Investment Fundamentals: How to Build Long-Term Wealth Through Smart Investing

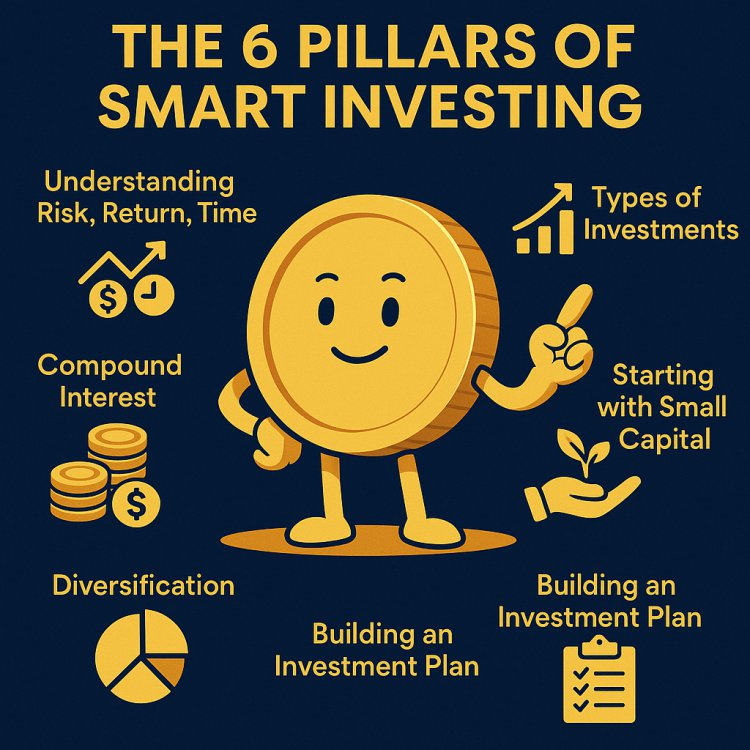

Discover the core investment fundamentals that help you build lasting wealth. Learn how to start investing with small capital, diversify your portfolio, and grow your money through stocks, bonds, real estate, SACCOs, and mutual funds. Designed for aspiring investors seeking financial freedom.

Introduction: The Foundation of Financial Freedom

Financial freedom is not about luck or chance — it is a result of strategic planning, disciplined investing, and a deep understanding of how money works. Whether you are just starting with limited capital or seeking to expand your portfolio, mastering the fundamentals of investing is essential.

In today’s fast-changing world, where digital assets, inflation, and global uncertainty reshape economies, financial literacy has become a survival skill. Investment knowledge is no longer a privilege for the elite; it’s a necessity for anyone who wants to achieve independence and long-term security.

This comprehensive guide explores the principles, tools, and strategies you need to become a confident investor — from understanding risk and return to crafting your personalized investment plan.

1. Understanding the Principles of Investing

Before you invest a single shilling or dollar, you must understand the three pillars of investing: risk, return, and time.

a. Risk

Every investment carries a degree of risk. The higher the potential reward, the higher the possible loss. Successful investors don’t run away from risk; they learn how to manage it through diversification, research, and patience.

b. Return

Return is the reward you earn from investing your money. It can come as interest, dividends, rent, or capital gains. The goal is to generate returns that outpace inflation — ensuring your money grows in real terms.

c. Time

Time is the most powerful ally of every investor. The longer your money stays invested, the more it compounds. Warren Buffett often says, “The stock market is a device for transferring money from the impatient to the patient.”

2. Types of Investments: The Building Blocks of Wealth

a. Stocks and ETFs

Stocks represent ownership in a company. When the company grows, your investment grows. Exchange-Traded Funds (ETFs) allow you to invest in a collection of stocks or assets, offering diversification even with small capital.

ETFs are ideal for beginners because they spread risk and track well-known market indexes like the S&P 500 or NASDAQ.

Example:

If you invest in an S&P 500 ETF, your money is automatically diversified across 500 leading companies, including Apple, Microsoft, and Amazon — without buying each individually.

b. Bonds and Treasury Bills

Bonds are loans you give to governments or corporations in exchange for fixed interest over a specific period. Treasury Bills (T-Bills) are short-term government securities with lower risk.

These are suitable for conservative investors who prioritize safety and steady income over high returns.

Example:

In Kenya, investing in government Treasury Bills through the Central Bank is one of the safest ways to earn predictable returns.

c. Real Estate and REITs

Real estate remains one of the oldest and most trusted investment vehicles. It provides both capital appreciation (value increase) and passive income (rent).

For those without large capital, Real Estate Investment Trusts (REITs) offer an affordable entry point. REITs allow you to buy shares in real estate projects — such as malls, apartments, or office complexes — and earn dividends from rental income.

Example:

You can invest in Acorn REITs in Kenya or global REITs listed on platforms like Vanguard or iShares.

d. SACCOs and Cooperatives

In many African economies, SACCOs (Savings and Credit Cooperative Organizations) remain the backbone of community investing. They promote saving discipline, offer loans at affordable rates, and pay annual dividends.

SACCOs are excellent for those starting their investment journey, particularly in developing economies where access to financial markets is limited.

Example:

A member of Stima SACCO or Mwalimu SACCO can earn annual dividends between 8–12% — a better return than most savings accounts.

e. Mutual Funds and Money Market Funds

Mutual funds pool money from multiple investors and invest in diversified assets like bonds, stocks, or money markets. They are professionally managed, making them ideal for beginners.

Money Market Funds (MMFs), a type of mutual fund, focus on short-term, low-risk investments and provide liquidity plus consistent returns.

Example:

Kenyan investors can start with as little as Ksh 1,000 in funds like Britam, CIC, or Sanlam Money Market Fund — earning 10–12% per year.

