Digital Finance and Fintech Opportunities: The New Path to Financial Freedom in 2025 and Beyond

Explore the future of wealth through digital finance and fintech innovation. Discover how mobile banking, investing apps, blockchain, AI, and digital assets can help you achieve financial freedom in the modern era.

Introduction: A New Era of Wealth Is Here

Money has changed forever.

The world is shifting from paper-based systems to digital ecosystems where technology, not tradition, drives opportunity. Those who understand and embrace digital finance are not just surviving—they’re multiplying their wealth faster than ever before.

In the past, financial success depended on your job, your education, or your family background. But in today’s digital economy, success depends on your ability to adapt. The tools that were once reserved for banks and institutions are now available on your phone.

You can invest, trade, save, and grow your wealth from anywhere in the world—whether you’re in Nairobi, Lagos, or New York.

This is the era of financial inclusion, where fintech (financial technology) has opened the gates of wealth to everyone willing to learn and take action.

In this guide, we’ll explore the modern digital finance landscape—from mobile banking and investing apps to blockchain, digital real estate, and the rise of AI in personal finance. You’ll discover how to use these innovations to design your personal roadmap to financial freedom.

1. The Rise of Digital Finance: Breaking the Old Barriers

Traditional banking used to be slow, expensive, and exclusive. To open an investment account, you needed paperwork, appointments, and often a large sum of money. Today, that has changed.

Fintech has disrupted the old system by making financial tools faster, cheaper, and more inclusive.

Key Shifts Driving the Digital Finance Revolution

-

Mobile-first economy: Over 70% of Africans now use mobile money.

-

Online access: Anyone can open an investment or savings account in minutes.

-

Automation: AI tools manage your budget and savings 24/7.

-

Borderless payments: Sending money globally is instant and cheap.

These innovations aren’t just making life convenient—they’re helping millions build wealth without traditional gatekeepers.

Faith-based perspective: Proverbs 21:5 reminds us, “The plans of the diligent lead surely to abundance.” The new financial tools reward those who plan, act, and steward their money wisely.

2. Mobile Banking and Fintech Platforms: The Foundation of Digital Wealth

How Mobile Banking Changed the Game

The foundation of fintech innovation lies in mobile banking—and Africa led this revolution.

Platforms like M-Pesa (Kenya), Flutterwave (Nigeria), and Paystack have allowed millions to transact, save, and run businesses digitally.

Mobile banking offers:

-

Accessibility: Even those without traditional bank accounts can save and invest.

-

Speed: Instant transactions and fund transfers.

-

Security: Encrypted platforms reduce risks associated with carrying cash.

-

Integration: Most mobile platforms now link with investing and budgeting apps.

Why It Matters for Financial Freedom

Financial freedom starts with control—knowing where your money is, how it moves, and how it grows.

Mobile banking gives you that control by connecting all your income, expenses, and investments in one ecosystem.

Example: A Digital Transformation in Kenya

A small entrepreneur in Nairobi once needed to travel to a bank branch to withdraw or deposit cash. Today, she can manage her business entirely through her phone—pay suppliers with M-Pesa, receive international payments via Flutterwave, and save through a Chumz investing app.

This accessibility is what financial freedom looks like in action.

3. Investing Apps: Democratizing Wealth Creation

In the past, investing felt like a luxury reserved for the rich or those with “inside knowledge.”

But modern fintech investing platforms have shattered that myth.

Apps like Bamboo, Chumz, Hisa, Absa, and RiseVest now allow users to invest with as little as $1 or Ksh 100.

Key Benefits of Investing Apps

-

Fractional Ownership: You can own a portion of a stock like Apple or Safaricom.

-

Instant Access: No brokers or middlemen—just your smartphone.

-

Learning Tools: Apps provide education, news, and analytics.

-

Automation: Set auto-invest rules for consistency.

