13:22 says, “A good man leaves an inheritance to his children’s children.”

Financial freedom is incomplete without legacy.

4. Lifestyle Design: Live Free, Give More, Stress Less

Money is a tool, not the goal. The goal is the life it enables you to live — one that aligns with your values and calling.

Simplify Your Life

True wealth isn’t about owning more; it’s about needing less. Learn to separate needs from wants. When you simplify, you free both time and mindspace.

Give More

The paradox of giving is that it expands your capacity to receive. Whether through tithing, charity, or helping family — generosity multiplies abundance.

Remember Luke 6:38: “Give, and it shall be given unto you.”

Your giving keeps wealth flowing, not stuck.

Design with Intent

Decide what freedom looks like for you:

-

Do you want to travel?

-

Work remotely?

-

Spend more time with family?

-

Fund a ministry or cause?

Design your financial goals around those answers — not society’s definition of success.

5. Faith, Focus, and Financial Systems

Faith: The Foundation of Prosperity

Financial freedom without faith often leads to emptiness. True wealth includes spiritual peace and purpose.

Invite God into your financial life — in planning, in decisions, in giving.

When faith becomes your foundation, money becomes a servant, not a master.

“But remember the Lord your God, for it is He who gives you the ability to produce wealth.” — Deuteronomy 8:18

Focus: The Power of Discipline

Focus is what turns dreams into reality.

Create daily habits that build momentum:

-

Review your goals weekly.

-

Read one financial book per month.

-

Avoid distractions — not every opportunity is your assignment.

Success follows those who stay consistent long after the excitement fades.

Financial Systems: The Engine of Freedom

Freedom thrives on systems, not motivation. Systems automate discipline.

Practical systems to set up:

-

Automated Saving & Investing: Set auto-transfers to your investment account.

-

Expense Tracking: Use apps like Mint, YNAB, or Chumz.

-

Debt Repayment Plan: Snowball or avalanche methods work well.

-

Monthly Review Ritual: Evaluate spending, income, and net worth.

Once your financial system runs smoothly, you’ll have freedom without chaos.

6. The Power of Compound Growth

Albert Einstein once called compound interest the “eighth wonder of the world.”

It’s simple: when your money earns returns, and those returns earn more returns — your wealth accelerates exponentially.

Formula:

A = P (1 + r/n)ⁿᵗ

-

A = Future Value

-

P = Principal

-

r = Annual Interest Rate

-

n = Number of compounding periods per year

-

t = Time in years

Example:

Invest $1,000 at 10% annually, compounded yearly:

A = 1,000 × (1.10)¹⁰ = $2,593.74

After 30 years = $17,449

That’s the quiet miracle of time — small amounts today create massive outcomes tomorrow.

Faith and patience are the twin engines of wealth.

7. The Financial Freedom Tracker

To achieve freedom, you must track progress. What gets measured gets improved.

Here’s how to build your own Financial Freedom Tracker:

| Category | Goal (Monthly) | Actual (Monthly) | Gap | Action Plan |

|---|---|---|---|---|

| Passive Income | $2,500 | $1,200 | $1,300 | Add another income stream |

| Savings Rate | 30% | 20% | 10% | Automate savings transfer |

| Debt Reduction | $300 | $200 | $100 | Increase payment frequency |

| Giving | 10% | 10% | 0 | Continue |

| Investment Growth | 12% | 9% | 3% | Diversify portfolio |

Step-by-Step:

-

Set financial goals by category.

-

Update your tracker monthly.

-

Review progress every 90 days.

-

Adjust based on real results.

This transforms financial freedom from dream to data-driven reality.

8. The Mindset Shift: From Scarcity to Abundance

Freedom starts in the mind before it shows up in your bank account.

People stuck in a scarcity mindset say:

-

“Money is hard to get.”

-

“I’ll never catch up.”

-

“The system is rigged.”

But abundant thinkers declare:

-

“Money flows to value.”

-

“I can create solutions.”

-

“God is my source.”

Your mindset determines your financial altitude.

You can’t build wealth with a poverty mindset.

Faith unlocks abundance, because you stop focusing on lack and start creating value.

9. Financial Freedom Across Generations

Freedom is fragile if it ends with you.

True success means passing wealth, wisdom, and systems to others.

Build Structures

-

Set up trusts, insurance, or investment accounts for your children.

-

Document passwords, plans, and financial records securely.

-

Write a will — legacy doesn’t happen by accident.

Teach the Next Generation

Teach your children early about tithing, saving, and investing.

Show them that money is a tool for purpose, not power.

As you build generational wealth, remember: freedom without wisdom leads to waste.

10. Living in the Overflow

When you reach financial freedom, your life shifts from striving to serving.

You’re now free to mentor others, fund dreams, and live purposefully.

“The blessing of the Lord makes rich, and He adds no sorrow with it.” — Proverbs 10:22

Freedom isn’t an end — it’s a beginning. It’s the point where your wealth begins to impact lives beyond your own.

Live generously.

Give strategically.

Build eternally.

Conclusion: Your Faith-Fueled Freedom Plan

Financial freedom is not a fantasy. It’s a formula — built on faith, focus, and financial systems.

You now have the blueprint:

-

Define your Freedom Number.

-

Replace active income with passive income.

-

Build long-term goals and track your progress.

-

Align faith and finance through wise stewardship.

-

Live intentionally and create a legacy that lasts generations.

Start where you are.

Use what you have.

And trust that God’s plan for your finances is bigger than your fears.

This is your moment to rise — to build wealth that brings peace, purpose, and prosperity.

What's Your Reaction?