3. The Power of Compound Interest and Time Value of Money

Albert Einstein called compound interest the “eighth wonder of the world.” It is the process where your earnings themselves start earning. Over time, this exponential growth transforms small amounts into significant wealth.

Formula for Compound Interest:

A = P (1 + r/n)ⁿᵗ

-

A = Future value of investment

-

P = Principal amount

-

r = Annual interest rate

-

n = Number of compounding periods per year

-

t = Time in years

Example:

If you invest $1,000 at 10% annual interest compounded yearly for 10 years:

A = 1,000 × (1.10)¹⁰ = $2,593.74

That’s nearly triple your money — without adding more. Now imagine continuing for 30 years: you’d have $17,449.

The key lesson: Start early. Stay consistent. Let time work for you.

4. How to Start Investing with Small Capital

You don’t need millions to begin. What you need is commitment and structure.

Step 1: Define Your Goals

Decide what you’re investing for — retirement, education, business expansion, or wealth creation. Clear goals determine your risk tolerance and investment horizon.

Step 2: Budget Wisely

Follow the 50/30/20 rule:

-

50% of income for needs

-

30% for wants

-

20% for savings and investments

Automate this process through mobile apps or direct debit to avoid emotional spending.

Step 3: Start with Low-Cost Options

Begin with mutual funds, money market funds, or fractional stock investing platforms like Bamboo, Hisa, or Chumz in Africa.

Step 4: Reinvest Earnings

Don’t withdraw your profits; reinvest them. This accelerates compounding and increases long-term growth.

Step 5: Learn Continuously

Read investment books like “The Intelligent Investor” by Benjamin Graham or “Rich Dad Poor Dad” by Robert Kiyosaki. Knowledge is your greatest asset.

5. Diversification: The Shield and Sword of Investing

Diversification is spreading your money across different assets to reduce risk. It’s the difference between surviving market shocks and losing everything in one downturn.

Example:

During economic recessions, stock prices may fall, but bonds and real estate often remain stable. A diversified portfolio balances these fluctuations.

Basic Diversification Strategy

-

40% in stocks/ETFs

-

20% in bonds or T-Bills

-

20% in real estate or REITs

-

10% in SACCOs or cooperative savings

-

10% in cash or money market funds

This blend offers both growth and stability.

6. Practical Guide: Building a Beginner Investment Plan

Step 1: Assess Your Financial Health

Before investing, clear high-interest debts. You can’t grow wealth while paying 25% interest on loans. Create an emergency fund covering 3–6 months of expenses.

Step 2: Determine Your Investor Type

Are you conservative, moderate, or aggressive?

-

Conservative: Prioritize safety (bonds, MMFs, SACCOs)

-

Moderate: Balance risk and return (mix of ETFs, real estate)

-

Aggressive: Aim for high returns (stocks, startups, crypto — with caution)

Step 3: Choose the Right Platforms

Select licensed, regulated platforms. Avoid get-rich-quick schemes promising unrealistic returns.

Examples:

-

Kenya: Hisa, Absa, Britam, NCBA Investment

-

Nigeria: Bamboo, Cowrywise, PiggyVest

-

USA/Global: Vanguard, Fidelity, Charles Schwab

Step 4: Automate and Monitor

Set automatic contributions monthly. Review your portfolio quarterly to rebalance according to market changes.

Step 5: Stay Emotionally Disciplined

Market volatility can cause panic. Remember: short-term dips don’t define your long-term growth. Patience separates speculators from investors.

7. The Psychological and Biblical Principles of Wealth Building

Investing isn’t just about numbers — it’s about mindset and discipline.

a. Mindset Matters

Your financial growth mirrors your thought patterns. Scarcity thinking leads to fear and inaction. Abundance thinking fosters courage and consistency.

As the Bible says in Proverbs 21:5, “The plans of the diligent lead surely to abundance, but everyone who is hasty comes only to poverty.”

b. Stewardship

True investors see money as a tool entrusted by God to multiply and serve others. Stewardship is about responsibility — managing wealth with integrity and wisdom.

c. Faith and Patience

Ecclesiastes 11:2 advises: “Invest in seven ventures, yes, in eight; you do not know what disaster may come upon the land.”

Diversification and long-term patience are ancient principles of smart investing.

8. Common Mistakes to Avoid in Investing

-

Chasing quick profits: Real wealth takes time. Avoid get-rich-quick traps.

-

Ignoring fees and taxes: Even small management fees can eat into returns.

-

Lack of diversification: Never put all your money in one asset or business.

-

Emotional trading: Fear and greed are the enemies of discipline.

-

Neglecting research: Always understand what you’re investing in.

9. How to Grow Your Portfolio Over Time

As your income grows, reinvest in assets that align with your long-term vision. Gradually shift from high-risk to stable assets as you near retirement.

Use these growth strategies:

-

Increase monthly investment contributions annually

-

Reinvest dividends

-

Explore international diversification

-

Balance between income-producing and appreciating assets

10. The Road to Financial Freedom

Financial freedom is not a dream — it’s a process. It requires discipline, knowledge, patience, and action.

Start small, stay consistent, and trust the process. The earlier you start, the greater your advantage.

No one ever became wealthy by saving alone — they did it by investing wisely, staying informed, and letting time do its work.

Conclusion

Building long-term wealth is a journey of wisdom, faith, and discipline. When you understand the fundamentals — risk, return, time, and diversification — you take control of your financial destiny.

Whether you invest through SACCOs, mutual funds, ETFs, or real estate, the principles remain the same:

-

Start early

-

Stay consistent

-

Think long-term

-

Diversify wisely

-

Reinvest your gains

Remember: financial freedom is not earned in a single decision — it’s built through consistent, intentional action.

What's Your Reaction?