Best Budgeting Apps for Kenyans & Globally: Your 2026 Wealth Blueprint

Master your money with the top budgeting apps for Kenyans and global professionals. Compare M-Pesa integrated tools like CountPesa with global giants like YNAB and Revolut for 2026.

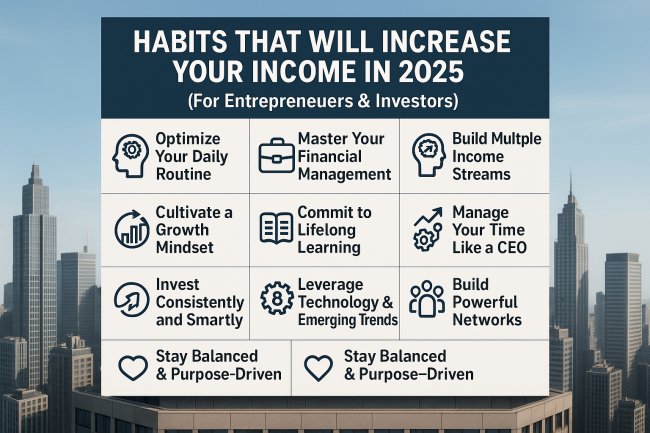

The New Frontier of Financial Management

In 2026, the way we handle money is no longer confined to physical ledgers or simple bank statements. For the global citizen and the Kenyan professional alike, the mobile phone has become a powerful financial command center. With inflation and shifting global markets, the ability to track every cent—whether in Kenyan Shillings or US Dollars—is the difference between financial stagnation and true wealth creation.

This guide explores the absolute best budgeting applications designed to bridge the gap between local Kenyan needs (like M-Pesa integration) and global financial standards.

1. The Best Apps Specifically for Kenyans

Kenya’s financial ecosystem is unique due to the dominance of mobile money. For a budgeting app to be truly effective in Nairobi or Mombasa, it must "speak" M-Pesa.

CountPesa and Caesh: The M-Pesa Specialists

These apps have become the gold standard for Kenyans because they automate the most tedious part of budgeting: data entry. By securely parsing your M-Pesa SMS notifications, CountPesa and Caesh automatically categorize your spending on "Buy Goods," "PayBill," and "Send Money" transactions. This provides a real-time view of your spending habits without you having to lift a finger.

Chumz: The Micro-Savings Powerhouse

For those looking to save, Chumz utilizes behavioral psychology to help you tuck away small amounts. It allows you to set "rules," such as rounding up your M-Pesa transactions and sending the spare change to a high-yield fund. It is an essential tool for anyone struggling to build an emergency fund.

M-Pesa Super App (Ratiba)

The official M-Pesa app has evolved significantly. The "Ratiba" feature allows you to schedule recurring payments, acting as a built-in budgeting tool. By automating your rent and utility payments directly within the app, you ensure your essential bills are covered before you spend on discretionary items.

2. Global Giants Worth Your Attention

If you are a professional working with international clients or someone who wants a more robust, "zero-based" budgeting philosophy, these global apps are unmatched.

YNAB (You Need A Budget)

YNAB is more than an app; it is a philosophy. It follows the "Four Rules," primarily that every dollar must have a job. In 2026, YNAB remains the top choice for people serious about getting out of debt. While it requires a subscription, the amount of money users typically save in their first year far outweighs the cost. It is available globally and supports manual entry for Kenyan users to track their local spending alongside global investments.

Wallet by BudgetBakers

Wallet is perhaps the most "global" app on this list. It supports over 150 currencies and offers bank synchronization with thousands of institutions worldwide, including several major Kenyan banks like Equity and KCB. Its "Groups" feature makes it perfect for families or small business partners to manage a shared pot of money.

PocketGuard

For the professional who wants a "hands-off" approach, PocketGuard is ideal. It calculates how much "In My Pocket" cash you have left after accounting for bills and savings goals. It is highly visual, providing clear charts that show exactly where your money is going.

3. Budgeting for Different Life Stages

For Students and Young Professionals

If you are just starting out, focus on simplicity. EveryDollar (by Dave Ramsey) offers a clean, easy-to-use interface for zero-based budgeting. For Kenyan students, combining the M-Pesa App with a tool like Caesh ensures you never run out of "pocket money" before the end of the semester.

For Business Professionals and Freelancers

Managing personal and business expenses can be a nightmare. QuickBooks Personal or Quicken Classic are the heavyweights here. They allow you to track tax-deductible expenses, manage invoices, and see your total net worth. In Kenya, many freelancers use Buxfer, which offers excellent multi-currency support and advanced forecasting.

4. Why 2026 is the Year to Automate

We are living in an era of "Invisible Spending." Subscriptions, automatic renewals, and digital micropayments can drain a bank account silently. The apps listed above serve as your financial "security guard."

-

Subscription Tracking: Apps like Rocket Money or Emma find unused subscriptions and help you cancel them.

-

Investment Integration: Tools like Monarch Money allow you to see your stocks, crypto, and bank balances in one single dashboard.

-

AI Assistance: Many 2026 apps now feature AI bots that can answer questions like, "Can I afford a new laptop this month?" based on your current spending trends.

Summary Table: Which App is Right for You?

| App Name | Primary Audience | Key Feature | Cost |

| CountPesa | Kenyans | Automatic M-Pesa Parsing | Free / Premium |

| YNAB | Global Debt-Haters | Zero-Based Budgeting | Subscription |

| Chumz | Kenyan Savers | Micro-savings / Round-ups | Free to use |

| Wallet | Global Travelers | Multi-currency & Bank Sync | Freemium |

| PocketGuard | Busy Professionals | "In My Pocket" spending view | Freemium |

Final Thoughts: The Pro Approach

A budgeting app is only as good as your commitment to it. The "Pro" approach is to choose one tool and check it daily for the first 30 days. For Kenyans, start with CountPesa to see your current reality, then move to a tool like Chumz to begin your wealth-building journey.

The technology exists to make you wealthy. The question is, which tool will you download today?

What's Your Reaction?