Personal Finance: The Art of Managing, Growing, and Protecting Your Money

A complete guide to personal finance in Kenya and Africa. Learn budgeting, saving, investing, and managing money effectively for long-term wealth.

Money is not just a means of survival — it’s a tool for building freedom, choices, and opportunities. Yet, many people spend their entire lives working for money without ever learning how to manage it.

Personal finance is the skill that separates those who control money from those controlled by it. It’s not about earning millions overnight — it’s about managing every shilling, dollar, or naira with purpose.

This guide simplifies personal finance for the modern African — from budgeting and saving to investing and long-term wealth planning.

1. What Is Personal Finance?

Personal finance is the process of managing your money — how you earn, spend, save, invest, and protect it.

It covers:

-

Budgeting

-

Saving

-

Debt management

-

Investing

-

Insurance and protection

-

Retirement planning

The goal is financial independence — the ability to live well without relying on salary alone.

2. The Five Foundations of Personal Finance

| Foundation | Goal | Example |

|---|---|---|

| Budgeting | Control money flow | Create a monthly plan for income and expenses |

| Saving | Build emergency & opportunity funds | Save 10–20% of income |

| Debt Management | Reduce financial stress | Pay off high-interest loans |

| Investing | Grow wealth | Buy assets that produce income |

| Protection | Safeguard against risk | Insurance, wills, diversification |

Mastering these five areas will transform your financial life.

3. Budgeting: Tell Your Money Where to Go

A budget is your financial GPS. Without it, your money disappears into untracked spending.

The 50-30-20 Rule

-

50% Needs — Rent, food, transport, utilities

-

30% Wants — Entertainment, clothes, travel

-

20% Savings/Investments — Build your future

Tools for Budgeting

-

Excel or Google Sheets

-

Chumz App, M-Pesa “Goal Saving”

-

Money Manager or Mint App

Budgeting isn’t restriction — it’s financial clarity.

4. Saving: Build a Cushion Before You Build Wealth

Savings give you security and flexibility. Before investing, establish an emergency fund equal to 3–6 months of expenses.

Where to Save

-

Money Market Funds (MMFs) – Britam, CIC, Zimele, Absa (8–11% p.a.)

-

SACCOs – Earn dividends + loan access

-

High-yield savings accounts

Automate It

Set a standing order from salary → savings → investment.

Saving manually rarely works — automate discipline.

5. Debt Management: Master Borrowing Before It Masters You

Debt can build wealth (business loans) or destroy it (consumer loans).

Good Debt

Used to buy assets or generate income (education, business equipment).

Bad Debt

Used to finance lifestyle or depreciating items.

Smart Debt Strategy

-

Keep debt-to-income ratio < 35%

-

Pay high-interest loans first

-

Avoid mobile loans for consumption

-

Negotiate better terms with lenders

The rule: Borrow to grow, not to survive.

6. Investing: Turn Savings into Growth

Saving protects you. Investing multiplies you.

Common Investment Options in Kenya & Africa

-

Money Market Funds – Safe entry point.

-

Treasury Bills & Bonds – Secure and predictable.

-

Stocks & ETFs – Higher returns over time.

-

SACCO Shares – Dividends + ownership.

-

Real Estate – Land, rentals, REITs.

-

Digital Investments – Hisa, Bamboo, Chumz, Absa Invest.

The Golden Rule

Start small, start now, and stay consistent. Compounding is your secret weapon.

7. The 3-Bucket Strategy for Wealth Management

Divide your income into three categories:

| Bucket | Purpose | Example |

|---|---|---|

| Short-Term | 0–1 year – Liquidity & emergency | MMF, savings account |

| Medium-Term | 1–5 years – Growth & flexibility | SACCO, bonds, unit trusts |

| Long-Term | 5 + years – Wealth & freedom | Stocks, real estate, business |

This balances safety, growth, and long-term vision.

8. Retirement Planning: Prepare for Tomorrow, Today

Retirement planning is not for the old — it’s for the wise.

Steps

-

Start Early: Even KES 1,000 monthly compounds.

-

Join Pension Plans: NSSF Tier II, Britam, Jubilee, Zamara.

-

Diversify: Don’t rely on one pension fund.

-

Reinvest Dividends: Let money work post-retirement.

Retirement is simply financial freedom that arrives early.

9. Insurance: Protect Your Financial Foundation

Without protection, one emergency can wipe out years of progress.

Essential Covers

-

Health Insurance: NHIF + private medical cover.

-

Life Cover: Protect dependents.