Local vs. Global Investing Platforms

| Platform | Type | Focus | Minimum Investment |

|---|---|---|---|

| Bamboo | Global | U.S. & global stocks | $1 |

| Chumz | Local | Savings & goal-based investing | Ksh 100 |

| Hisa | Hybrid | Kenyan & U.S. stocks | Ksh 500 |

| Absa App | Bank-based | Managed portfolios | Variable |

Smart Investing Habits

-

Start early – Time is the most powerful multiplier.

-

Diversify – Don’t put all your money in one app or one stock.

-

Reinvest returns – Let your profits compound.

-

Avoid emotional investing – Follow strategy, not trends.

-

Pray for wisdom – Remember, “Plans fail for lack of counsel, but with many advisers, they succeed” (Proverbs 15:22).

When done right, investing apps turn your smartphone into a digital wealth engine.

4. Blockchain and Cryptocurrency: The Future of Trust and Ownership

Understanding Blockchain in Simple Terms

Blockchain is a digital ledger that records transactions securely, transparently, and without middlemen.

Think of it as a notebook that everyone can see but no one can erase.

Why Blockchain Matters

-

It enables secure digital ownership.

-

Reduces fraud and corruption.

-

Powers cryptocurrencies, NFTs, and smart contracts.

-

Creates opportunities for global trade and digital assets.

Cryptocurrency Basics

Cryptocurrencies like Bitcoin and Ethereum use blockchain to function as decentralized money—meaning no government or bank controls them.

For investors, they present both high potential and high risk.

How to Approach Crypto Safely

-

Start small—invest what you can afford to lose.

-

Learn before you leap—understand how wallets and exchanges work.

-

Use regulated platforms (like Binance, Yellow Card, or Luno).

-

Store crypto securely in hardware or private wallets.

-

Avoid greed and hype—focus on knowledge and stewardship.

Faith reflection: The Bible warns against quick riches (Proverbs 13:11). Crypto can multiply your wealth, but without discipline, it can also magnify your mistakes.

5. Digital Real Estate and Online Asset Ownership

When you hear the word real estate, you might imagine buildings, land, or apartments.

But in the digital age, “real estate” also means online properties—websites, domains, NFTs, and digital brands.

What Is Digital Real Estate?

Digital real estate refers to any online asset that earns money or grows in value, such as:

-

A monetized blog or YouTube channel

-

An online store or e-commerce site

-

A valuable domain name (e.g., fintechkenya.com)

-

Virtual land in the metaverse

-

NFTs (unique digital collectibles)

How to Invest in Digital Real Estate

-

Build or buy a blog and monetize it through ads or affiliate marketing.

-

Purchase digital domains and resell them.

-

Create or invest in NFTs linked to art or intellectual property.

-

Lease digital space (e.g., website banner ads or sponsorships).

Case Study

A Nigerian creator builds a digital brand teaching personal finance on YouTube.

Her “channel” becomes her digital property—producing monthly ad income, partnerships, and online course sales.

That’s digital real estate in action.

Faith reminder: “By wisdom a house is built, and through understanding it is established” (Proverbs 24:3). Whether physical or digital, true wealth begins with knowledge and wise structure.

6. The Rise of AI and Automation in Personal Finance

Artificial Intelligence (AI) is no longer futuristic—it’s the financial advisor in your pocket.

How AI Is Changing Personal Finance

-

Budgeting bots track expenses automatically.

-

Robo-advisors recommend personalized investment portfolios.

-

AI-powered analytics identify spending leaks.

-

ChatGPT and finance bots help you plan, save, and grow faster.

AI Tools to Explore

| Tool | Function | Benefit |

|---|---|---|

| Plum / Cleo | AI budgeting | Helps automate savings |

| ChatGPT | Financial education | Explains investing concepts |

| Betterment / Wealthfront | Robo-investing | Builds portfolios for you |

| Mint / YNAB | Expense tracking | Improves discipline |

Automation = Freedom

When your financial systems are automated:

-

Bills get paid on time.