-

Education Plan: For children’s future.

-

Business & Asset Insurance: For entrepreneurs.

Insurance converts uncertainty into stability.

10. Financial Records and Tracking

Track your income, expenses, assets, and liabilities monthly.

Tools:

-

Notion or Excel Tracker

-

PocketGuard, Money Lover, Chumz App

Why it matters:

-

Helps you measure growth

-

Guides investment decisions

-

Keeps accountability

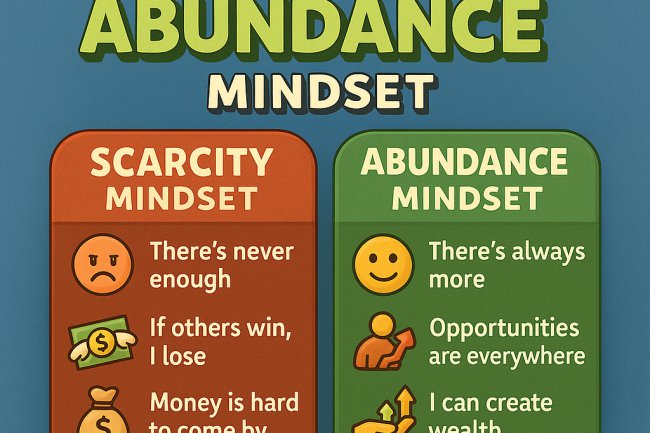

11. Mindset and Behaviour

Wealth starts with mindset — not income.

Replace:

-

“I can’t save” → “I can start small.”

-

“Investing is risky” → “Not investing is riskier.”

-

“I’ll start later” → “Today is the best day.”

Financial success = Discipline + Consistency + Time.

12. The African Opportunity

Africa’s youth population, mobile-money systems, and digital innovation create huge opportunities for financial growth.

-

Kenya: Fintechs like Hisa, Chumz, and Absa Invest democratize investing.

-

Nigeria: Platforms like Bamboo and Cowrywise open global markets.

-

Rwanda & Ghana: Expanding stock markets and SACCO culture.

Financial literacy is the next frontier of empowerment.

13. Mistakes That Keep People Broke

-

No budget or plan

-

Living for status

-

Not investing early

-

Ignoring insurance

-

Depending on one income

-

Confusing wants with needs

-

Lack of consistency

Correcting these early accelerates your financial freedom.

14. Practical Example: The 30-Year Plan

Let’s assume you start saving KES 10,000 monthly at 10% annual growth.

-

Year 5 → KES 774,000

-

Year 10 → KES 2.06 million

-

Year 20 → KES 6.9 million

-

Year 30 → KES 19.8 million

That’s the power of compounding — wealth that works quietly while you sleep.

15. The Digital Tools for Personal Finance in Kenya

| Category | Tool | Function |

|---|---|---|

| Budgeting | Money Manager, Mint | Expense tracking |

| Saving | Chumz, M-Pesa Goals | Automated saving |

| Investing | Hisa, Bamboo, Absa Invest | Stocks + ETFs |

| SACCOs | Stima, Safaricom SACCO | Dividends + Loans |

| Pensions | Britam, Zamara | Long-term retirement |

| Market Info | NSE App, CMA Reports | Market updates |

Technology turns every smartphone into a financial office.

16. How to Build Multiple Streams of Income

| Stream | Description | Example |

|---|---|---|

| Active | Main job or business | Salary, freelancing |

| Semi-Passive | Requires setup | YouTube, blogging |

| Passive | Minimal effort | Dividends, MMF, rent |

Diversify now. One stream pays bills; others build wealth.

17. Personal Finance Checklist

-

Monthly budget created

-

Emergency fund (3–6 months)

-

Debts tracked and reduced

-

Investments started

-

Insurance active

-

Financial goals written

-

Records updated monthly

Financial success is measurable — check your list often.

18. The Future of Personal Finance in Africa

The next decade will redefine money management:

-

AI-driven investing tools

-

Digital currencies & tokenized assets

-

Youth-led financial education

-

Regional capital-market integration

Those who learn, adapt, and act will lead Africa’s wealth era.

Conclusion: Control Money, Control Your Life

Personal finance is not a one-time project — it’s a lifelong habit.

Your income level doesn’t determine your success — your management does.

Every shilling has a mission: either it works for you, or it escapes you.

Start small. Stay disciplined. Track your growth.

Over time, you’ll master the art of managing, growing, and protecting your money — and live the life you design.

— Maertin K | Wealth Insights Kenya

What's Your Reaction?