-

Savings happen automatically.

-

Investments grow while you sleep.

This frees you to focus on creating value, not counting coins.

Faith insight: Automation mirrors the biblical principle of diligence—systems working even when you’re not watching (Proverbs 10:4).

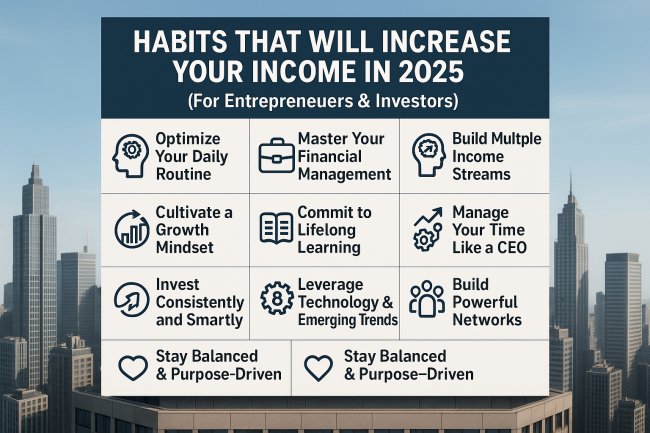

7. The Step-by-Step Roadmap to Financial Freedom in the Digital Age

Step 1: Define Your Financial Vision

What does financial freedom look like to you?

Is it debt-free living? Passive income? Global travel? Define it clearly. You can’t achieve what you can’t envision.

Step 2: Separate Business and Personal Finances

Open separate accounts for clarity.

Digital banks like Kuda, Carbon, or Absa make this easy.

Step 3: Build an Emergency Fund

Save at least 3–6 months of expenses using Chumz or a Money Market Fund.

This creates confidence and protects you during uncertainty.

Step 4: Invest Consistently

Use automation to invest weekly or monthly.

Apps like Bamboo or Hisa allow recurring contributions.

Start small but stay consistent—the secret ingredient of compound growth.

Step 5: Learn Financial Literacy Daily

Enroll in free online fintech courses or follow credible advisors.

The more you understand money, the more money understands you.

Step 6: Create Multiple Income Streams

-

Freelance digitally (Upwork, Fiverr)

-

Start an e-commerce store

-

Create digital products (eBooks, courses)

-

Earn through affiliate marketing

-

Invest in dividend-paying stocks

Step 7: Protect Your Digital Assets

Use two-factor authentication, strong passwords, and cloud backups.

Your wealth is only as safe as your security.

Faith principle: Stewardship is protection—guarding what God has entrusted you with.

8. The Future Belongs to the Digitally Wise

We are entering an era where wealth flows through data, algorithms, and digital trust.

The question is no longer “Can you access money?” but “Can you use technology to multiply it?”

Those who combine faith, financial literacy, and digital strategy will thrive in this new world.

Technology will keep evolving—AI will become smarter, blockchain more integrated, and virtual wealth more real. But principles remain timeless: diligence, patience, and wisdom.

Final Thoughts

-

Learn before you leap.

-

Use fintech tools to serve your purpose, not replace it.

-

Let technology amplify your discipline, not your distractions.

-

And above all, remember that true wealth is built on faith, purpose, and service.

Financial freedom isn’t a dream—it’s a discipline.

The tools are already in your hands.

Now, it’s your turn to act.

Conclusion: The Digital Future Is Your Opportunity

The 21st century belongs to the financially literate and digitally equipped.

Mobile banking, blockchain, and AI aren’t trends—they’re the infrastructure of modern wealth.

If you’re ready to achieve financial freedom:

-

Start where you are.

-

Use what you have.

-

Grow what you know.

The opportunity is digital, but the wisdom must be spiritual.

Your journey to financial independence begins with a single tap—but it grows through faith, patience, and smart action.

What's Your Reaction?